Pharma Stock Roundup: GSK's New Deal With Alector, MRK & AZN's FDA Updates

This week, Glaxo GSK signed a deal with Alector ALEC to co-develop and co-commercialize the latter’s two pipeline candidates for neurodegenerative diseases. The FDA approved Merck’s MRK blockbuster medicine, Keytruda for expanded use in skin cancer and granted priority review tag to Amgen AMGN/AstraZeneca’s AZN regulatory submission for asthma candidate, tezepelumab.

Recap of the Week’s Most Important Stories

Glaxo Inks Deal to Co-Develop Alector’s Antibodies for Neurodegenerative Diseases: Glaxo announced a deal with Alector to jointly develop and co-commercialize the latter’s two progranulin-elevating monoclonal antibodies, AL001 and AL101 for neurodegenerative diseases. While AL001 is being developed in a phase III study for frontotemporal dementia due to a progranulin gene mutation (FTD-GRN), AL101 is in early-stage development and has been designed for treating more common neurodegenerative diseases like Parkinson’s disease and Alzheimer’s disease. For the deal, Glaxo will make an upfront payment of $700 million to Alector while the latter will also be entitled to up to $1.5 billion in potential milestone payments, profit sharing and royalties.

FDA’s Priority Tag to Amgen/AstraZeneca’s Asthma Candidate: The FDA accepted and granted priority review to AstraZeneca and partner Amgen’s biologics license application (BLA) seeking approval for tezepelumab for the treatment of asthma. The FDA’s decision is expected in the first quarter of 2022. The BLA was based on data from the PATHFINDER clinical program on tezepelumab including the pivotal NAVIGATOR phase III study.

FDA Approves Merck’s Keytruda for Expanded Indication in Skin Cancer: The FDA approved Merck’s PD-L1 inhibitor Keytruda for an expanded indication in skin cancer. The latest approval is as a monotherapy for patients with locally advanced cutaneous squamous cell carcinoma (cSCC) whose disease is not curable by surgery or radiation. The approval is based on interim data from a second analysis of the phase II KEYNOTE-629 study. In June last year, Keytruda was approved for recurrent or metastatic cSCC that is not curable by surgery or radiation based on data from the first interim analysis of the same study, KEYNOTE-629. Keytruda is thus now approved for locally advanced or recurrent or metastatic cSCC that cannot be cured by surgery or radiation.

Lilly’s Jardiance Succeeds in HFpEF Study: Lilly LLY announced that the EMPEROR-Preserved phase III study, which evaluated its diabetes drug, Jardiance in adults (with and without diabetes) with heart failure with preserved ejection fraction (HFpEF) met the primary endpoint. Top-line data from the study showed that Jardiance significantly reduced the risk of the composite of cardiovascular death or hospitalization for heart failure versus placebo in patients with HFpEF, the most challenging form of heart failure to treat. Lilly’s supplemental new drug application (sNDA) seeking approval for Jardiance for adults with heart failure with reduced ejection fraction (HFrEF), with and without diabetes is under review with the FDA. The sNDA for the HFrEF indication was based on data from the phase III EMPEROR-Reduced study. If approved for HFpEF, Jardiance would become the only clinically proven treatment to improve outcomes for the full spectrum of heart failure patients regardless of ejection fraction

The NYSE ARCA Pharmaceutical Index rose 0.7% in the last five trading sessions.

Large Cap Pharmaceuticals Industry 5YR % Return

Large Cap Pharmaceuticals Industry 5YR % Return

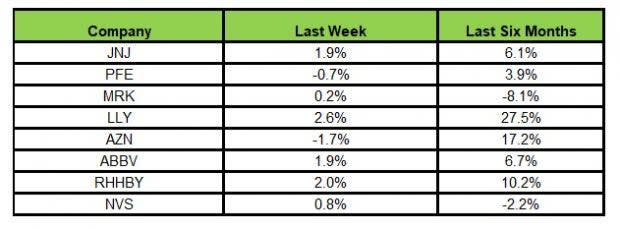

Here’s how the eight major stocks performed in the last five trading sessions.

Image Source: Zacks Investment Research

In the last five trading sessions, Lilly rose the most (2.6%) while AstraZeneca recorded the maximum decline (1.7%).

In the past six months, Lilly has recorded the maximum gain (27.5%) while Merck declined the most (8.1%)

(See the last pharma stock roundup here: EU Nod to RHHBY, MRK Drugs, FDA and Pipeline Updates)

What's Next in the Pharma World?

Watch out for regular pipeline and regulatory updates next week.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Alector, Inc. (ALEC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research