Philip Morris (PM) Q4 Earnings Beat Estimates on Solid Pricing

Philip Morris International Inc. PM reported fourth-quarter 2020 results, wherein the top and bottom lines cruised past the Zacks Consensus Estimate and the latter increased year over year. Results were backed by favorable pricing variance, mainly from higher combustible pricing. However, sales were weighed upon by adverse volume/mix due to soft cigarette shipment volumes, though heated tobacco shipment volumes were strong (thanks to strength in IQOS).

Quarter in Detail

Adjusted earnings per share came in at $1.26, which beat the Zacks Consensus Estimate of $1.23. Further, the bottom line grew 3.3% year over year. On an organic basis, the bottom line increased 7.4%.

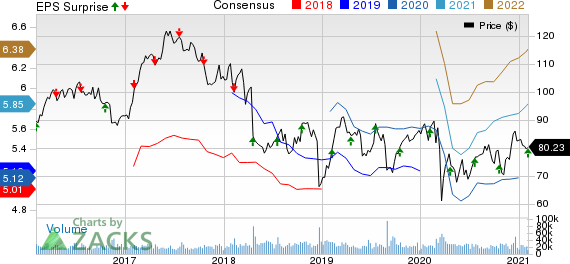

Philip Morris International Inc. Price, Consensus and EPS Surprise

Philip Morris International Inc. price-consensus-eps-surprise-chart | Philip Morris International Inc. Quote

Net revenues of $7,444 million outpaced the Zacks Consensus Estimate of $7,435 million. However, the top line decreased 3.5% from the figure reported in the year-ago quarter. Net revenues, on an organic basis, also declined 3.5%. This was due to adverse volume/mix mainly stemming from soft cigarette shipment volumes, somewhat made up by greater heated tobacco shipment volumes. The company also received some respite from favorable pricing variance (mainly from higher combustible pricing in most regions).

During the fourth quarter, revenues from combustible products were down 10.9% to $5,507 million due to declines in all regions, except the European Union. Revenues in the RRPs grew 26.3% to $1,937 million.

Total cigarette and heated tobacco unit shipment volumes dropped 8.2% to 176.4 billion units. Cigarette shipment volumes fell 11.7% to 154.7 billion units in the quarter, while heated tobacco unit shipment volumes of 21.7 billion units jumped 26.9% year over year.

Adjusted operating income rose 1.7% on an organic basis on positive pricing variance, reduced marketing, administration and research costs as well as a decline in manufacturing costs – partly countered by adverse volume/mix. Adjusted operating margin expanded 2 percentage points on an organic basis.

Region-Wise Performance

Net revenues in the European Union increased 12.6% to $2,742 million. Revenues climbed 6.4% at constant currency (cc), courtesy of improved volume/mix and favorable pricing variance (courtesy of increased combustible pricing). Volumes were mainly backed by a rise in heated tobacco unit volumes, somewhat countered by lower cigarette volumes. Total shipment volumes in the region slid 4.3% to 43,051 million units.

In Eastern Europe, net revenues tumbled 7.5% to $908 million but grew 4.5% at cc. The upside can be attributed to favorable pricing (thanks to elevated combustible pricing), countered partly by adverse volume/mix. Total shipment volumes dropped 6% to 29,249 million units.

In the Middle East & Africa region, net revenues declined 24.8% (down 21.6% at cc) to $740 million due to adverse volume/mix, partly negated by favorable pricing. Further, total shipment volumes dipped 9.3% to 30,100 million units.

Revenues in South & Southeast Asia fell 20.3% (down 20.6% at cc) to $1,185 million. The downside was a result of adverse volume/mix as well as pricing variance (mainly in Indonesia). Shipment volumes collapsed 18% to 36,635 million units.

Revenues from East Asia & Australia advanced 9% (up 6.1% at cc) to $1,384 million owing to pricing gains (mainly in Japan) as well as improved volume/mix. Total shipment volumes inched up 1.5% to 19,009 million units.

Finally, revenues from Latin America & Canada dropped 12.5% (down 4.7% at cc) to $485 million due to adverse volume/mix, somewhat compensated by improved pricing. Moreover, total shipment volumes declined 5.9% to 18,342 million units.

Other Financials & Developments on IQOS

This Zacks Rank #3 (Hold) company ended the fourth quarter with cash and cash equivalents of $7,280 million. Also, it had long-term debt of $28,168 million and shareholders’ deficit of $10,631 million.

On Dec 7, 2020, the U.S. Food and Drug Administration or the FDA said that the company’s IQOS 3 is suitable for public health protection, and approved it for sale in the United States. Notably, a premarket tobacco product application (PMTA) for the same was filed with the FDA in March 2020. Apart from this, the FDA had approved a version of IQOS’s marketing as a modified risk tobacco product (MRTP) in July 2020.

IQOS delivered solid improvement in 2020, which helped drive major increases in total users, alongside boosting heated tobacco shipment as well as in-market sales volumes. Notably, total users of IQOS as of the end of full-year 2020 were estimated at 17.6 million, including 12.7 million who have shifted to IQOS and discontinued smoking.

COVID-19 Update & Guidance

Philip Morris has been on track to lower the COVID-19-related business disruptions. The company notified that it currently has adequate access to inputs and is not encountering any major supply-related hurdles. All of the company’s cigarette and heated tobacco unit production units are operational globally. The pandemic doesn’t have any major impact on the availability of the company’s products to its customers and adult consumers. Further, the company has sufficient liquidity to manage business.

In 2021, management expects gradual improvement in the general operating landscape. The company does not expect a near-term recovery in the duty-free business due to travel-related uncertainties. In fact, management expects the existing dynamics to persist through the end of 2021. Management further issued its 2021 guidance, considering that even in case of continued pandemic-led constraints — consumption levels will not go back to reduced levels as the second quarter of 2020. The company has entered 2021 with a positive momentum, though several hurdles related to duty-free business, pricing in Indonesia and COVID-19 impacts are likely to prevail.

Additionally, total cigarette and heated tobacco unit shipment volume growth is likely to range between decline 2% to increase 1%, in 2021. Total international industry volume growth (excluding China and the United States) are estimated to be negative 3% to flat. Heated tobacco shipment volumes are envisioned in a band of 90-100 billion units in 2021 compared with the 76.1 billion units seen in full-year 2020.

For 2021, Phillip Morris expects net revenues to skyrocket 407% on an organic basis, courtesy of the increasing contribution from IQOS. Adjusted operating margin on an organic basis is likely to jump at least 150 basis points in 2021. Finally, the company envisions adjusted earnings per share to be $5.90-$6. At cc, adjusted earnings per share are expected to grow 9-11% to $5.65-$5.75 from the $5.17 reported in 2020. This is likely to be fueled by revenue growth and focus on achieving cost efficiencies .

For the first quarter of 2021, the company expects net revenue growth (on an organic basis) in a range of slight decline to largely stable. Management projects robust operating income margin improvement in the quarter on increased IQOS weight age in the business and continued cost savings. Based on these factors, the company envisions earnings per share of $1.40, including positive currency impact of about 9 cents.

Shares of Phillip Morris have gained 13.2% in the past three months compared with the industry’s growth of 12.5%.

Consumer Staple Stocks to Bet On

Medifast MED, which currently carries a Zacks Rank #2 (Buy), has a trailing four-quarter earnings surprise of 20.2%, on average. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Nomad Foods NOMD holds a Zacks Rank of 2 and has a trailing four-quarter earnings surprise of 10.2%, on average.

Hain Celestial HAIN sports a Zacks Rank #1 and has a trailing four-quarter earnings surprise of 24.6%, on average.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

The Hain Celestial Group, Inc. (HAIN) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research