Philip Morris (PM) to Reduce Operations in Russian Federation

Philip Morris International Inc. PM unveiled that it suspended its planned investments in the Russian Federation. This includes all new product launches along with investments related to innovation, commercial and manufacturing.

Additionally, the company initiated plans to reduce its manufacturing operations in Russia due to ongoing supply-chain bottlenecks and the changing regulatory landscape due to the Ukraine war. However, management stated that it would support its workers in Russia through continued salary payments. Russia formed more than 10% of the company’s total cigarette and heated tobacco shipment volumes and roughly 6% of its total net revenues. Philip Morris has more than 3,200 workers in Russia, where it opened its first representative office in 1992.

Last month, the company also announced the temporary suspension of its operations in Ukraine, including its factory in Kharkiv. Ukraine formed nearly 2% of the company’s total cigarette and heated tobacco unit shipment volumes in 2021 and less than 2% of its total net revenues. PM operates one factory and has more than 1,300 workers in Ukraine. Management also stated that it has contingency plans to restart the supply of products when conditions are safer.

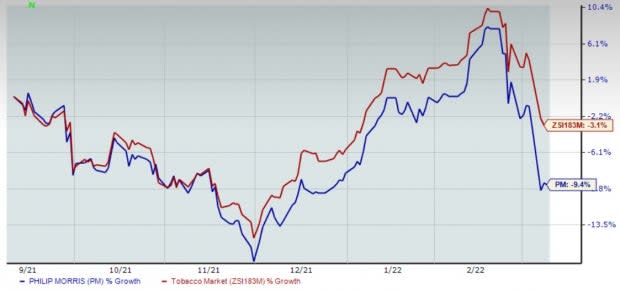

Image Source: Zacks Investment Research

What Else to Know?

Philip Morris has been making solid strides for delivering a smoke-free future. The company is progressing well with its business transformation, with smoke-free products generating more than 30% of the company’s net revenues in the fourth quarter of 2021. The company is well-placed for becoming a majority smoke-free company by 2025. Sales from reduced risk products or RRPs increased 23.4% to $2,391 million in the fourth quarter of 2021.

Philip Morris has also been benefiting from its strong pricing power. Though higher pricing might lead to a possible decline in cigarette consumption, it is seen that smokers tend to absorb price increases due to the addictive quality of cigarettes. Higher pricing has been aiding the company’s performance for a while. The higher pricing variance was an upside to PM’s performance across most regions in the fourth quarter of 2021. During the quarter, both the top and the bottom line improved year over year and beat the respective Zacks Consensus Estimate.

For 2022, Phillip Morris expects adjusted net revenues to increase nearly 4-6% on an organic basis. However, on its fourth-quarter 2021 earnings call, management highlighted that it expects continued uncertainty concerning the recovery pace from the pandemic-led operating landscape in 2022. Management expects continued gradual recovery in the duty-free business outside Asia and no meaningful recovery in Asia.

Coming back to the latest announcements, let’s see how these actions impact the performance of this Zacks Rank #3 (Hold) company. Shares of Philip Morris have declined 9.4% in the past six months compared to the industry’s rise of 3.1%.

Looking for Consumer Staple Stocks? Check These

Some better-ranked stocks are Pilgrim’s Pride PPC, Tyson Foods TSN and Flowers Foods FLO.

Pilgrim’s Pride, which produces, processes, markets and distributes fresh, frozen, and value-added chicken and pork products, sports a Zacks Rank #1 (Strong Buy). Shares of Pilgrim’s Pride have moved down 18.2% in the past six months. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pilgrim’s Pride’s current financial-year earnings per share (EPS) suggests growth of 16.2% from the year-ago reported number. PPC has a trailing four-quarter earnings surprise of 24.9%, on average.

Tyson Foods, a renowned meat products company, carries a Zacks Rank #2 (Buy) at present. Shares of Tyson Foods have risen 21.2% in the past six months.

The Zacks Consensus Estimate for Tyson Foods’ current financial-year sales and EPS suggests growth of 9.5% and 2.9%, respectively, from the year-ago reported number. TSN has a trailing four-quarter earnings surprise of 32.2%, on average.

Flowers Foods, the producer and marketer of packaged bakery products, currently carries a Zacks Rank #2. Shares of Flowers Foods have jumped 7.6% in the past six months.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales and EPS suggests growth of 7.2% and 3.2%, respectively, from the year-ago reported figure. FLO has a trailing four-quarter earnings surprise of 9%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research