Pilgrim's Pride (PPC) Q3 Earnings: High Costs Dim Prospects

Pilgrim's Pride Corporation PPC is scheduled to release third-quarter 2018 results on Nov 1. This renowned company, engaged in the manufacturing and selling of fresh, frozen as well as value-added chicken products, has a mixed record of earnings surprises in the trailing four quarters. Let’s see how things are placed ahead of the upcoming quarterly results.

High Costs & Other Factors to Dent Q3 Performance

Rising cost of sales is a significant hurdle for Pilgrim’s Pride. This has been caused by commodity costs inflation, primarily related to corn and soybeans. Corn prices have been rising, due to higher export demand and lower expected corn production in Argentina. Further, soybean prices have shot up since January, thanks to crop losses in Argentina.

Such rising costs, if not properly mitigated, can impair the company’s profitability. Evidently, during second-quarter 2018, cost of sales rose 12.5% year over year. As a result, gross profit declined 42% and gross margin deteriorated 760 basis points (bps) year over year. This hurt the company’s bottom-line performance in the said period. Other food companies, whose performance has been eclipsed by high costs, are Campbell Soup CPB, General Mills GIS and TreeHouse Foods THS.

To make matters worse, trade tensions with China is causing excess volatility in soybean prices, as the country accounts for a significant chunk of soybean export demand. Going ahead, such volatile conditions in the commodity market continues to pose significant threats.

To top such deterrents, Pilgrim's Pride is exposed to threats stemming from plant-based protein. The medical community is promoting plant-based protein products over meat-based ones, on account of health risks. The rising demand for such products is likely to dampen revenues and profitability of meat-product producers like Pilgrim’s Pride.

Will Efforts Aid?

We note that management is resorting to aggressive efforts to revamp supply chain to enhance efficiency and reduce costs. Also, the company’s focus on key customers and initiatives to develop a sturdy brand portfolio are impressive.

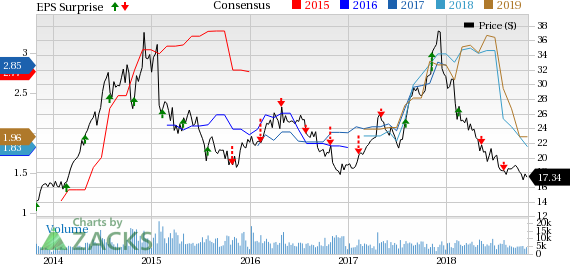

Pilgrim's Pride Corporation Price, Consensus and EPS Surprise

Pilgrim's Pride Corporation Price, Consensus and EPS Surprise | Pilgrim's Pride Corporation Quote

Estimates Reveal Dull Prospects

However, the aforementioned headwinds cannot be ignored and they are likely to drag the company’s performance in the upcoming earnings release. Notably, the consensus mark for third-quarter earnings is currently pegged at 55 cents. This reflects a decline of almost 43.9% from the year-ago quarter’s figure. The estimate has been stable in the past 30 days.

Further, the Zacks Consensus Estimates for net revenues is pegged at $2,720 million, depicting a fall of roughly 2.6% from $2,794 million in the prior-year quarter.

What Does the Zacks Model Predict?

Our proven model doesn’t show that Pilgrim's Pride can beat bottom-line estimates this quarter. For this to happen, a stock needs to have a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Pilgrim's Pride’s Zacks Rank #5 (Strong Sell) and Earnings ESP of 0.00% reduce chances of earnings beat to a great extent. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research