Pingtan Marine Enterprise (NASDAQ:PME) Shareholders Booked A 68% Gain In The Last Three Years

Want to participate in a research study? Help shape the future of investing tools and earn a $60 gift card!

By buying an index fund, you can roughly match the market return with ease. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Pingtan Marine Enterprise Ltd. (NASDAQ:PME), which is up 68%, over three years, soundly beating the market return of 42% (not including dividends).

View our latest analysis for Pingtan Marine Enterprise

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

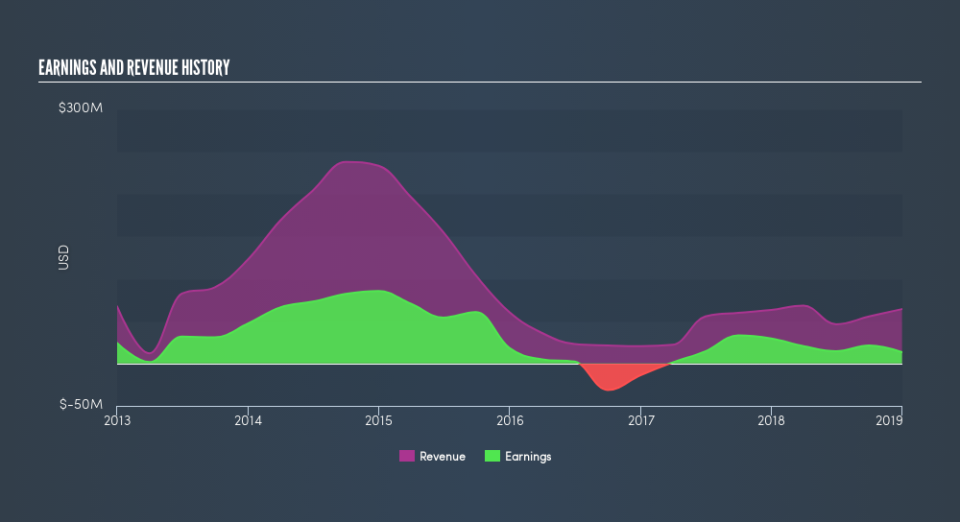

During the three years of share price growth, Pingtan Marine Enterprise actually saw its earnings per share (EPS) drop 10.0% per year. So we doubt that the market is looking to EPS for its main judge of the company's value. Given this situation, it makes sense to look at other metrics too.

It could be that the revenue growth of 23% per year is viewed as evidence that Pingtan Marine Enterprise is growing. If the company is being managed for the long term good, today's shareholders might be right to hold on.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. You can see what analysts are predicting for Pingtan Marine Enterprise in this interactive graph of future profit estimates.

A Dividend Lost

It's important to keep in mind that we've been talking about the share price returns, which don't include dividends, while the total shareholder return does. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Pingtan Marine Enterprise's TSR over the last 3 years is 77%; better than its share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

Investors in Pingtan Marine Enterprise had a tough year, with a total loss of 39%, against a market gain of about 12%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 6.5% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Pingtan Marine Enterprise is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.