Pinnacle West (PNW) Gains From CAPEX & Focus on Clean Energy

Pinnacle West Capital Corporation’s PNW planned investments in strengthening its infrastructure and an increasing focus on renewable sources for power generation will help it take advantage of the expected demand surge for clean energy. Also, the company’s efforts to reduce costs will drive its earnings.

The Zacks Consensus Estimate for 2021 earnings is pegged at $4.95 per share, indicating growth of 1.64% from the year-ago reported figure. Also, the consensus mark for current-year revenues stands at $3.69 billion, suggesting 2.86% growth from the prior-year reported number. Additionally, long-term (three-five years) earnings growth of the company is pegged at 3.99%.

The stock currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

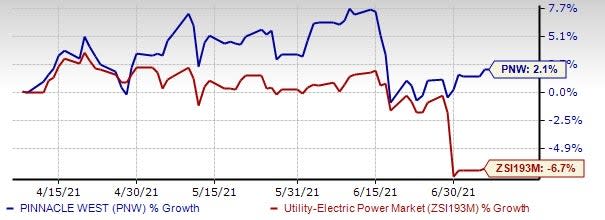

In the past three months, shares of the company have gained 2.1% against the industry’s fall of 6.7%.

Three Months Price Performance

Image Source: Zacks Investment Research

Tailwinds

Pinnacle West’s investments in clean power generation, and transmission and distribution lines will help it expand its customer base with better efficiency. After investing $1,262 million in 2020, it spent $363.8 million in the first three months of 2021. Also, the utility has plans to spend $1,500 million, annually, through the 2021-2023 forecast period. Moreover, it is working to reduce costs, which will help keep the customer rates low as well as enhance its customer benefits and shareholder value.

Apart from growing its utility infrastructure, Pinnacle West continues to focus on expanding its generation from renewable sources. In the 2021-2023 time frame, the company will invest $1,112 million in increasing clean power generation. It also set a goal to deliver 100% carbon-free electricity to its customers by 2050, which includes a near-term target of attaining a resource mix within 2030 comprising 65% clean energy and 45% coming from renewable sources.

Some other players from the same industry are also making efforts to supply clean energy to their customers and enrich the reliability of services. Companies like Duke Energy DUK, DTE Energy DTE and Xcel Energy XEL have plans in place to provide absolute clean energy by 2050.

Headwinds

However, Pinnacle West’s progress could be hindered by fluctuations in commodity prices, stringent environmental regulations and unplanned outages in nuclear-generation facilities.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Xcel Energy Inc. (XEL) : Free Stock Analysis Report

Duke Energy Corporation (DUK) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research