Pioneer Natural’s 4Q Profit Sinks 55%; Shares Slip

Pioneer Natural Resources' 4Q earnings slumped as lower oil production and a decline in realized prices took a toll on its revenues, and in turn, its profitability. Shares of the oil and gas exploration and production company closed 3.2% lower in Tuesday’s extended trading session.

Pioneer Natural Resources’ (PXD) 4Q adjusted earnings plunged 54.7% to $1.07 per share year-over-year but exceeded analysts' estimates of $0.70 per share. Revenues declined 30.3% to $1.86 billion, topping Street estimates of $1.75 billion.

Total production increased marginally to 364.5 thousand barrels of oil equivalent per day (BOE/D) from 363.4 thousand. However, the average realized price plunged 25.1% to $28.22 per BOE year-over-year.

The company registered a 7.2% year-on-year decline in average daily oil production, while the production of its Natural Gas Liquids (NGLs) and Gas increased 7% and 18.1%, respectively. Meanwhile, the average prices for oil and NGLs declined 26.9% and 0.5%, respectively, and the average price for Gas increased by 7.2% year-over-year. (See Pioneer Natural Resources stock analysis on TipRanks)

Pioneer Natural raised its Parsley Energy acquisition-related annual cost-saving synergy targets by $25 million to $350 million. Notably, the company completed the acquisition of Parsley Energy on Jan. 13.

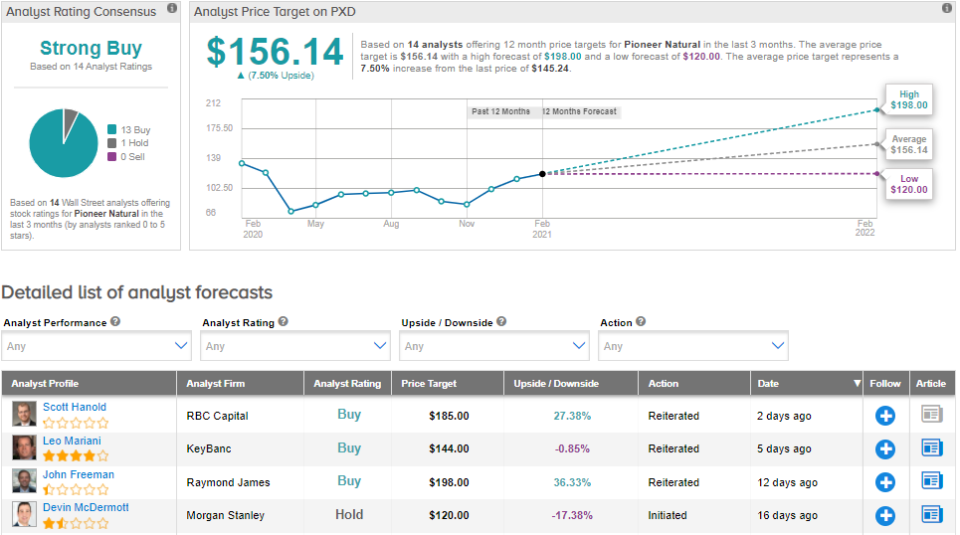

On Feb. 8, Morgan Stanley analyst Devin McDermott initiated coverage on the stock with a Hold rating and price target of $120 (17% downside potential).

McDermott remains optimistic about PXD's acquisition of Parsley Energy and expects it to be accretive to the FCF (Free Cash Flow). He added that the company's "attractive scale, limited exposure to federal regulatory uncertainty, and a strong balance sheet, support PXD's premium valuation."

Unlike McDermott, the rest of the Street has a bullish outlook on the stock, with a Strong Buy consensus rating based on 13 Buys and 1 Hold. The average analyst price target of $156.14 implies upside potential of about 7.5% from current levels. Shares have gained about 12% over the past year.

Related News:

Occidental Petroleum’s Quarterly Loss More Than Doubles; Shares Slip

Frontline 4Q Sales Sink 48% On Weak Oil Tanker Demand

Shell Midstream’s 4Q Revenues Outperform On Volume Recovery