Pitney Bowes (PBI) Stock Down Despite Q4 Earnings Beat

Pitney Bowes Inc. PBI reported fourth-quarter 2020 adjusted earnings of 13 cents per share, beating the Zacks Consensus Estimate by 30%. However, the bottom line declined 7.1% year over year. This might have hurt investor sentiments.

Despite strong top-line performance, shares of Pitney Bowes fell 19.2% following fourth-quarter 2020 results on Feb 2, eventually closing at $8.72.

Notably, total revenues improved 24% year over year to $1.028 billion. Adjusting for foreign currency exchange, revenues increased 23% year over year to $1.024 billion. Management is optimistic on investments in shipping starting to pay off. Notably, Shipping-related revenues represented 54% of total revenues in the reported quarter.

Quarter in Detail

Commerce Services increased 42% (up 42% after adjusted for currency) from the year-ago quarter’s figure to $652.8 million. Global Ecommerce revenues surged 60% to $518.1 million, while Presort Services of $134.7 million remained almost flat on a year-over-year basis.

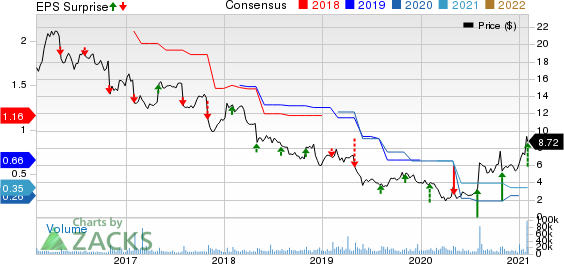

Pitney Bowes Inc. Price, Consensus and EPS Surprise

Pitney Bowes Inc. price-consensus-eps-surprise-chart | Pitney Bowes Inc. Quote

Global Ecommerce revenues benefited from strong growth in Domestic Parcel, Digital Delivery and Cross Border Services volumes.

In Presort Services space, revenues remained flat due to declining Marketing Mail and flat First Class revenues and First Class volumes despite growth in Marketing Mail Flats and Bound Printed Matter volumes.

Sending Technology Solutions inched up 1% year over year (flat after adjusting for currency) to $375.6 million. The improvement was due to higher business service revenues, driven by increased usage of shipping offerings and capabilities, and equipment sales. In fact, SendTech shipping revenues were $35 million, growing at a double-digit rate. Moreover, SendTech shipped nearly 20,000 units of the SendPro Mailstation since its launch in April.

However, COVID-19 induced sluggishness in support services, supplies and financing limited the upside.

Adjusted EBITDA Details

In the fourth quarter, adjusted EBITDA declined 3.3% from the year-ago quarter’s figure to $102.4 million.

Segment EBITDA fell 1% from the year-ago quarter’s figure to $150.1 million. Segment EBIT declined 1% from the year-ago quarter’s figure to $115.9 million.

Balance Sheet & Cash Flow

As of Dec 31, 2020, cash and cash equivalents and short-term investments were $940 million compared with $820.4 million as of Sep 30, 2020.

As of Dec 31, 2020, long-term debt (including current portion) was $2.56 billion, compared with $2.6 billion as of Sep 30, 2020.

Cash flow generated was $110.8 million compared with $103.8 million of net cash generated in operations in the previous quarter. Free cash flow was $96.8 million compared with free cash flow of $84.6 million in the prior quarter.

On Feb 2, Pitney Bowes’ board of directors announced a cash dividend of 5 cents per share payable on Mar 8 to shareholders as on Feb 12.

The company incurred expenses of $4 million under restructuring payments and capital expenditures worth $24 million in the reported quarter.

Guidance

For 2021, the company expects revenues to grow over 2020 in the low-to-mid single digit range, marking it as the fifth consecutive year of growth. The company also expects adjusted earnings per share to grow on a year-over-year basis.

However, the company anticipates lower free cash flow due to changes in certain working capital items that helped 2020 performance, “and are not expected to continue at the same level in 2021.”

Zacks Rank & Stocks to Consider

Currently, Pitney Bowes carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Shopify SHOP, Microchip MCHP and Synaptics SYNA. Shopify flaunts a Zacks Rank #1 (Strong Buy) while Microchip and Synaptics carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Microchip and Synaptics are scheduled to report earnings on Feb 4, while Shopify is slated to release quarterly results on Feb 17.

Long-term earnings growth rate for Microchip, Synaptics and Shopify is currently pegged at 14.9%, 10% and 32.5%, respectively.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pitney Bowes Inc. (PBI) : Free Stock Analysis Report

Microchip Technology Incorporated (MCHP) : Free Stock Analysis Report

Synaptics Incorporated (SYNA) : Free Stock Analysis Report

Shopify Inc. (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research