Pizza Wars: Should Investors Buy Domino's or Papa John's Stock?

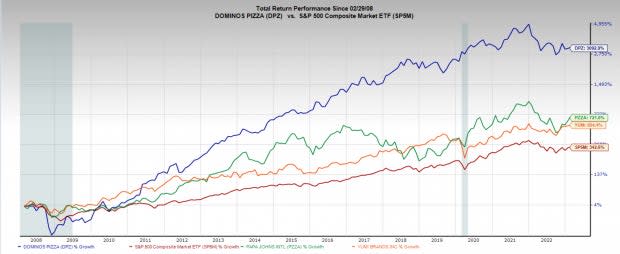

Over the last decade, Domino’s Pizza DPZ has evolved into something of a juggernaut stock providing investors with a 30x return on their money.

But pizza is a good business, and Papa John’s PZZA is no slack. PZZA stock has doubled the returns of the S&P 500 over the last 15 years, and more than 7x’d investors’ money.

Both DPZ and PZZA report earnings on Thursday, February 23.

Image Source: Zacks Investment Research

Domino’s Pizza

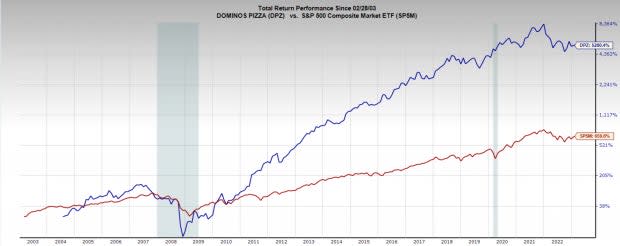

Domino’s wasn’t always the kingmaker it is today. Zoom out a little further and you can see DPZ stock was stagnant from 2004-2010. So, what caused this turnaround?

Image Source: Zacks Investment Research

Domino’s, originally DomiNick’s, was founded back in 1960, with a single pizza shop secured by a $500 down payment. By 1967 DomiNick’s had become Domino’s and began a franchise model, expanding to 200 stores by 1978. Fast forward to 2004 and Domino’s lists on the NYSE as a public company.

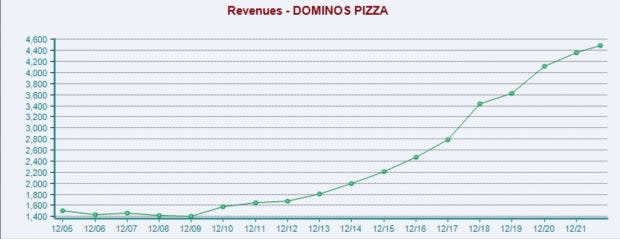

Domino’s had been growing at a nice clip up until its IPO, but between 2004 and 2010 sales were stagnant. What was the issue and what caused sales to finally inflect higher? In 2009 a consumer taste preferences survey placed Domino’s in last place, tied with Chuck E. Cheese, and this was rock bottom.

Image Source: Zacks Investment Research

After this point DPZ committed to a new recipe and a massive advertising campaign and rebrand. In the ad campaign, in an act of radical transparency DPZ actually highlighted how bad the pizza had become. By owning it and committing to a new recipe Domino’s actually won customers back.

With this momentum, the CEO also dove headfirst into in to digital, enabling customers to order online, on their phones, and even through social media. This new approach smoothed the ordering process, allowed for creative upsells, and most importantly gave DPZ access to very valuable consumer data.

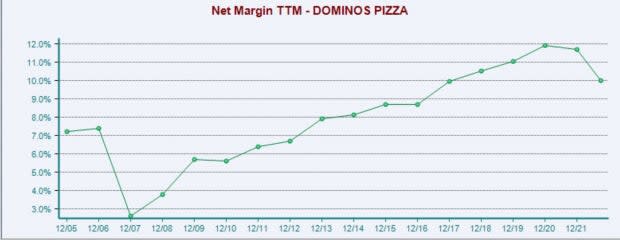

Today Domino’s is a tremendous success story and a case study for turnarounds. Sales have tripled in the last ten years from $1.6 billion to $4.6 billion today. DPZ has also expanded its margins significantly over that time, further improving the business fundamentals.

Image Source: Zacks Investment Research

DPZ currently holds a Zacks Rank #3 (Hold), indicating a mixed earnings revision trend. Sales estimates are still looking strong though with current quarter sales expected to grow 6.9% to $1.4 billion, and current year sales to climb 5.1% to $4.6 billion.

The bottom line is taking a hit though. Current quarter earnings estimates are expecting $3.92 per share, a YoY decrease of -7.8%, and full year earnings are expected to drop -11.8% to $12 per share.

Domino’s currently trades at a one-year forward P/E of 25x, while not cheap, it is well below its 10-year median of 30x. DPZ is well known for its exceptional turnaround thanks to its forward looking management. That’s a good thing, and sometimes you have to pay a premium for that.

Image Source: Zacks Investment Research

Papa John’s

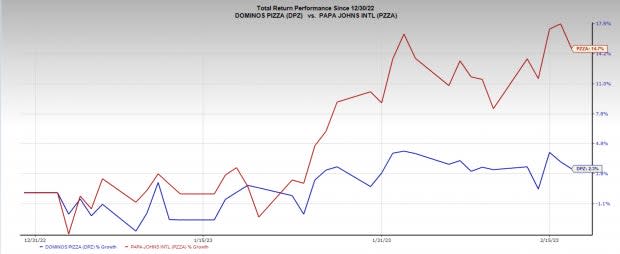

Papa John’s doesn’t have quite the turnaround story that DPZ, and more recently, actually received some bad press related to the former CEO. Nonetheless the stock is outperforming DPZ YTD by a significant margin. PZZA is also a considerably smaller company at just a $3 billion market cap versus DPZ’s $12.6 billion.

This smaller size is currently a bit of an advantage, as PZZA has more room to expand, with a recent focus on its international presence. PZZA and DPZ also have slightly different models around their businesses as PZZA owns just 10% of the restaurants, and the rest are franchised, while DPZ owns 33% of the restaurants. This gives PZZA the edge in gross margins.

Image Source: Zacks Investment Research

Papa John’s currently has a Zacks Rank #3 (Hold), indicating mixed earnings revisions trend. PZZA is also bumping into some growth issues in sales. The current quarter sales expectations of $523 million is a -1.2% YoY decrease. Current year sales still see some growth at $2.1 billion expected, a 1.5% increase, and next year is projecting a 4.2% increase.

Earnings are a bit challenged too, with current quarter estimates expecting $0.65 per share, a -13.3% decrease, and current year estimates projected down -21% to $2.78 per share. Consensus estimates are also consistently being revised lower across timeframes.

Image Source: Zacks Investment Research

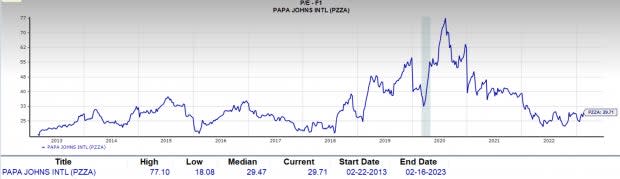

Compared to Domino’s, Papa Johns is also trading at a pricier valuation. Its one-year forward P/E of 30x is in line with its 10-year median, although it is well off it’s 2020 high valuation of 77x.

Domino’s has a more international brand, and more pedigreed, experienced management, so I am not sure PZZA deserves a higher multiple. As we addressed earlier though, PZZA does have a higher margin business model.

Image Source: Zacks Investment Research

Conclusion

Pizza restaurants can clearly be a great business. DPZ and PZZA have proven just how far pizza can be stretched. They are direct competitors, with very comparable products and valuations. Whether one stock is better than the other is hard to say.

Also, worth considering is Pizza Hut, whose parent company Yum Brands YUM has been a winning stock. Although we didn’t cover it here, YUM is an extremely diversified, global restaurant business with brands like KFC and Taco Bell. YUM is certainly worth researching as well.

All three stocks are certainly worthy considerations for an investment portfolio.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Domino's Pizza Inc (DPZ) : Free Stock Analysis Report

Papa John's International, Inc. (PZZA) : Free Stock Analysis Report