Plexus' (PLXS) Q4 Earnings and Revenues Surpass Estimates

Plexus Corp PLXS reported fourth-quarter fiscal 2022 adjusted earnings of $1.78 per share, which surged 53.4% year over year. The Zacks Consensus Estimate stood at $1.28 per share.

Revenues of $1.12 billion topped the consensus mark by 11.1% and increased 33.3% year over year. The top-line performance gained from a robust demand environment amid global macroeconomic uncertainty and geopolitical instability in Europe.

In the reported quarter, Asia-Pacific revenues rose 39.5%, while that from Europe and the Middle East and Africa and the Americas increased 14.9% and 23.8%, respectively.

During the quarter, Plexus won 32 manufacturing contracts worth $214 million in annualized revenues when fully ramped into production. Trailing four-quarter manufacturing wins totaled more than $1 billion in annualized revenues

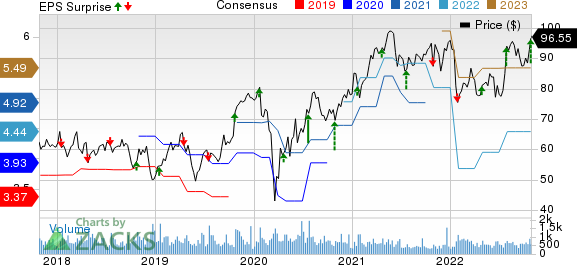

Plexus Corp. Price, Consensus and EPS Surprise

Plexus Corp. price-consensus-eps-surprise-chart | Plexus Corp. Quote

Market Sector Details

Industrial revenues were up 32.7% year over year to $520 million, contributing 46% to total revenues.

Healthcare/Life Sciences revenues jumped 40.2% from the year-ago quarter’s levels to $467 million. The segment contributed 42% to total revenues.

Aerospace/Defense revenues increased 16.1% year over year to $137 million, contributing 12% to total revenues.

The top 10 customers of the company accounted for 56% of net revenues for fiscal 2022.

Operating Details

Gross profit on a GAAP basis increased 35.6% year over year to $107.1 million. The gross margin expanded 10 basis points (bps) to 9.5%.

Selling and administrative expenses (4% of revenues) increased 22.3% from the year-ago quarter to $44.8 million.

Plexus reported an adjusted operating income of $62.3 million, up 47.2% year over year. Adjusted operating margin expanded 50 bps to 5.5%.

Balance Sheet & Cash Flow

As of Oct 1, Plexus had cash & cash equivalents worth $274.8 million compared with $276.6 million as of Jul 2.

As of Oct 1, the company had long-term debt and finance lease obligations, net of the current portion of $187.8 million compared with $184.7 million as of Jul 2.

In the quarter under review, the cash flow used in operations was $0.4 million. The company reported a free cash outflow of $17.1 million.

The company repurchased shares worth $3.5 million at an average price of $90.63 per share in the fiscal fourth quarter. As of Oct 1, the company had shares worth $46.5 million left under its existing share repurchase authorization. For fiscal 2022, the company repurchased shares worth $50.4 million under its share repurchase programs.

Guidance

For first-quarter fiscal 2023, revenues are projected between $1.08 billion and $1.13 billion.

GAAP operating margin is expected to be between 5% and 5.5%. GAAP earnings are expected in the range of $1.40-$1.58 per share, including 20 cents of stock-based compensation expenses.

Zacks Rank & Stocks to Consider

Plexus currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader technology space are Pure Storage PSTG, Blackbaud BLKB and Aspen Technology AZPN. All stocks currently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Pure Storage’s 2022 earnings is pegged at $1.18 per share, up 24.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 35.5%.

Pure Storage’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 171.8%. Shares of PSTG have gained 9% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2022 earnings is pegged at $2.55 per share, unchanged in the past 60 days. The long-term earnings growth rate is anticipated to be 3%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 8.5%. Shares of BLKB have lost 26.4% in the past year.

The Zacks Consensus Estimate for Aspen’s fiscal 2023 earnings is pegged at $6.77 per share. The long-term earnings growth rate is anticipated to be 18.2%.

AZPN’s earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 6.2%. Shares of AZPN have gained 60.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Plexus Corp. (PLXS) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Aspen Technology, Inc. (AZPN) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research