Is The PNC Financial Services Group Inc (NYSE:PNC) Worth $146.12 Based On Its Intrinsic Value?

One of the most difficult industry to value is banking, given that they adhere to different rules compared to other companies. Banks, for example, must hold certain levels of tiered capital in order to maintain a safe cash cushion. Looking at factors such as book values, in addition to the return and cost of equity, can be practical for evaluating PNC’s intrinsic value. Today we will look at how to value PNC in a fairly useful and easy approach. See our latest analysis for PNC Financial Services Group

Why Excess Return Model?

Before we begin, remember that financial stocks differ in terms of regulation and balance sheet composition. The regulatory environment in United States is fairly rigorous. In addition, banks usually do not hold significant amounts of physical assets on their balance sheet. So the Excess Returns model is suitable for determining the intrinsic value of PNC rather than the traditional discounted cash flow model, which places emphasis on factors such as depreciation and capex.

The Calculation

The key belief for Excess Returns is, the value of the company is how much money it can generate from its current level of equity capital, in excess of the cost of that capital. The returns above the cost of equity is known as excess returns:

Excess Return Per Share = (Stable Return On Equity – Cost Of Equity) (Book Value Of Equity Per Share)

= (10.07% – 9.82%) * $89.09 = $0.24

Excess Return Per Share is used to calculate the terminal value of PNC, which is how much the business is expected to continue to generate over the upcoming years, in perpetuity. This is a common component of discounted cash flow models:

Terminal Value Per Share = Excess Return Per Share / (Cost of Equity – Expected Growth Rate)

= $0.24 / (9.82% – 2.47%) = $3.23

Combining these components gives us PNC’s intrinsic value per share:

Value Per Share = Book Value of Equity Per Share + Terminal Value Per Share

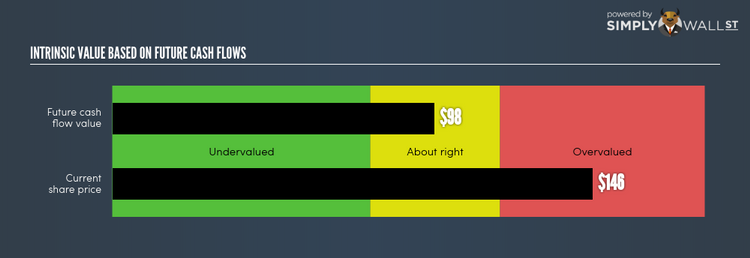

= $89.09 + $3.23 = $98.08

Given PNC’s current share price of $146.12, PNC is , at this time, trading above what it’s actually worth. This means PNC isn’t an attractive buy right now. Pricing is one part of the analysis of your potential investment in PNC. Analyzing fundamental factors are equally important when it comes to determining if PNC has a place in your holdings.

Next Steps:

For banks, there are three key aspects you should look at:

1. Financial health: Does it have a healthy balance sheet? Take a look at our free bank analysis with six simple checks on things like bad loans and customer deposits.

2. Future earnings: What does the market think of PNC going forward? Our analyst growth expectation chart helps visualize PNC’s growth potential over the upcoming years.

3. Dividends: Most people buy financial stocks for their healthy and stable dividends. Check out whether PNC is a dividend Rockstar with our historical and future dividend analysis.

For more details and sources, take a look at our full calculation on PNC here.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.