Pocket an Instant Profit for the Chance to Buy This Retailer at a Steep Discount

J.C. Penney Company (JCP) shares lost more than half of their value in 2012. The sell-off came after posting multi-year highs above $43 in February 2012, even against the backdrop of a tough economy.

In 2013, a $20 support base was violated, and the decade lows around $14, made in 2009, have also been tested with the recent decline.

The stock hit a 52-week low of $13.55 this month, but a new price base has formed at $14 since the end of February, offering a key level of support for the shares. JCP is currently trading near $15.35.

If you are comfortable holding on to this stock near its 10-year low for a potential recovery, then selling put options could allow you to collect income while you wait to get into the stock at an 18% discount. The high volatility and short amount of time until May options expiration make this a high-probability play.

Cash-Secured Put Selling Strategy

While the typical investor might use a limit order to buy a stock or ETF at a designated price or lower, the options trader can do one better by selling a cash-secured put.

This strategy has the same mathematical risk profile as a covered call. With put selling, there is an obligation to buy the stock at the strike price if it is assigned, allowing you to get into the stock at a discount. In fact, the true entry cost basis is even lower with the subtraction of the premium you earned from selling the puts.

And if the stock is not below the strike price at expiration, then the premium received is all profit. In other words, you're getting paid not to own the stock.

There are two rules traders must follow to be successful at put selling.

Rule One: Only sell puts on stocks you want to own.

The intention of this strategy is to be assigned the stock as a long-term investment (each option contract represents 100 shares). So make sure you have the funds in your account to buy the stock at the options strike price if a sell-off occurs. Paying in full ensures that no additional money is needed to hold the stock for potentially many months or even years until a price recovery occurs.

Rule Two: Sell either of the front two option expiration months to take advantage of time decay.

Collect premium every month on put sales until you are assigned shares at a cost-reduced basis. Every month that you keep the premium is money subtracted from your entry price.

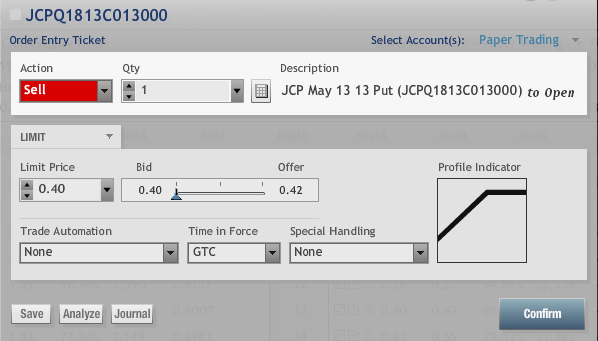

Recommended Trade Setup: Sell to open JCP May 13 Puts at $0.40 or better.

This cash-secured put sale would assign long shares at $12.60 ($13 strike minus $0.40 premium), which is about 18% below JCP's current price and about $1 below its decade low, costing you $1,260 per option sold. Remember: Only sell this put if you want to own JCP stock at a discount to the current price. If you are assigned the shares, a June covered call can be sold against the stock to lower your cost basis even further.

If the stock does not fall below the strike price before expiration, then you keep the premium you collected, essentially getting paid not to buy the stock.

Related Articles

Education Stock's Comeback Could Make Income Traders 52% a Year