Pollution Control Industry Outlook: Growth Prospects Alluring

The pollution-control equipment manufacturing firms are currently witnessing a substantial uptick in new task orders backed by higher infrastructure-related work in the United States and several other emerging economies. In addition, rising demand for engineering and assessment services in disaster-related work (like California wildfires), escalating pollution-related health concerns and stringent government regulations are spurring demand for products and services offered by these companies.

Furthermore, recovery in the oil and gas market is favorably impacting the spending plans of energy exploration & production companies, in turn, driving demand for pollution-control equipment products.

Some economists, however, argue that escalating trade tensions between the Republican administration and other countries, as well as shortage in skilled workers might curb business spending over pollution-control products and services.

Nevertheless, the December 2017 tax overhaul, increased government spending, rising oil prices and the President’s long-awaited $1.5-trillion infrastructure program are likely to expedite corporate investments in the days ahead.

Industry Outperforms S&P 500, Sector

The Zacks Pollution Control industry, which is a 14-stock group, has outperformed the growth recorded by its broader Zacks Industrial Products sectorand the benchmark S&P 500 group, over the past year.

While the stocks in this industry have collectively rallied 30.4%, the Zacks S&P 500 Composite and Zacks Industrial Products Sector have gained 16.7% and 4.9%, respectively (the green line in the chart below represents the industry).

One-Year Price Performance

As you can see, the industry's stock market performance has been improving since the beginning of March 2018, as did the broader market.This proves that increasing global demand for pollution-control products and services has been strengthening the group’s performance for the last couple of months.

Industry Trading At a Discount

Since the pollution-control equipment manufacturing companies are debt laden, it makes sense to value these based on the EV/EBITDA (Enterprise Value/ Earnings before Interest Tax Depreciation and Amortization) ratio. This is because the valuation metric takes into account not just equity, but also the level of debt. For capital-intensive companies, the EV/EBITDA is a better valuation metric because it is not influenced by changing capital structures and ignores the impact of non-cash expenses.

The industry displays a favorable valuation picture, even with its outperformance over the past year. The industry, currently, has a trailing 12-month EV/EBITDA ratio of 10.8X, which is marginally below the high of 11.3X for the past year, but slightly higher than the median multiple of 10.5x.

The space is trading at a discount when compared to the market at large, as the trailing 12-month EV/EBITDA ratio for the S&P 500 is 12.0X and the median level is 11.6X.

Enterprise Value/EBITDA Ratio (TTM)

Earnings Outlook Marginally Tempered

Robust industry fundamentals and expectations of solid top-line growth will likely help the pollution-control equipment manufacturing stocks generate higher shareholder returns in the near future.

However, per some pessimistic views, tariff-related uproar may dampen the profitability of pollution-control equipment manufacturing companies. Many of these manufactures are facing margin pressures due to setbacks like shortage in skilled workers, as well as higher tariff and transit expenses, at present. Consequently, some producers are offering products at higher prices to defy bottom-line stagnation, but this might curb demand for pollution-control products and services in the long run.

But what really matters to investors is whether this group has the potential to perform better than the broader market in the quarters ahead. The earlier valuation discussion shows that market participants might be interested in gaining exposure in the stock at current levels.

One reliable measure that can help investors understand the industry’s prospects for a solid price performance, going forward, is the industry's earnings outlook. Empirical research shows that earnings outlook for the industry, a reflection of the earnings revisions trend for the constituent companies, has a direct bearing on its stock market performance.

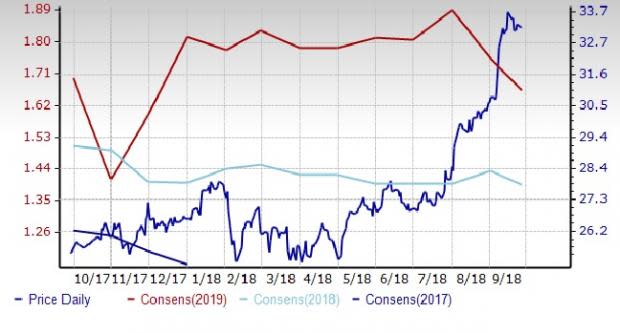

The Price & Consensus chart for the industry below shows the market's evolving bottom-up earnings expectations for the industry and the industry's aggregate stock market performance. The red line in the chart represents the Zacks measure of consensus earnings expectations for 2019, while the light blue line represents the same for 2018.

Price and Consensus: Zacks Pollution Control Industry

Looking at the aggregate estimate revisions, it appears that analysts are slightly losing confidence in this group’s earnings potential.

Current Fiscal Year EPS Estimate Revisions

The consensus earnings estimate for the Zacks Pollution Control industry is pegged at $1.40 per share, implying a 7.3% decline year over year. Please note that the estimate for the industry for 2018 is not the actual bottom-up dollar EPS estimate for every company in the Zacks Pollution Control industry, but rather an illustrative aggregate number created by our proprietary analytics model.

Zacks Industry Rank Retains Hope

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates outperformance in the near term as the industry battles trade tariffs and higher input cost inflations.

The Zacks Pollution Control industry currently carries a Zacks Industry Rank #23, which places it at the top 9% of more than 250 Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Industry Assures Long-Term Growth

The long-term prospects for the industry are alluring. When compared with the broader Zacks S&P 500 composite, the long-term (3-5 years) EPS growth estimate for the Zacks Pollution Control industry appears promising.

The group’s mean estimate of long-term EPS growth has remained stable in the past couple of months to reach the current level of 13.5%, better than 9.8% for the Zacks S&P 500 composite.

Mean Estimate of Long-Term EPS Growth Rate

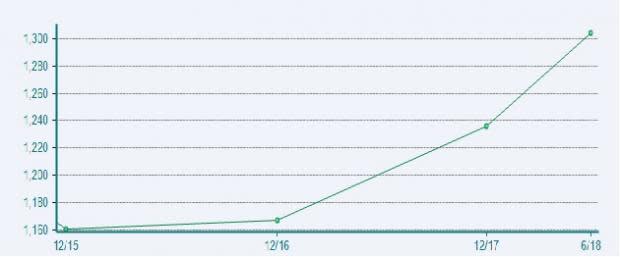

In fact, the basis of this long-term EPS growth could be the recovery in top line that the Zacks Pollution Control industry has been displaying since the beginning of 2017.

Zacks Pollution Control Industry Revenues

Another important indication of the industry’s solid long-term prospect is improvement in its net income before non-recurring items (BNRI). The image below clearly shows that the group’s net income BNRI has been improving since the beginning of 2016.

Zacks Pollution Control Net Income BNRI

Bottom Line

The outlook analysis shows that on average, stocks within the Zacks Pollution Control industry are currently trading at a discount despite its outperformance over the broader market and sector over the past year. Enjoying a favorable Zacks Rank, the industry assures long-term growth with bright top-line prospects, although near-term earnings outlook appears slightly tempered.

Increased public and commercial demand for pollution-control equipment products and services will likely continue to hold up performances of stocks within this industry. Nevertheless, earnings outlook for these companies is marginally on the lower side, possibly on account of the prevailing supply-side setbacks.

Below, we have picked four stocks from the Zacks Pollution Control industry, with a favorable Zacks Rank #1 (Strong Buy) or 2 (Buy). Notably, these stocks have witnessed positive earnings estimate revisions for the last 60 days.

Donaldson Company, Inc. (DCI) produces and sells filtration replacement parts and systems across the globe. The Zacks Consensus Estimate for earnings has climbed 4.4% to $2.37 for fiscal 2019 (ending July 2019). The company currently flaunts a Zacks Rank of 1. You can see the complete list of today’s Zacks #1 Rank stocks here.

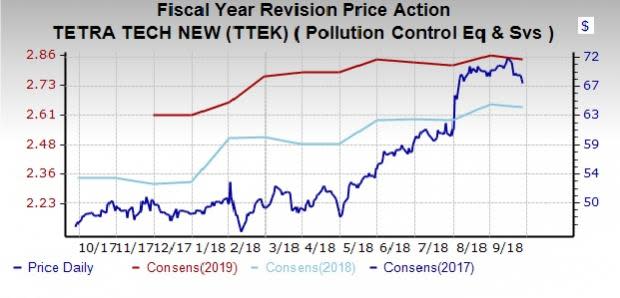

Tetra Tech, Inc. (TTEK) provides engineering and consulting services globally. Currently, the company carries a Zacks Rank #2. The Zacks Consensus Estimate for earnings has inched up 0.7% to $2.84for fiscal 2019 (ending September2019).

Advanced Emissions Solutions, Inc. (ADES) provides variable emission reduction technologies and related speciality chemicals in the United States. The company currently carries a Zacks Rank of 2. The Zacks Consensus Estimate for earnings has jumped 17.3% to $2.30for 2018.

Casella Waste Systems, Inc. (CWST) is a premium vertically-integrated solid waste services company. The company carries a Zacks Rank #2, at present. The Zacks Consensus Estimate for earnings has moved up 1.4% to 71 centsfor the current year.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tetra Tech, Inc. (TTEK) : Free Stock Analysis Report

Donaldson Company, Inc. (DCI) : Free Stock Analysis Report

Casella Waste Systems, Inc. (CWST) : Free Stock Analysis Report

Advanced Emissions Solutions, Inc. (ADES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research