Polymarket platform for placing crypto bets on COVID, Bennifer 2.0, and Trump's return is under investigation by the CFTC, report says

The CFTC is investigating whether Polymarket allows improper trading of swaps or binary options, Bloomberg reported.

The regulator, which is investigating Binance for insider trading, is scrutinizing the crypto industry closely.

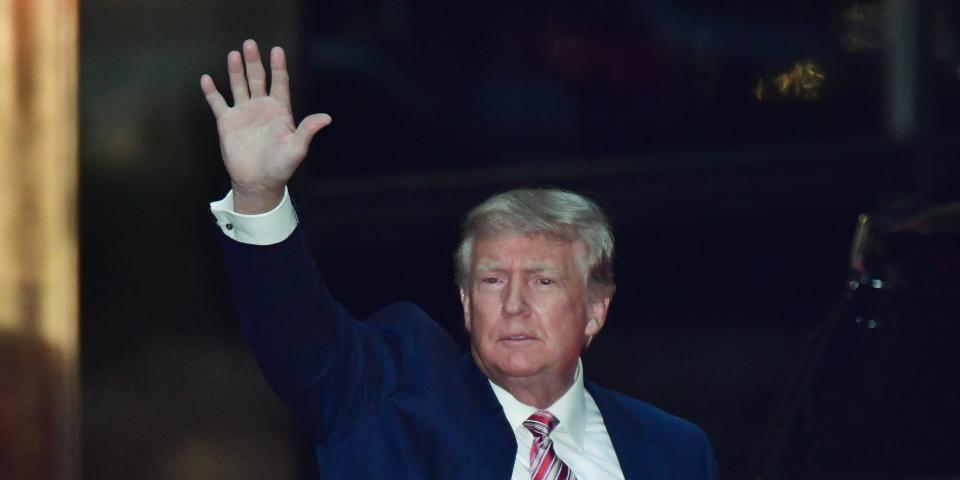

Polymarket gathers prediction data by letting people bet crypto on beliefs such as whether Trump will be re-elected.

Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Polymarket, one of the biggest cryptocurrency prediction venues, is being scrutinized by the Commodity Futures Trading Commission over whether it is allowing users to make improper trades, Bloomberg reported Saturday.

The US-based platform lets people place crypto bets on what will happen next in topics in the news and social media, such as whether former president Donald Trump will return to the White House. That trading activity is then turned into prediction data.

The CFTC, the US derivatives markets regulator, is probing whether Polymarket let users improperly trade swaps or binary options, people familiar with the matter told Bloomberg. Its officials are also looking to see whether the platform should be registered with the CFTC.

Swaps are derivative contracts to exchange money for a set period of time, while binary options let investors trade on price fluctuations.

Polymarket and the CFTC did not respond to requests for comment.

On the Polymarket platform right now, people can place bids on whether Jennifer Lopez and Ben Affleck will get engaged again by Thanksgiving - so far, most have said no. Wagers have been placed on whether Nicki Minaj will get the COVID-19 vaccine by November 29 (most said no). When a prediction proves to be true, the person betting gets a return.

Polymarket is not the only crypto-related company to come under the CFTC's lens, as the regulator has been investigating crypto exchange Binance for insider trading since late September. Its officials are looking into whether Binance profited from trading on customer orders before they were executed.

Other US regulators have trained their sights on crypto. The Securities and Exchange Commission and the Treasury Department are looking at how they can tax and regulate crypto trading better, to prevent fraud and "malign actors" from transferring funds across borders.

Read the original article on Business Insider