Pool Corp's (POOL) Stock Slips Despite Q3 Earnings Beat

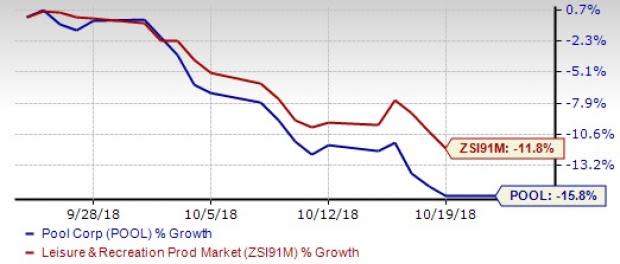

Shares of Pool Corporation POOL, which belongs to the Zacks Leisure and Recreation Products industry, have declined more than 2% in the last three trading sessions, despite reporting better-than-expected results in the third quarter of 2018 on Oct 18. In all likelihood, headwinds associated with weather and cost inflation have more than offset its improved revenues and earnings, as well as upbeat EPS guidance. In fact, shares of the world’s largest wholesale distributor of swimming pool and related backyard products have declined almost 16% over the past month.

Earnings of $1.66 per share in the quarter topped the Zacks Consensus Estimate of $1.58 by 5.1%. The bottom line also increased 43% from the year-ago quarter on the back of higher demand trends for discretionary pool and irrigation-related products, coupled with tax benefits.

Quarterly net sales of $811.3 million surpassed the consensus mark of $804 million by 0.9% and also grew 9.1% year over year. The revenue growth was primarily attributable to improved performance of the company’s base business. Despite abnormal weather conditions in Texas, wildfires in California and the impact from Hurricane Florence, base volumes grew in the quarter.

Let’s delve deeper into the numbers.

Segmental Performance

Pool Corp reports operations under two segments: The Base Business segment (constituting majority of the business) and Excluded segment (sale centers excluded from base business).

The Base business segment recorded sales growth of 8% to nearly $801 million year over year, courtesy of higher demand for discretionary products, comprising building materials and other commercial product offerings. Operating income in the segment increased 12.2%. Operating margin expanded 30 basis points (bps) from the year-ago quarter.

The Excluded segment reported net sales of $10.3 million, up from about $5 million in the prior-year quarter. The segment incurred operating loss of $0.112 million compared with the prior-year quarter’s $0.487 million.

Operating Highlights & Expenses

Cost of sales in the quarter increased 9.4% from the prior-year quarter. Gross profit, as a percentage of net sales, fell 10 bps to 29% from the year-ago level due to changes in product mix. The company also pointed out that gross margin will face some impact in the last four months of 2018, given materials and operating cost pressures.

Operating income increased 13% year over year to $92.3 million. Operating margin improved 40 bps to 11.4% from the prior-year quarter. Selling and administrative expenses increased 6% year over year. Net income was $69.3 million, up from $48.8 million recorded in the year-ago quarter.

Adjusted EBITDA increased to $102.5 million in the quarter from $91.7 million in the third quarter of 2017.

Pool Corporation Price, Consensus and EPS Surprise

Pool Corporation Price, Consensus and EPS Surprise | Pool Corporation Quote

Balance Sheet

Cash and cash equivalents as of Sep 30, 2018 were $35.7 million compared with $36.4 million on Sep 30, 2017. Total net receivables, including pledged receivables, increased 10% and inventory levels grew 26% as of the same date compared with Sep 30, 2017. Notably, this year, the company increased its inventory purchases in advance of greater-than-normal vendor price increases, which negatively impacted operating cash flow. However, it believes that this should positively impact operating income in the remainder of 2018 and fiscal 2019.

Its long-term debt was $580.7 million, up 16.1 million from the prior-year quarter. Goodwill increased 5% year over year.

Cash provided by operations declined $60.7 million to $4.5 million. The decline reflects timing differences as a result of the pre-price increase inventory purchases discussed above, which is expected to benefit future periods’ cash flow as the inventory is sold.

Raised 2018 EPS Expectation

For 2018, the company expects EPS in the range of $5.58-$5.78, up from the previous guided range of $5.50-$5.70. This increase in expectation mainly reflects the 8-cent per share benefit realized from Accounting Standards Update or ASU 2016-09 in the third quarter. The company did not project any additional tax benefit from ASU 2016-09 in its guided EPS range for the remainder of the year.

Zacks Rank & Other Stocks to Consider

Pool Corp currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other top-ranked stocks from the leisure space include Callaway Golf Company ELY, Malibu Boats MBUU and Marine Products Corporation MPX, each sporting a Zacks Rank #1.

Callaway Golf, Malibu Boats and Marine Products’ earnings are expected to increase 88.7%, 24.2% and 38.3% in the current year, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Malibu Boats, Inc. (MBUU) : Free Stock Analysis Report

Marine Products Corporation (MPX) : Free Stock Analysis Report

Callaway Golf Company (ELY) : Free Stock Analysis Report

Pool Corporation (POOL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research