This Portfolio of 3 Dividend Aristocrats Pays Monthly

Receiving steady dividend payouts from your investments is always a great feeling, as paydays are always the best.

And over the last year, many investors have targeted dividend-paying stocks to counter volatility and cushion the impact of drawdowns.

Interestingly enough, by targeting companies that pay out dividends in different months, investors can construct a portfolio that allows them to get paid monthly.

For example –

The first stock pays its dividend in January, April, July, and October. The second stock pays out in February, May, August, and November. And finally, the third stock will pay its dividend in March, June, September, and December.

As we can see, this type of portfolio would undoubtedly be attractive to income-focused investors.

The combination of three Dividend Aristocrats – Cardinal Health CAH, General Dynamics GD, and Archer Daniels Midland ADM – would allow investors to reap a monthly income stream.

Below is a chart illustrating the performance of all three over the last year, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

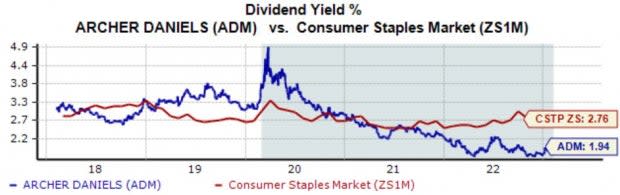

Archer Daniels Midland

Archer Daniels Midland is one of the leading producers of food and beverage ingredients and goods made from various agricultural products. The company’s dividends are paid in March, June, September, and December.

Currently, the company’s annual dividend yields roughly 2%, below the Zacks Consumer Staples sector average.

While the yield is below its sector average, ADM’s commitment to shareholders through 25+ years of increased dividend payouts puts its reliable nature on full display.

Image Source: Zacks Investment Research

In addition, Archer Daniels Midland’s earnings outlook has improved across all timeframes as of late, pushing the stock into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

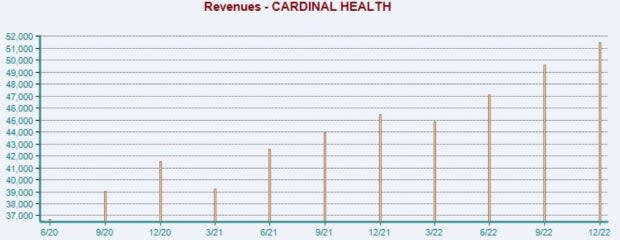

Cardinal Health Inc.

Cardinal Health is a nationwide drug distributor and provider of services to pharmacies, healthcare providers, and manufacturers. The company’s dividends are paid in January, April, July, and October.

Cardinal Health’s annual dividend stands tall at 2.6%, nearly double that of its Zacks Medical sector average. In addition, the company’s 39% payout ratio is certainly sustainable.

Image Source: Zacks Investment Research

CAH has delivered strong quarterly results as of late, exceeding the Zacks Consensus EPS Estimate by double-digit percentages in back-to-back releases.

Cardinal Health crushed earnings estimates by nearly 17% in its latest print and posted sales 2% above expectations. Below is a chart illustrating the company’s quarterly revenue.

Image Source: Zacks Investment Research

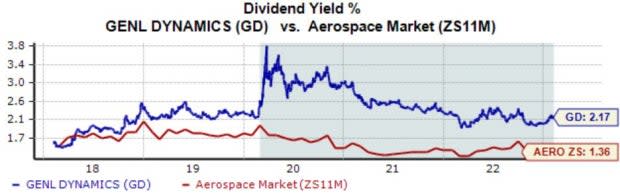

General Dynamics

General Dynamics is an aerospace and defense company engaging in mission-critical information systems and technologies. GD’s dividends are paid in February, May, August, and November.

As it stands, General Dynamics’ annual dividend yields 2.2%, well above the Zacks Aerospace sector average. Impressively, the company’s payout has grown by 8% over the last five years.

Image Source: Zacks Investment Research

In addition, the company’s sector-beating 18.9% TTM return on equity is worth highlighting, indicating that GD has generated profits from existing assets more efficiently.

Image Source: Zacks Investment Research

Bottom Line

Dividends are always a solid portfolio boost, limiting the impact of drawdowns in other positions and providing the ability for maximum returns through dividend reinvestment.

And if investors select their stocks in a structured manner, they can create a portfolio that pays them monthly.

When combined, all three stocks above – Cardinal Health CAH, General Dynamics GD, and Archer Daniels Midland ADM – construct a portfolio that allows monthly income.

In addition, all three hold the ranks of a Dividend Aristocrat, providing investors with reliability.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Dynamics Corporation (GD) : Free Stock Analysis Report

Archer Daniels Midland Company (ADM) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report