Posthaste: More borrowers struggle as IMF warns Canada at highest risk of mortgage defaults

Good Morning,

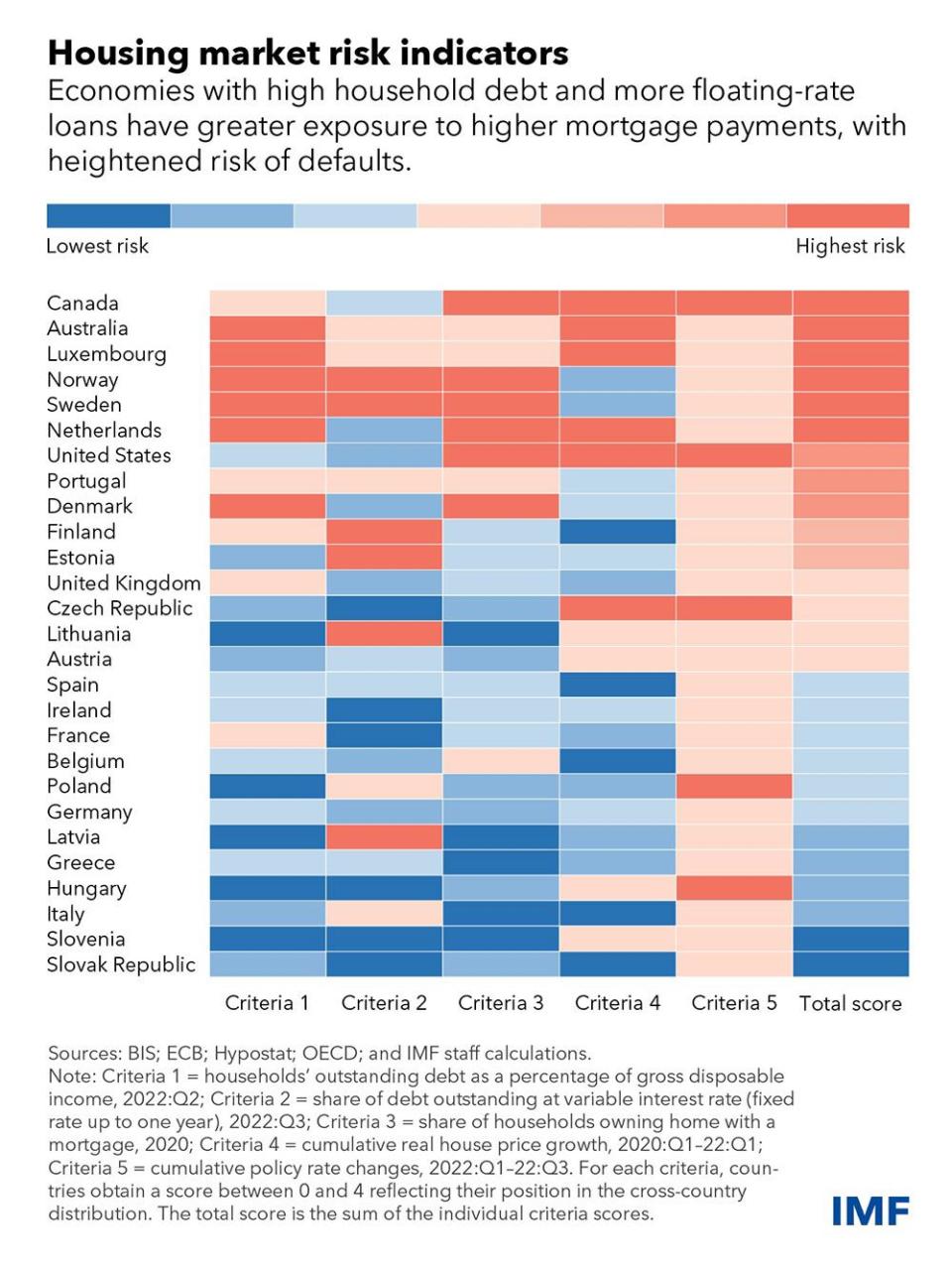

Canada runs the highest risk of mortgage defaults among advanced economies, the International Monetary Fund warns, while other reports show Canadians are increasingly struggling with debt.

The IMF flagged Canada, Australia, Norway, and Sweden at greatest risk of mortgage defaults using data from the Organisation for Economic Co-operation and Development, a group of 38 economies.

After central banks rapidly raised interest rates to fight inflation, the average mortgage rate in advanced economies rose to 6.8 per cent in late 2022, more than doubling from the start of last year, the IMF report says. Countries with high levels of household debt and a large share of borrowing at floating rates are most vulnerable to higher mortgage payments and at greater risk of defaults — with Canada topping the list.

The report, however, says there are important differences between current conditions and the global financial crisis in 2008.

Banks are better capitalized and underwriting standards tighter than before that crisis, said Nina Biljanovska, an economist at the IMF’s research department.

However, the average household debt-to-income ratio across countries is about the same as in 2007, as countries such as Canada that escaped the full brunt of the 2008 crisis have gone on to run up household debt.

“In most cases, while it is unlikely that falling home prices will spark a financial crisis, a sharp drop in house prices could dim the economic outlook. And the build-up of vulnerabilities warrants close monitoring in coming years — and possibly even intervention by policymakers,” the IMF said.

The IMF’s report doesn’t jive with other data that show mortgage delinquency rates in Canada remain lower than pre-pandemic levels, but strain is beginning to show.

According to a recent study by the Canadian Mortgage and Housing Corporation, household debt in Canada is now the highest among G7 countries. In 2021 it was seven per cent higher than the country’s total gross domestic product.

And there are signs that debt is taking a toll.

A report by credit research firm Equifax Canada out today shows that an increasing number of Canadians with a mortgage are missing payments on non-mortgage credit, up 15.7 per cent from the first quarter of 2022, almost double the rise seen in the previous quarter. The numbers suggest people are feeling the pressure of higher mortgage payments and turning to credit cards to cover other expenses.

“We are now starting to see more homeowners struggle as well, especially following mortgage renewals where payments have risen significantly,” said Rebecca Oakes, vice-president of advanced analytics at Equifax Canada.

Canadian consumers on average are spending 21.5 per cent more each month on credit cards, compared to pre-pandemic levels. Average monthly spending per credit card holder exceeded $2,200 this quarter, up about $400 compared to the first quarter of 2020.

Meanwhile, an Angus Reid survey out this week found that three in 10 Canadians say they are struggling to get by. That is six percentage points higher than a year ago.

Almost half, 45 per cent, of the people surveyed with mortgages say they are finding their monthly payments “tough or very difficult to manage.”

That’s up from 34 per cent in June of 2022.

Faced with increasing costs for housing and food, Canadians have used credit to keep up, said Angus Reid. And if the Bank of Canada hikes interest rates again, as some economists expect, it would put more pressure on indebted Canadians.

One quarter of the people polled said debt is a major source of stress for them. Among people with mortgages that percentage is even higher, with 30 per cent saying their debt was majorly stressful.

_____________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

Today’s chart from National Bank economists offers a discouraging outlook for Canadian renters.

Real residential investment fell 14.6 per cent in the first quarter in the fourth double-digit decline in a row, recent GDP data showed, writes National economist Stéfane Marion. With new construction slowing and immigration growing, the gap between housing supply and demand will only get worse.

Marion said the working-age population rose by a record 270,000 in the first four months of 2023, and with Canada’s rental vacancy rate already at generational lows, rents will continue to rise.

“As this situation endures for the foreseeable future, we expect CPI rental inflation to remain elevated or even accelerate to levels not seen since the 1980s if residential construction does not rebound,” wrote Marion.

Today’s Data: Canada building permits, global supply chain pressure index

Earnings: JM Smucker Co., Nordstrom AGM

_______________________________________________________

David Rosenberg: The Canadian stock market is not underperforming as much as you think

Most Canadians waiting for mortgage rates to drop to re-enter housing market: poll

Wildfires force miners in Quebec to suspend operations and pull staff out

We spend 15 hours a week worrying about our finances. That’s like working two extra days each week, but instead of earning a paycheque, it’s spent stressing about bills, routine expenses, debts or a lack of savings and it usually doesn’t lead to a solution. Credit counsellor Sandra Fry offers some ways to take back control.

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.