PPG Industries (PPG) Q2 Earnings Top Estimates, Sales Lag

PPG Industries Inc. PPG logged net income of $443 million or $1.86 per share in second-quarter 2022, up from the year-ago quarter’s profit of $431 million or $1.80 per share.

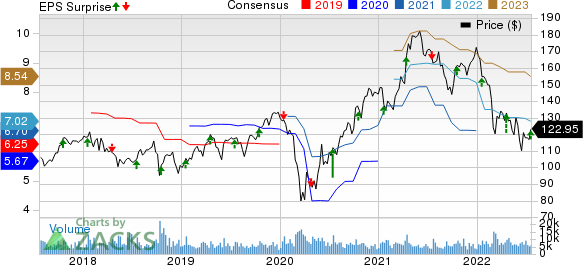

Barring one-time items, adjusted earnings were $1.81 per share in the reported quarter, down from $1.94 logged in the year-ago quarter. However, the figure topped the Zacks Consensus Estimate of $1.75.

Net sales rose roughly 8% year over year to $4,691 million. The figure, however, missed the Zacks Consensus Estimate of $4,748.3 million. The top line was driven by the company’s price hike actions to counter cost inflation and contributions from acquisitions that offset weaker consumer demand in Europe, significant pandemic-related demand disruptions in China and unfavorable currency swings. Organic sales rose 8%, aided by higher selling prices.

PPG Industries, Inc. Price, Consensus and EPS Surprise

PPG Industries, Inc. price-consensus-eps-surprise-chart | PPG Industries, Inc. Quote

Segment Highlights

Performance Coatings: Net sales in the segment were $2,929 million in the second quarter, up 7% year over year, driven by acquisitions and higher selling prices in all businesses. Sales volumes in the segment were down 4%. Selling prices rose 11% year over year. Volumes were impacted by raw material availability and logistics bottlenecks that affected coatings manufacturing in the United States.

Segment income declined 2% year over year to $446 million. The downside was caused by raw material and logistics cost inflation, unfavorable currency, higher manufacturing costs and lower sales volumes, partly offset by increased selling prices and restructuring cost savings.

Industrial Coatings: Sales in the segment totaled around $1,762 million, up 9% year over year. Sales rose due to higher selling prices across all businesses and contributions of acquisitions, partly offset by lower sales volumes due to lockdowns in China and reduced industrial activity in Europe. Sales volumes declined 3% year over year and selling prices were up 14% year over year.

Segment income totaled $156 million, down 18% year over year. It was lower than the previous year’s levels primarily due to raw material and energy cost inflation, unfavorable currency, higher operating costs in China due to pandemic-led restrictions and lower sales volumes. The downside was partly offset by higher selling prices and restructuring cost savings.

Financials

PPG Industries ended the quarter with cash and cash equivalents of $931 million, down roughly 22% year over year. Long-term debt rose around 6% year over year to $6,766 million.

The company repurchased shares worth $135 million during the reported quarter.

Outlook

Moving ahead, the company sees overall underlying demand for its products to remain strong in most major regions and end-use markets. It expects strong sequential growth in Asia due to increased industrial production compared to the second quarter. PPG Industries also envisions positive growth trends to continue in North America. It also expects economic conditions to remain soft in Europe, including normal seasonal demand trends.

PPG Industries projects adjusted earnings per share (EPS) in the band of $1.75-$2.00 for third-quarter 2022, barring amortization expenses of 13 cents and costs related to earlier approved and communicated business restructuring of 2 cents. It also sees reported EPS of $1.60-$1.85 for the quarter.

The company also expects aggregate net sales volumes to be flat to down a low-single-digit percentage on a year-over-year basis in the third quarter.

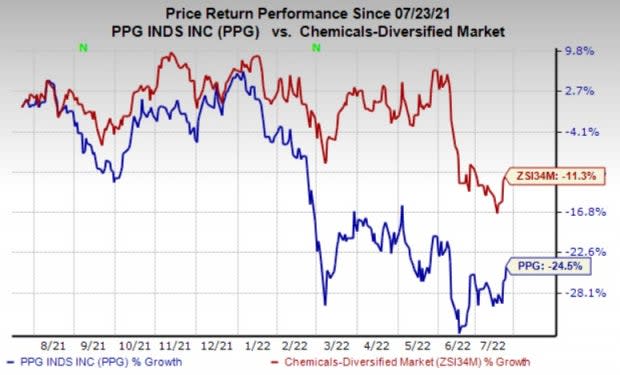

Price Performance

Shares of PPG Industries have lost 24.5% in the past year compared with an 11.3% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

PPG Industries currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Cabot Corporation CBT, ATI Inc. ATI and Albemarle Corporation ALB.

Cabot, currently carrying a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 22.5% for the current fiscal year. The Zacks Consensus Estimate for CBT's earnings for the current fiscal has been revised 0.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 35% over a year.

ATI, currently sporting a Zacks Rank #1, has a projected earnings growth rate of 1,069.2% for the current year. The Zacks Consensus Estimate for ATI's current-year earnings has been revised 17.8% upward in the past 60 days.

ATI’s earnings beat the Zacks Consensus Estimate in the last four quarters. It has a trailing four-quarter earnings surprise of roughly 128.9%, on average. ATI shares are up around 19% in a year.

Albemarle has a projected earnings growth rate of 241.8% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 21.5% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 20%. ALB has gained roughly 17% in a year. The company flaunts a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research