Prem Watsa Exits 4 Stocks, Trims 1 Position

The founder of Fairfax Financial Holdings, Prem Watsa (Trades, Portfolio), sold shares of the following stocks during the third quarter.

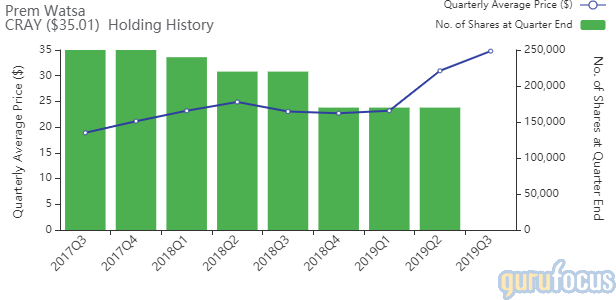

Cray

Watsa exited his Cray Inc. (NASDAQ:CRAY) position. The portfolio was impacted by -0.33%.

The provider of storage and data analytics solutions has a market cap of $1.45 billion and an enterprise value of $1.34 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -32.47% and return on assets of -21.51% are underperforming 91% of companies in the hardware industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 3.7 is above the industry median of 1.22.

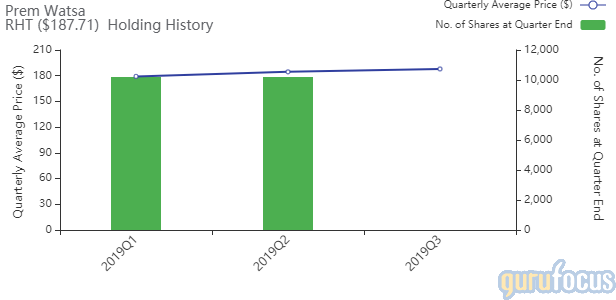

Red Hat

The guru's Red Hat Inc. (NYSE:RHT) holding was dissolved after its merger with IBM (NYSE:IBM) closed. The portfolio was impacted by -0.11%.

On its last day of trading, the company had a market cap of $33.43 billion and an enterprise value of $31.33 billion.

GuruFocus gave the company a profitability and growth rating of 10 out of 10. The return on equity of 30.72% and return on assets of 8.79% were outperforming 100% of companies in the software industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 6.57 is above the industry median of 2.33.

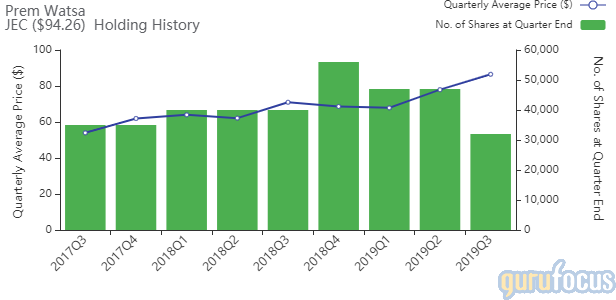

Jacobs Engineering Group

The Jacobs Engineering Group Inc. (NYSE:JEC) position was reduced by 31.91%, impacting the portfolio by -0.07%.

One of the largest providers of engineering and construction services has a market cap of $12.77 billion and an enterprise value of $13.07 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 11.47% and return on assets of 5.33% are outperforming 66% of companies in the construction industry. Its financial strength is rated 7 out of 10. The cash-debt ratio of 0.8 is above the industry median of 0.63.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 5.58% of outstanding shares, followed by Ruane Cunniff (Trades, Portfolio) with 4.15%, Barrow, Hanley, Mewhinney & Strauss with 3.38% and Joel Greenblatt (Trades, Portfolio) with 0.17%.

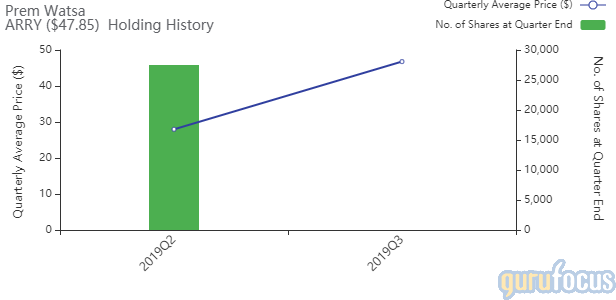

Array BioPharma

The guru closed his Array BioPharma Inc. (NASDAQ:ARRY) holding. The trade had an impact of -0.07% on the portfolio.

The biopharmaceutical company has a market cap of $10.68 billion and an enterprise value of $10.39 billion.

GuruFocus gives the company a profitability and growth rating of 3 out of 10. The return on equity of -48.85% and return on assets of -24.66% are outperforming 100% of companies in the biotechnology industry. Its financial strength is rated 6 out of 10, with a cash-debt ratio of 3.15 that is below industry median of 9.6.

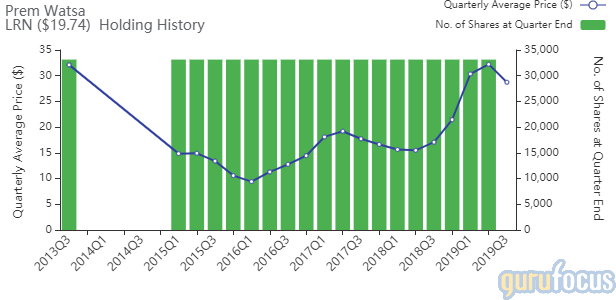

K12

Watsa exited his K12 Inc. (NYSE:LRN) holding. The portfolio was impacted by -0.06%.

The online educational company has a market cap of $808.45 million and an enterprise value of $693.44 million.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. While the return on equity of 5.84% is underperforming the sector, the return on assets of 4.46% is outperforming 54% of companies in the education industry. Its financial strength is rated 9 out of 10, with a cash-debt ratio of 3.26 that is above the industry median of 1.63.

The largest guru shareholder of the company is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 4.30% of outstanding shares, followed by Jeremy Grantham (Trades, Portfolio) with 1.15%, Pioneer Investments (Trades, Portfolio) with 0.20% and Paul Tudor Jones (Trades, Portfolio) with 0.05%.

Disclosure: I do not own any stocks mentioned.

Read more here:

8 Stocks Ron Baron Continues to Buy

Sarah Ketterer Exits General Electric, Trims Bank of America

7 Stocks John Rogers Continues to Buy

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.