Price & Time: Pound Prone to Turn?

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

Foreign Exchange Price & Time at a Glance:

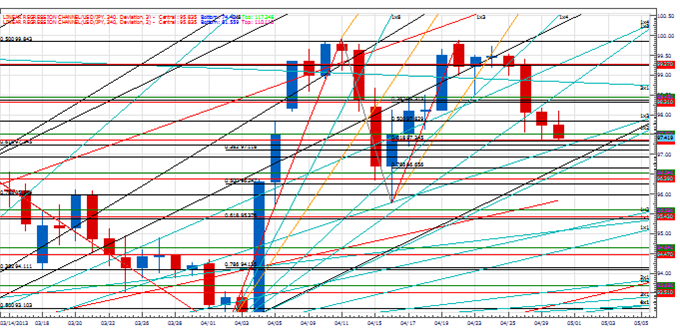

USD/JPY:

Charts Created using Marketscope – Prepared by Kristian Kerr

-USD/JPY closed under the 97.80 50% retracement of the late April advance on Monday

-Our bias remains lower in the exchange rate with focus now on the 1x3 Gann angle line from the February low in the 97.20 area

-Traction below this level needed to setup further downside towards 96.60 and beyond

-The short-term cyclical picture is a bit muddled, but weakness is favored for a couple more days

-A close back over the 1st square root progression from the year-to-date high in the 98.50 area would turn us positive on USD/JPY

Strategy: Favor the short side in USD/JPY while under 98.50.

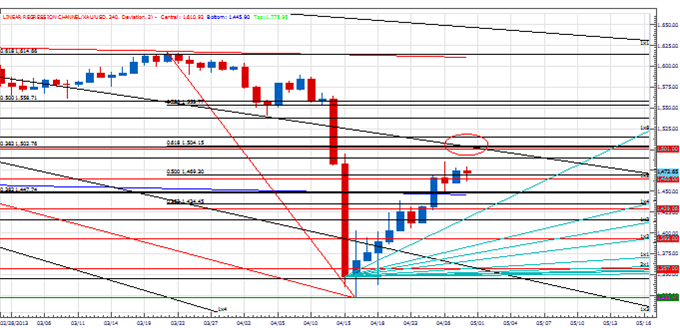

GOLD:

Charts Created using Marketscope – Prepared by Kristian Kerr

-XAU/USD closed above the 50% retracement of the March to April decline on Monday

-Rebound from the Fibonacci support zone in the 1320 area has been remarkably steady, but our broader bias is still lower in the metal

-Several key retracements and the 1x1 Gann angle line from last year’s closing high converge near 1500 making this an absolute critical resistance area

-Short-term cycle counts point to Wednesday being a potential turning point

-The 3rd square root progression from the year-to-date low near 1430 is now a near-term pivot with weakness below needed to signal a downside resumption

Strategy: We like the reward to risk of selling against the 1500 resistance zone in the next couple of days.

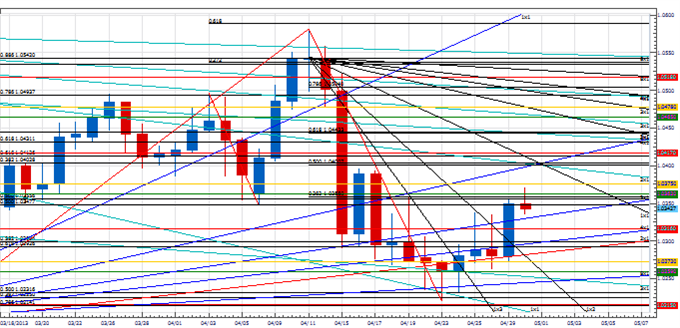

AUD/USD:

Charts Created using Marketscope – Prepared by Kristian Kerr

-AUD/USD rebound last week from just above the 78.6% retracement of the March to April advance has been unimpressive

-Our bias remains lower in the exchange rate with immediate focus on the 2nd square root progression of the year-to-date low in the 1.0320 area

-However, a close below the 3rd square root progression of the year-to-date high is really required to signal the start of a more important decline

-Near-term focused cyclical studies indicate a turn could be seen over the next day or so

-Traction over the 50% retracement of the April range in the 1.0400 area is needed for us to turn positive on the Aussie

Strategy: We still like selling the rate on rallies.

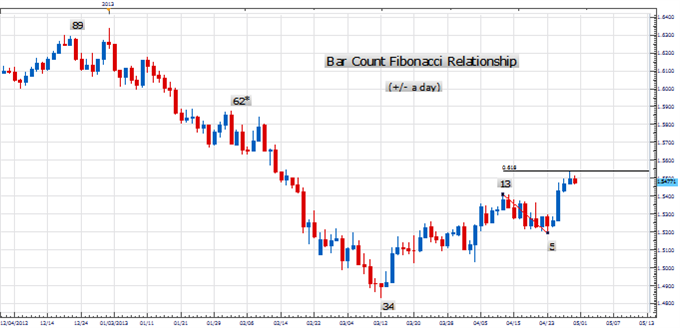

Focus Chart of the Day: GBP/USD

A variety of markets look prone to reverse in the next few days as a major cyclical turn window continues to play out. Cable has joined the mix of potential candidates as a simple bar count on the daily chart above reveals a burgeoning Fibonacci relationship between recent swing points. Further bolstering this view is the resistance level that has capped the rate so far as Monday’s high was an almost perfect 161.8% extension of the mid-April decline. A close today below Monday’s low would be further evidence of a medium-term top while strength back through 1.5545 would begin to invalidate our suspicions.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Are you looking for other ways to pinpoint support and resistance levels? Take our free tutorial on using Fibonacci retracements.

Need guidance managing risk on trades? Download the free Risk Management Indicator.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.