Price & Time: Right Shoulder in the Euro?

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

Foreign Exchange Price & Time at a Glance:

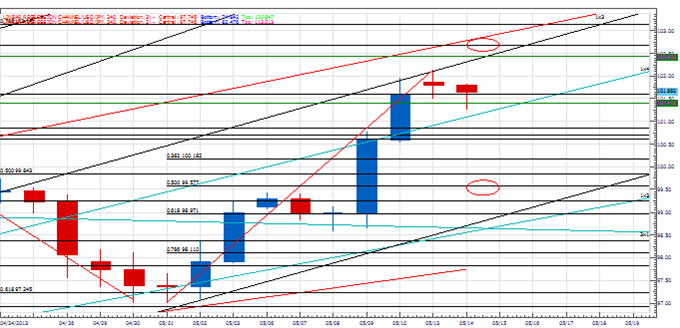

USD/JPY:

Charts Created using Marketscope – Prepared by Kristian Kerr

-USD/JPY traded to its highest level in over 4 ½ years on Monday before finding resistance at and Andrew’s line related to the February and March lows

-Our bias is higher in the exchange rate, but traction over the 100% extension of the late April decline in the 102.65 area is needed to maintain the upward tack

-Near-term time cycles suggest scope for a minor high today or at the end of the week

-The 1x4 Gann angle line from the February low in the 101.15 area is immediate support

-However, only weakness below the 50% retracement of the May advance at 99.60 turns us negative on the rate

Strategy: Over 99.60 we continue to like holding long positions.

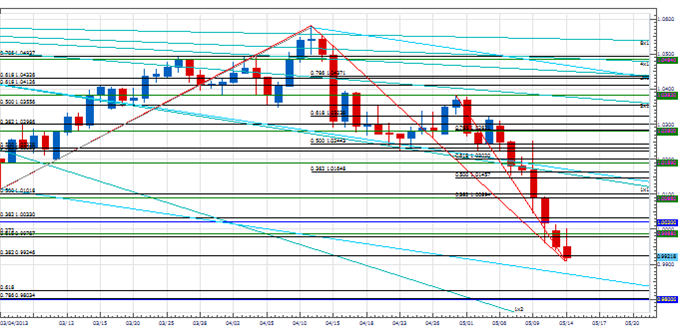

AUD/USD:

Charts Created using Marketscope – Prepared by Kristian Kerr

-AUD/USD has come under further pressure pressure over the past few days and touched its lowest level since June on Tuesday

-Our bias is still lower with focus on the important 38% retracement of the 2010 to 2011 advance in the .9920 area

-This level could act as a strong support and a close below there is needed to expose .9870 and below

-Near-term focused time cycle analysis suggests the latter part of the week is a minor turn window

-The 6th square root progression of the year-to-date high in the .9990 area is now resistance and only strength back through this level turns us positive on the Aussie

Strategy: Like holding reduced short postions whilst below .9990.

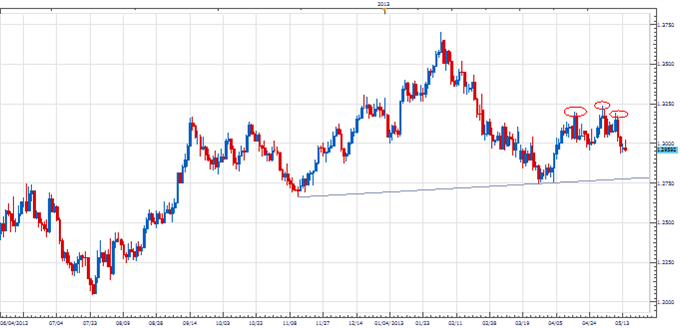

Gold:

Charts Created using Marketscope – Prepared by Kristian Kerr

-XAU/USD failed last week at the 4th square root progression of the year-to-date low in the 1470 area

-Our bias remains to the downside in the metal with the 1397 convergence of the 1x2 Gann line and 2nd square root progression of the year-to-date low seen as the next key pivot area

-Short-term focused time cycles indicate a turn could be seen in the metal around the middle of the week

-The 50% retracement of the May decline near 1453 is immediate resistance

-However, only a close over 1470 would undermine the negative technical structure

Strategy: Short positions favored in Gold whilst below 1470.

Focus Chart of the Day: EUR/USD

Since late January we have written about the importance of the late April/early May timeframe for the Euro as a confluence of Gann, Fibonacci and Pi related cyclical techniques suggested an important turn in the market would be seen during this time. With the window now past us and the exchange rate having made 3 clear highs during this period a high of some significance looks to be in place in EUR/USD. If our view is correct then the Euro should remain generally weak in the weeks/months ahead. A potential head & shoulders topping pattern extending back to September of last year seems to further support this view. The 1.3240 area now looks like critical resistance. Any unforeseen aggressive strength over this level would be very positive for the exchange rate and likely setup an aggressive move higher as major time resistance is offset.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

Need guidance managing risk on trades? Download the free Risk Management Indicator.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.