Price & Time: USD Pullback into Quarter-End?

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

Foreign Exchange Price & Time at a Glance:

Charts Created using Marketscope – Prepared by Kristian Kerr

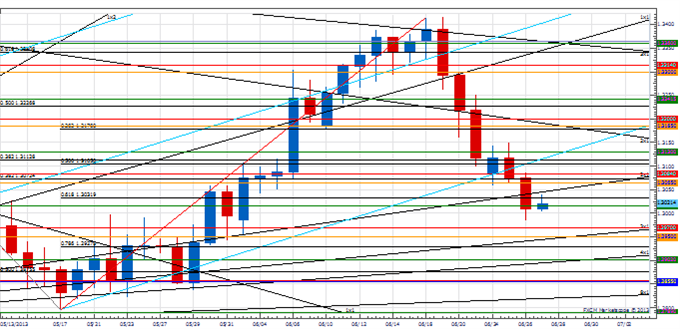

EUR/USD came under further pressure on Wednesday and broke below the 2x1 Gann angle line of the year-to-date low in the 1.3045 area

Our trend bias remains lower in the exchange rate with focus now on the 4th square root progression of the month-to-date high near 1.2950

The level can often times spark a counter-trend reaction and a close below 1.2950 is required to maintain the immediate downside tack

Longer-term cycle studies remain negative on the Euro, but shorter-term counts suggest trading could become choppy over the next few days as a variety of very minor turn windows materialize

The 3rd square root progression of this month’s high near 1.3065 is immediate resistance, but only clear strength over 1.3185 turns us positive on the Euro

Strategy: Short positions favored while below 1.3185

Exchange Rate | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

EUR/USD | 1.2900 | *1.2950 | 1.3035 | 1.3065 | *1.3185 |

AUD/USD:

Charts Created using Marketscope – Prepared by Kristian Kerr

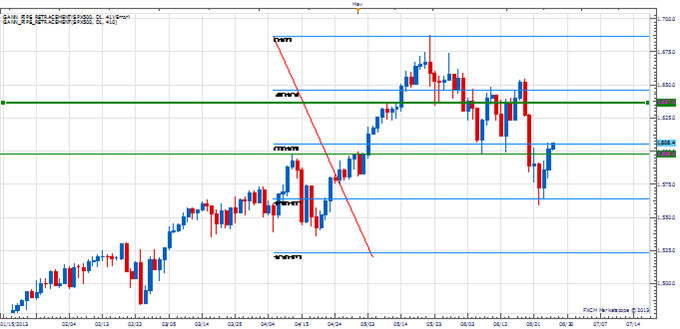

AUD/USD continues to struggle higher off the 13th square root progression of the year-to-date high in the .9175 area

Our trend bias is still lower in the Aussie with clear strength above .9425 needed to signal some sort of trend shift

Long-term cycle studies warn of a turn this week, but shorter-term counts point to a minor turn window at the end of the week

Back under .9175 exposes key long-term support at .9135

A close below there is needed to signal the start of another more important decline

Strategy: Like being flat around these longer-term support levels. May look to go long over .9425.

Exchange Rate | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

AUD/USD | *0.9135 | 0.9175 | 0.9310 | 0.9335 | *0.9425 |

USD/CAD:

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/CAD has come under steady pressure over the past couple of days after finding stiff resistance near the 88.6% retracement of the 2011 to 2012 decline in the 1.0540 area

Our trend bias is still higher, but a close above 1.0540 is now needed to signal a resumption of the broader uptrend

Near-term focused time cycles point to further weakness over the next few days

Immediate support is seen at the 4th square root progression of May low in the 1.0410 area

However, only aggressive weakness below a retracement convergence near 1.0340 would turn us negative on Funds

Strategy: Like buying Funds against 1.0340 over the next few days.

Exchange Rate | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/CAD | *1.0340 | 1.0410 | 1.0440 | 1.0500 | *1.0540 |

Focus Chart of the Day: S&P 500

The reversal in the S&P 500 at the start of the week was a good example of how a cycle turn window is ideally supposed to work. The short-term trend was down leading into the June 20-25 window following the break of the early June lows. During this time period the index successfully tested a key level of symmetry at 1565 as this marked a convergence of the 3rd square root progression of the 1687 all-time high and a measured move of the early June decline. Just how important this upside resumption is will now depend on how the index reacts at key Gann levels near 1605 and 1637. Traction over the latter is required to set up a re-test of the May high. In a similar vein to Gold, any unexpected aggressive weakness that violates Monday’s price/time convergence would be a very negative cyclical development and opens the way for a much more aggressive equity decline in the weeks ahead.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

Looking for a way to pinpoint sentiment extremes in SPX in real time? Try the Speculative Sentiment Index.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.