Will Pricing Aid Keurig's (KDP) Q3 Earnings Amid Cost Woes?

Keurig Dr Pepper Inc. KDP is scheduled to release third-quarter 2022 results on Oct 27, before market open. The Zacks Consensus Estimate for third-quarter earnings is pegged at 46 cents, suggesting a 4.6% increase from the year-ago quarter’s reported figure. The consensus mark has also been unchanged in the past 30 days.

The consensus mark for quarterly revenues is pegged at $3.63 billion, indicating 11.8% growth from the year-ago period’s reported number.

In the last reported quarter, the company’s earnings were in line with the Zacks Consensus Estimate. Notably, the company’s earnings met the Zacks Consensus Estimate, on average, in the trailing four quarters.

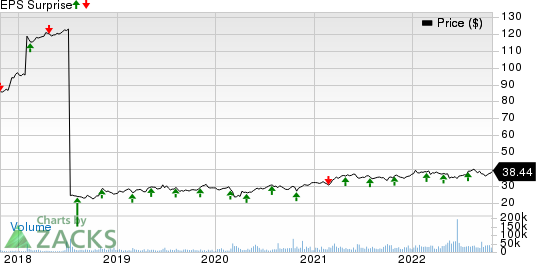

Keurig Dr Pepper, Inc Price and EPS Surprise

Keurig Dr Pepper, Inc price-eps-surprise | Keurig Dr Pepper, Inc Quote

Key Factors to Note

Keurig has been gaining from solid portfolio demand and strong market share gains. Sales gains in the third quarter are anticipated to have been driven by continued growth in the Packaged Beverages, Beverage Concentrates and Latin America Beverages segments. A recovery in the supply chain of coffee and non-carbonated beverages, better pricing to mitigate inflation, and continued portfolio growth are likely to have contributed to the third-quarter performance.

The company is likely to have retained its strong performance in the Packaged Beverages segment in the third quarter, attributable to growth in CSDs, coconut water, seltzers, teas, apple juice and fruit drinks. Strength in Dr Pepper, Sunkist, Canada Dry, A&W and Squirt CSDs, Vita Coco, Polar seltzers, Snapple, and Mott's have been aiding the segment's sales.

KDP's Packaged Beverages segment has also been gaining from growth in Canada Dry, Dr Pepper, 7UP, A&W, Sunkist and Squirt CSDs, Mott's and Snapple, CORE Hydration, Polar seltzers, Hawaiian Punch and Vita Coco.

However, the company has been witnessing input cost inflation, rising transportation costs and supply-chain disruptions. These, along with the adverse impacts of higher marketing investment, acted as deterrents.

On the last reported quarter’s earnings call, management anticipated inflation to remain the greatest challenge.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for Keurig this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Keurig currently has a Zacks Rank #4 (Sell) and an Earnings ESP of 0.00%.

Stocks With Favorable Combination

Here are some companies you may want to consider, as our model shows that these have the right combination of elements to deliver an earnings beat.

Dutch Bros BROS currently has an Earnings ESP of +1.11% and a Zacks Rank #2. BROS is anticipated to register top-line growth when it reports third-quarter 2022 results. The Zacks Consensus Estimate for Dutch Bros’ quarterly revenues is pegged at $196.3 million, indicating an improvement of 51.2% from the figure reported in the prior-year quarter. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dutch Bros’ bottom line has moved down 25% in the past 30 days to 6 cents per share. However, the consensus estimate for BROS suggests a decline of 73.9% from the year-ago quarter’s reported figure. BROS has delivered an earnings beat of 53%, on average, in the trailing four quarters.

Kellogg's K currently has an Earnings ESP of +1.85% and a Zacks Rank #3. K is likely to register top-line growth when it reports the third-quarter 2022 numbers. The Zacks Consensus Estimate for its quarterly revenues is pegged at $3.8 billion, which suggests growth of 4% from the figure reported in the prior-year quarter.

However, the Zacks Consensus Estimate for Kellogg's quarterly earnings has been unchanged in the past 30 days at 96 cents per share, suggesting a decline of 11.9% from the year-ago quarter’s reported number. K has delivered an earnings beat of 13.3%, on average, in the trailing four quarters.

Hershey HSY currently has an Earnings ESP of +1.94% and a Zacks Rank of 3. The company is expected to register top-line growth when it reports the third-quarter 2022 numbers. The Zacks Consensus Estimate for HSY’s quarterly revenues is pegged at $2.6 billion, which suggests growth of 10.5% from the prior-year quarter’s reported figure.

The Zacks Consensus Estimate for Hershey’s quarterly earnings has been unchanged in the past 30 days at $2.07 per share, suggesting a 1.4% decline from the year-ago reported number. HSY has delivered an earnings beat of 8.7%, on average, in the trailing four quarters.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hershey Company The (HSY) : Free Stock Analysis Report

Kellogg Company (K) : Free Stock Analysis Report

Keurig Dr Pepper, Inc (KDP) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research