Product Differentiation, a Sound Strategy Could Boost American Express' Performance

- By Robert Stephens, CFA

Recent second-quarter results from American Express Co. (AXP) showed an improvement in revenue and profitability. Compared to the same quarter of the prior year, total revenue increased by 9% to $10 billion, while diluted earnings per share moved 25% higher to $1.84.

The company benefited from 19% growth in net interest income, with higher loan balances being the key driver. Increased spending by cardholders was a major catalyst during the period. It helped to increase discount revenue by 8%, while net card fees moved 9% higher.

Warning! GuruFocus has detected 5 Warning Signs with AXP. Click here to check it out.

The intrinsic value of AXP

The company reaffirmed its previous guidance for the full year. It expects to deliver earnings that are at the high end of its previous range of $6.90 to $7.30 per share.

Product differentiation

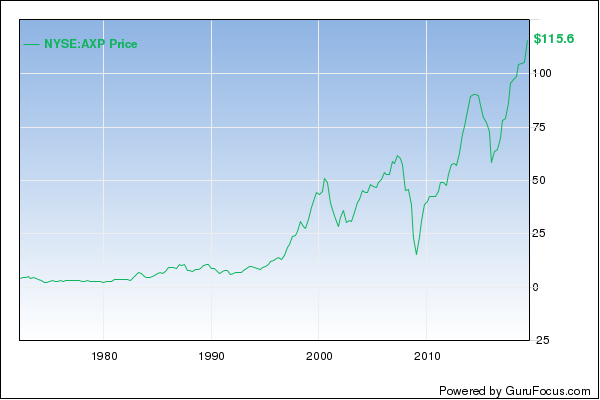

Since the release of its second-quarter results in July, American Express' stock price has risen 5%. That takes its gain in the last year to 24%, which is significantly higher than the 17% rise delivered by the S&P 500 over the same period.

The financial performance of the business could be catalyzed by continued product differentiation. It has been able to appeal to a wide range of consumers through product innovation, with around half of customer acquisitions on its U.S. consumer platinum cards coming from millennials. Services such as rewards for its card members, access to exclusive airport lounges and credits to ride-sharing services are appealing to consumers across the globe. This is helping to boost demand for its fee-paying cards in particular, with 60% of its new card acquisitions being in this space.

American Express is also seeking to differentiate its offering in terms of the technology it provides to customers. It is making significant investments in the digital space, seeking to develop artificial intelligence, machine learning and blockchain capabilities to improve customer service levels. These investments seem to be having a tangible impact. The company placed first in J.D. Power's 2018 mobile app competitive survey. Among millennials in particular, an increased focus on technology could lead to rising customer numbers.

Strategic focus

With discount revenue contributing to the majority of the company's revenue in the second quarter, American Express' refreshed strategy in this area could make a significant impact on its overall returns. It is focused on increasing discount revenue through maintaining discount rates. This is helping to widen acceptance of American Express products, so that cardholders can use their cards more often. This should provide the company with a higher share of wallet with existing cardmembers.

One example of its discount strategy is the OptBlue program. It allows smaller merchants to negotiate directly with a third party for card fees, which has helped to increase merchant acceptance of the company's products. In the last year, the company has signed over a million merchants in the U.S. This could help to make its products more attractive to new customers.

The company also has valuable data on customers due, in part, to its business model. Since it lends directly to its account holders, it operates a closed-loop network. This provides it with data that a number of rivals do not have. Customer data could help shape how American Express adapts its customer offers and may be able to keep it a step ahead of the competition in what is a fast-moving industry.

Possible threats

A possible threat facing American Express is an increasing provision for bad debt. In the second quarter, total provisions grew 38% to $806 million versus the previous year. This could prove to be a drag on earnings, with the company expecting a rise in provisions at a similar level in the second half of the year to that recorded in the first half. Alongside this, the company's lending net write-off rate has risen from 1.8% in the year-ago quarter to 2.1% in the second quarter. This could have a negative impact on its future prospects if it continues to rise.

The company, though, has guided investors toward a higher level of provisions. Its growth in this area in the first half of the year is in line with guidance. It has been targeting new customers who are more likely to be carrying a balance. The increasing size of its loan book also means that provisions are likely to continue to rise. Similarly, a higher net write-off rate is not yet a cause for concern since it remains low compared to its sector peers.

Verdict

A focus on product differentiation could lead to improved financial performance for American Express. An increasing focus on technology, utilizing data and widening acceptance of its cards could also act as positive catalysts over the medium term. Although provisions and write-offs have risen, an increase in the size of its loan book and favorable comparisons to sector peers mean the company appears to be performing well. Its stock price could, therefore, increase further after outperforming the S&P 500 over the last year.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 5 Warning Signs with AXP. Click here to check it out.

The intrinsic value of AXP