Profound Medical (TSE:PRN) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Profound Medical Corp. (TSE:PRN) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Profound Medical

How Much Debt Does Profound Medical Carry?

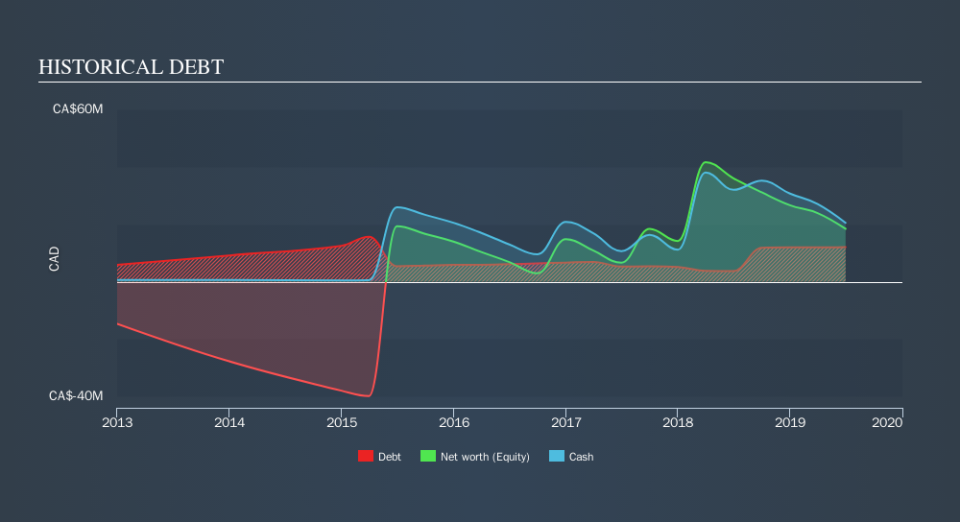

The image below, which you can click on for greater detail, shows that at June 2019 Profound Medical had debt of CA$12.0m, up from CA$3.72m in one year. But it also has CA$20.5m in cash to offset that, meaning it has CA$8.46m net cash.

A Look At Profound Medical's Liabilities

The latest balance sheet data shows that Profound Medical had liabilities of CA$7.47m due within a year, and liabilities of CA$12.0m falling due after that. On the other hand, it had cash of CA$20.5m and CA$3.41m worth of receivables due within a year. So it can boast CA$4.46m more liquid assets than total liabilities.

This surplus suggests that Profound Medical has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that Profound Medical has more cash than debt is arguably a good indication that it can manage its debt safely. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Profound Medical's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Profound Medical wasn't profitable at an EBIT level, but managed to grow its revenue by3.0%, to CA$4.1m. That rate of growth is a bit slow for our taste, but it takes all types to make a world.

So How Risky Is Profound Medical?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And the fact is that over the last twelve months Profound Medical lost money at the earnings before interest and tax (EBIT) line. And over the same period it saw negative free cash outflow of CA$19m and booked a CA$19m accounting loss. However, it has net cash of CA$8.46m, so it has a bit of time before it will need more capital. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. For riskier companies like Profound Medical I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.