PROG Holdings: This Subprime Lender Is Cheap but Risky

PROG Holdings Inc. (NYSE:PRG) is a subprime lender which specializes in enabling consumers to make purchases of items from retailers they cannot afford to pay for immediately. It uses its proprietary process to evaluate and extend credit. The company used to be known as Aaron before it spun off its retail business (now know as the Aaron company) in November of 2020 while retaining its fintech business.

The company is headquartered in Draper, Utah and currently employs 1,849 full-time employees. PROG has three businesses: Progressive Leasing, a provider of e-commerce, app-based and in-store lease-to-own purchase options; Vive Financial, a provider of omnichannel second-look (subprime) revolving credit products; and Four Technologies, a Buy Now, Pay Later provider that allows consumers to pay for merchandise through four interest-free installments.

I believe this company is undervalued and has great potential, but it is also a rather risky bet. Here's why.

Segment breakdown

The Progressive Leasing segment provides consumers with lease-purchase solutions through its point-of-sale partner locations and through its e-commerce website partners in the United States (collectively, POS partners). The company does so by purchasing merchandise from the POS partners desired by customers and, in turn, leasing that merchandise to the customers through a cancellable lease-to-own transaction.

The Vive segment primarily serves customers that may not qualify for traditional prime lending offers who desire to purchase goods and services from participating merchants. Vive offers customized programs, with services that include revolving loans through private label and Vive-branded credit cards. Vive's network of POS partner locations and e-commerce websites includes furniture, mattresses, home exercise equipment and home improvement retailers.

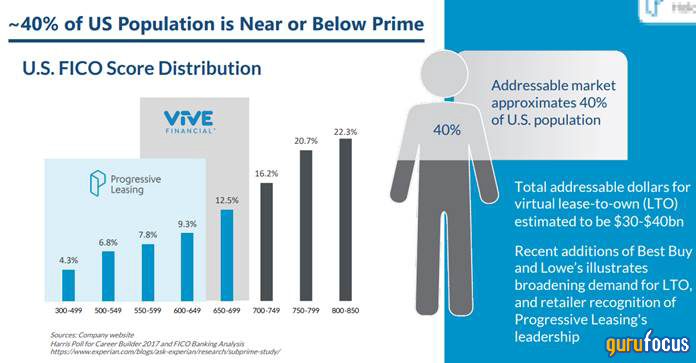

Source: PROG's investor materials

PROG integrates its processes with many retailers, some of them shown above. The company estimates that about 40% of the U.S. population is subprime from the lenders' perspective, and that is its target market as subprime customers are charged higher interest due to lack of credit options and higher delinquencies. The company has developed the requisite expertise and experience to profit from this demographic, despite the higher risks of default.

Source: PROG's investor materials

Financial condition

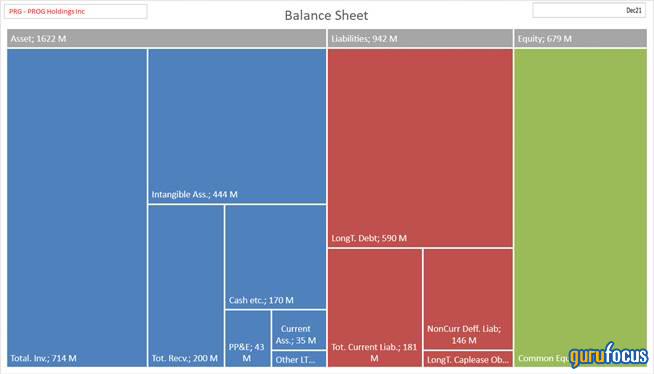

PROG's financial strength is quite good for a finance company. The company maintains reasonable leverage and a solid debt-to-equity ratio, as shown in the below screenshot from the GuruFocus summary page:

The following is a snapshot of the company's year-end balance sheet:

And here we have a summary of the company's long-term debt, net of applicable unamortized debt issuance costs, as of Dec. 31, 2021:

Type | ($) thousands |

Senior Unsecured Notes, 6.000%, due November 2029 | 600,000 |

Revolving Facility Outstanding1 | |

Less: Unamortized Debt Issuance Costs | (10,346) |

Total Debt, Net of Unamortized Debt Issuance Costs | 589,654 |

Of the long-term debt, the company has used up $425 million of it to buy back company stock in 2021 and intends to use the rest for more buybacks. The company also has a revolving line of credit of $350 million, which it plans to use for working capital. The debts are subject to various covenants of liquidity and solvency.

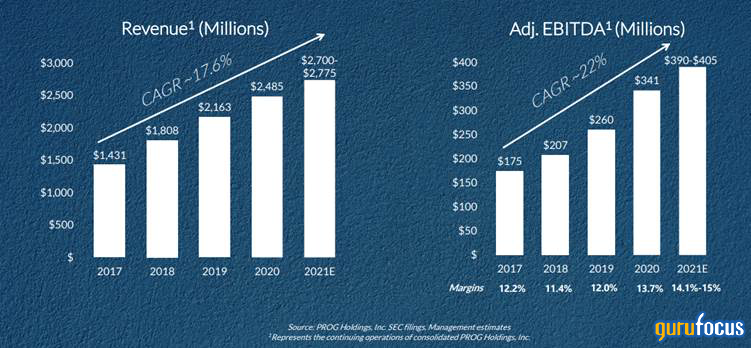

PROG's growth of revenue and Ebitda over the past five years has been very good. Note that prior to 2021, they were consolidated with the Aaron retail business, and these numbers below are unconsolidated:

Valuation

PROG is trading at a price-earnings ratio of about 8 and an enterprise-value-to-Ebitda of about 6. For a business that is growing well in the double-digit CAGR range, this is very cheap. I think the stock price ought to be more than twice where it is at currently.

Most likely, recession fears are affecting the stock. If the U.S. economy does enter a recession, subprime loans will likely see enormous defaults, since the poorest people are the ones who suffer the most during times of recession. This risk is real and undeniable; in other words, the stock is undervalued for good reason.

However, PROG seems to be confident in its business capabilities given that it bought back over 13% of its outstanding stock last year and is continuing to buy back more this year. It does not pay a dividend, and buybacks appears to be the main instrument of shareholder returns.

Ultimately, this is spread business and the company earns its keep by pocketing the difference between the cost of capital and return on invested capital less delinquencies and expenses. I estimate this gross spread is in the high single digits over a business cycle. This is very good, as the net interest margin for a regular bank (which deals with prime customers) is in the low single digits. The company is obviously dealing with a less creditworthy clientele and has to deal with a high level of delinquency and write-offs, exposing it to even greater risk if the market tanks. However, the management team is experienced and has been through multiple recessions. The company (previously as Aaron) has been around since 1955. Overall, I believe this undervalued subprime lender could be a value opportunity for those with high risk tolerance.

This article first appeared on GuruFocus.