Prologis (PLD) Beats Q1 FFO Estimates, Issues Upbeat View

Prologis, Inc. PLD reported first-quarter 2022 core funds from operations (FFO) per share of $1.09, beating the Zacks Consensus Estimate of $1.08. This also compares favorably with the year-ago quarter’s figure of 97 cents.

Results reflect solid demand for industrial real estate, leading to low vacancies and an increase in rents. Further, this industrial REIT issued an upbeat 2022 guidance.

Prologis generated rental revenues of $1.076 billion, up from the prior-year quarter’s $1.021 billion. However, PLD missed the Zacks Consensus Estimate of $1.087 billion. Total revenues were $1.2 billion, up from the year-ago quarter’s $1.1 billion.

Per Hamid R. Moghadam, co-founder and chief executive officer of the company, "The need for resilience in the supply chain continues to drive record demand despite today's economic and geopolitical risks."

Quarter in Detail

The average occupancy level in Prologis’ owned and managed portfolio was 97.4% in the first quarter. Moreover, the company’s owned and managed portfolio was 98.1% leased as of Mar 31, 2022.

In the quarter under review, 52.2 million square feet of leases commenced in the company’s owned and managed portfolio, with 49.0 million square feet in the operating portfolio and 3.2 million square feet in the development portfolio. The retention level was 75.4% in the quarter.

Prologis’ share of net effective rent change was 37.0% in the January-March quarter, which was led by the United States at 41.5%. Cash rent change was 19.2%. Cash same-store net operating income (NOI) grew 8.7%, which was led by the United States at 9.7%.

The company’s share of building acquisitions amounted to $98 million, with a weighted average stabilized cap rate of 3.7% in the reported quarter. Development stabilization aggregated $212 million, while development starts totaled $1.02 billion, with 36.6% being build to suit. PLD’s total dispositions and contributions were $1.53 billion, with a weighted average stabilized cap rate (excluding land and other real estate) of 4.0%.

Liquidity

Prologis exited the first quarter of 2022 with cash and cash equivalents of $1.9 billion, up from $556.1 million at the end of the prior year. Its liquidity amounted to $6.8 billion in cash and availability on its credit facilities.

Debt, as a percentage of the total market capitalization, was 13.5%. The company's weighted average interest rate on its share of the total debt was 1.7%, with a weighted average term of 10.0 years. The combined investment capacity of Prologis and its open-ended ventures, in line with their current ratings, is roughly $18 billion. The company and its co-investment ventures issued $2.6 billion of debt in the first quarter at a weighted average interest rate of 1.5%.

Guidance

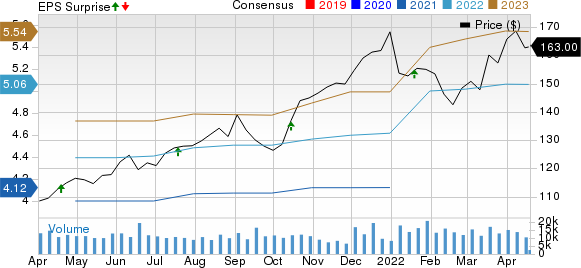

Prologis raised its 2022 core FFO per share guidance to the range of $5.10-$5.16 from the $5.00-$5.10 range guided earlier, indicating a 1.6% increase at the midpoint. This is also ahead of the Zacks Consensus Estimate pegged at $5.06.

The company expects average occupancy in the band of 96.75-97.50%, up 12.5 basis points at the midpoint. Cash same-store NOI (Prologis share) is projected at 7.25-8.00% compared with the 6-7% band guided earlier.

Prologis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Prologis, Inc. Price, Consensus and EPS Surprise

Prologis, Inc. price-consensus-eps-surprise-chart | Prologis, Inc. Quote

Upcoming Earnings Releases

It’s time to look forward to the earnings releases of REITs, including Crown Castle International Corp. CCI, SL Green Realty Corp. SLG and Alexandria Real Estate Equities, Inc. ARE.

Crown Castle and SL Green are slated to release first-quarter 2022 results on Apr 20, while Alexandria Real Estate Equities is scheduled to report its numbers on Apr 25.

The Zacks Consensus Estimate for Crown Castle’s first-quarter 2022 FFO per share stands at $1.80, indicating a year-over-year increase of 5.26%. CCI currently has a Zacks Rank of 3.

The Zacks Consensus Estimate for SL Green’s first-quarter 2022 FFO per share is pegged at $1.64, implying a year-over-year decrease of 7.87%. SLG currently carries a Zacks Rank of 3.

The Zacks Consensus Estimate for Alexandria Real Estate Equities’ first-quarter 2022 FFO per share is pegged at $2.00, suggesting a year-over-year increase of 4.71%. ARE currently carries a Zacks Rank of 2 (Buy).

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Prologis, Inc. (PLD) : Free Stock Analysis Report

Crown Castle International Corporation (CCI) : Free Stock Analysis Report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

Alexandria Real Estate Equities, Inc. (ARE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research