Prologis (PLD) to Buy IPT for $3.99B, Beats Q2 FFO Estimates

Prologis, Inc. PLD has agreed to acquire warehouse owner Industrial Property Trust Inc. (IPT) in an all-cash deal valued at about $3.99 billion, including debt, from Black Creek Group. The deal, including an operating portfolio of 236 properties, expands the company’s position in Southern California, the San Francisco Bay Area, Chicago, Atlanta, Dallas, Seattle and New Jersey.

Further, the company delivered a better-than-expected performance in the second quarter in terms of funds from operations (FFO) per share. It reported core FFO per share of 77 cents, beating the Zacks Consensus Estimate by a penny. Results also compare favorably with the year-ago figure of 71 cents.

Moreover, the company raised its guidance at the mid-point backed by healthy market conditions, solid customer demand and rent growth. The company now projects year-over-year growth without promotes of 9.5%.

Acquisition Deal

The acquisition transaction, likely to close in fourth-quarter 2019 or early 2020, is expected to be accretive to annual core FFO per share by about 5 to 6 cents, on a stabilized basis.

Moreover, the transaction is unlikely to have any significant impact on Prologis’ leverage. In fact, the company anticipates adding no corporate overhead. Therefore, combining the entities is projected to lower general and administrative expenses as a percentage of assets under management by around 4%, per the company’s press release.

Quarter in Detail

Prologis witnessed top-line growth in the June-end quarter, while period-end occupancy remained high. The company generated rental revenues of $700.7 million, which compares favorably with the year-ago tally of $544.7 million. However, the revenue figure missed the Zacks Consensus Estimate of $705.5 million.

At the end of the reported quarter, occupancy level in the company’s owned-and-managed portfolio was 96.8%, flat sequentially, but down 60 basis points year over year. During the quarter, 37 million square feet of leases commenced in the company’s owned-and-managed portfolio, slightly down from 39 million square feet in the year-ago period.

Prologis’ share of net effective rent change was 25.6% in the April-June quarter compared with 20.6% recorded a year ago. This was driven by the United States at 30.1%. Cash rent change was 12.3%, as against 9.7% recorded in the year-earlier quarter. However, cash same-store net operating income (NOI) registered 4.6% growth compared with the 7% increase reported in the comparable period last year.

In second-quarter 2019, Prologis’ share of building acquisitions amounted to $214 million, with a weighted average stabilized cap rate of 4.5%. Development stabilization aggregated $493 million, while development starts totaled $324 million, with 27.1% being build-to-suit. Furthermore, the company’s total dispositions and contributions came in at $607 million, with weighted average stabilized cap rate (excluding land and other real estate) of 4.4%.

Liquidity

The company exited the June-end quarter with cash and cash equivalents of $401.2 million, up from $251 million recorded at the end of the previous quarter. Prologis ended the quarter with leverage of 19.4% on a market capitalization basis and debt-to-adjusted EBITDA of 4.1x and $4.2 billion of liquidity.

Outlook Raised

Prologis raised its core FFO per share outlook for full-year 2019. The company projects core FFO per share of $3.26-$3.30, up from the $3.20-$3.26 estimated earlier. The guidance is above the Zacks Consensus Estimate of $3.23. However, the guidance does not include any impact from the proposed acquisition of Industrial Property Trust.

The company forecasts year-end occupancy of 96.5-97.5%, and cash same-store NOI (Prologis share) of 4.5-5% compared with the prior projection of 4.3-5%.

Our Take

We are encouraged with Prologis’ impressive performance in the second quarter. In a rising e-commerce market, the industrial real estate asset category has grabbed headlines and continues to play a pivotal role, transforming the way how consumers shop and receive their goods. Services like same-day delivery are gaining traction and last-mile properties in high-income urban areas are witnessing solid pricing, occupancy and growth in rentals.

In this favorable environment, Prologis is well poised to benefit from its capacity to offer modern distribution facilities at strategic in-fill locations. The company is actively banking on its growth opportunities through acquisitions and developments.

Last year, the company completed the acquisition of DCT Industrial Trust Inc. for more than $8 billion. Also, the latest merger agreement to acquire Industrial Property Trust is encouraging as it will help the company gain a premium-quality portfolio in submarkets, which is in sync with its investment strategy. The company plans to capture substantial cost and revenue synergies, apart from improving customer relationships.

Prologis also has decent balance-sheet strength to back its growth endeavors. Being a market leader, the company has the ability to raise capital at favorable rates.

Nevertheless, recovery in the industrial market has continued for long and a whole lot of new buildings are becoming available in the market, leading to higher supply and lesser scope for rent and occupancy growth. Additionally, any protectionist trade policies will have an adverse impact on economic growth, as well as the company’s business over the long haul.

Prologis currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

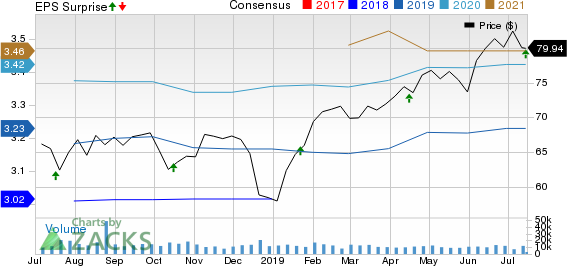

Prologis, Inc. Price, Consensus and EPS Surprise

Prologis, Inc. price-consensus-eps-surprise-chart | Prologis, Inc. Quote

We now look forward to the earnings releases of other REITs like SL Green Realty Corp. SLG, Crown Castle International Corp. CCI and PS Business Parks Inc. PSB. While SL Green and Crown Castle are slated to report second-quarter earnings on Jul 17, PS Business Parks has its earnings release scheduled for Jul 23.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft stock in the early days of personal computers… or Motorola after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Crown Castle International Corporation (CCI) : Free Stock Analysis Report

SL Green Realty Corporation (SLG) : Free Stock Analysis Report

PS Business Parks, Inc. (PSB) : Free Stock Analysis Report

Prologis, Inc. (PLD) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research