ProPetro (PUMP) Q2 Earnings Miss, Sales Surpass Estimates

ProPetro Holding Corporation PUMP reported mixed second-quarter 2019 results, wherein earnings missed the Zacks Estimate but revenues topped the same.

Its net income per share came in at 35 cents, lagging the Zacks Consensus Estimate of 66 cents and declining from the year-ago figure of 45 cents. Lower adjusted EBITDA from the pressure pumping division and high costs led to underperformance. To be precise, adjusted EBITDA from the pressure pumping unit came in at $131 million, missing the consensus estimate of $138 million.

Total adjusted EBITDA in the second quarter amounted to $126.6 million, increasing substantially from $96 million a year ago but declining from $150.3 million recorded in the first quarter. In the reported quarter, ProPetro’s adjusted EBITDA margin was 23.9% compared with 21% and 27.5% recorded in second-quarter 2018 and first-quarter 2019, respectively.

The company’s revenues of $529.5 million improved 15.1% year over year and outpaced the Zacks Consensus Estimate of $524 million.

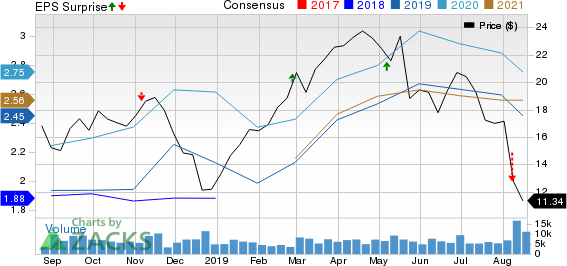

ProPetro Holding Corp. Price, Consensus and EPS Surprise

ProPetro Holding Corp. price-consensus-eps-surprise-chart | ProPetro Holding Corp. Quote

Pressure Pumping Division

ProPetro, through its Pressure Pumping division, performs hydraulic fracturing, cementing and acidizing functions. The business accounted for 97.4% of the company's total revenues in the quarter under review.

Effective utilization of its fracturing assets was 25.6 fleets during the quarter. ProPetro expects an average of 25 effective fleets in the third quarter, down from 25.6 in second-quarter 2019 amid decrease in customer activities.

As we know, the company is making its foray in the electric fracking technology, with the deployment of three DuraStim fleets. Set to be delivered by late 2019, these 36,000 horsepower DuraStim fleets — boasting fuel efficiency and lower costs — will be deployed under dedicated agreements with clients.

Costs & Expenses

ProPetro’s total costs and expenses in the quarter under review were $480.7 million compared with $406.3 million in the year-ago period. The company reported cost of services of $386.2 million, 9.8% higher than the year-ago quarter. General and administrative expenses came in at around $27.8 million, up from $14.2 million in the year-ago period. Depreciation charges increased to $35.5 million from $21.3 million in the second quarter of 2018.

Capex & Balance Sheet

Capital expenditure amounted to $161.2 million. As of Jun 30, ProPetro had cash and cash equivalents of $36.3 million, and a long-term debt of $150 million. The company’s debt-to-capitalization ratio was 14.2%. ProPetro has $110.2 million of available capacity under the revolving credit facility.

Zacks Rank & Key Picks

ProPetro currently carries a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are NuStar Energy NS, Delek Logistics Partners DKL and BP Midstream Partners BPMP. While NuStar sports a Zacks Rank #1 (Strong Buy), Delek Logistics and BP Midstream carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delek Logistics Partners, L.P. (DKL) : Free Stock Analysis Report

NuStar Energy L.P. (NS) : Free Stock Analysis Report

BP Midstream Partners LP (BPMP) : Free Stock Analysis Report

ProPetro Holding Corp. (PUMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research