Prosperity Bancshares (PB) Down 3.4% Despite Q3 Earnings Beat

Prosperity Bancshares Inc.’s PB third-quarter 2020 earnings per share of $1.40 surpassed the Zacks Consensus Estimate of $1.31. Moreover, the bottom line increased from adjusted earnings of $1.25 in the prior quarter.

Results were primarily driven by an increase in non-interest income and decline in expenses. Further, the company’s balance sheet position remained strong and provisions were stable during the quarter.

However, lower net interest income and fall in loan balance were the undermining factors. These, along with economic slowdown, weighed on investors mind, which perhaps led to 3.4% decline in the company’s shares following the earnings release.

Net income available to common shareholders was $130.1 million, which was relatively stable on a sequential basis.

Revenues Rise, Expenses Down

Net revenues were $293 million, up 3% from the prior quarter. Also, the figure beat the Zacks Consensus Estimate of $278.7 million.

Net interest income was $258.1 million, down marginally on a sequential basis. The decline was primarily due to decrease in loan discount accretion and interest income on securities, partially offset by lower interest expense.

Net interest margin, on a tax-equivalent basis, declined 12 basis points (bps) sequentially to 3.57%.

Non-interest income jumped 36% to $34.9 million. The rise was attributable to increase in all fee income components except bank owned life insurance income. Additionally, the quarter recorded lower net loss on sale or write-down of assets.

Non-interest expenses decreased 12.2% from the second quarter to $117.9 million. The fall was largely due to absence of merger-related expenses during the quarter.

As of Sep 30, 2020, total loans were $20.8 billion, down 1.1% from the prior quarter. Total deposits rose 1.2% to $26.5 billion.

Credit Quality Improves

Provision for credit losses was $10 million, on par with the second-quarter 2020 level. Net charge-offs were $10.6 million, down 18.7% sequentially.

Further, as of Sep 30, 2020, total non-performing assets were $69.5 million, decreasing 10.8%. However, the ratio of allowance for credit losses to total loans was 1.56%, up 2 bps from the second quarter.

Capital Ratios Improve, Profitability Ratios Worsen

As of Sep 30, 2020, Tier-1 risk-based capital ratio was 13.17%, up from 12.29% on Jun 30, 2020. Moreover, total risk-based capital ratio was 14.28% compared with 13.36% at second quarter-end.

The annualized return on average assets was 1.58%, down from 1.68% at second quarter-end. Annualized return on common equity was 8.64%, falling from 8.84%.

Share Repurchase Update

During the quarter, the company repurchased nearly 1 million shares at an average weighted price of $49.99.

Dividend Hike

Concurrently, Prosperity Bancshares announced a 6.5% hike in the quarterly dividend to 49 cents per share. The dividend will be paid out on Jan 4, 2021 to shareholders on record as of Dec 15.

Our Take

The acquisition of LegacyTexas Financial is likely to continue aiding Prosperity Bancshares’ growth. Moreover, solid loans and deposit balances are expected to support profitability. However, due to lower rates, margins might be under pressure in the near term.

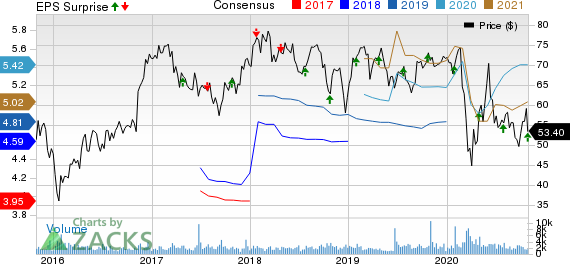

Prosperity Bancshares, Inc. Price, Consensus and EPS Surprise

Prosperity Bancshares, Inc. price-consensus-eps-surprise-chart | Prosperity Bancshares, Inc. Quote

Prosperity Bancshares currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Zions Bancorporation’s ZION third-quarter 2020 net earnings per share of $1.01 surpassed the Zacks Consensus Estimate of 86 cents. However, the bottom line compares unfavorably with the year-ago quarter’s $1.17.

Commerce Bancshares Inc.’s CBSH third-quarter 2020 earnings per share of $1.11 surpassed the Zacks Consensus Estimate of 70 cents. Also, the bottom line came in 19.4% higher than the prior-year quarter reported figure.

Associated Banc-Corp’s ASB third-quarter 2020 adjusted earnings of 24 cents per share topped the Zacks Consensus Estimate of 19 cents. The bottom line, nevertheless, slumped 51% year over year.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Commerce Bancshares, Inc. (CBSH) : Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research