Provention (PRVB) Skyrockets 260% on Buyout Offer From Sanofi

Shares of Provention Bio PRVB were up 260% on Mar 13 after the company announced that it has signed a definitive agreement with Sanofi SNY. Provention would be acquired by Sanofi for $25 per share in cash, amounting to $2.90 billion.

A commercial-stage pharmaceutical company, PRVB is engaged in developing new therapies targeting life-threatening immune-meditated diseases. Provention has only marketed drug in its portfolio Tzield (teplizumab), which the FDA approved last November as the first and only treatment that can delay the onset of stage 3 type 1 diabetes (T1D) in adults and pediatric patients aged eight years and older having stage 2 T1D.

The acquisition deal made by Sanofi stems from a previously signed co-promotion deal for Tzield signed between Provention Bio and Sanofi in October 2022.Per the terms of the agreement, Sanofi will commit commercial resources for Tzield in the United States. Provention will reimburse field force-related expenses that Sanofi will incur in connection with commercializing Tzield under the agreement. Sanofi also holds the exclusive right of the first negotiation to in-license Tzield globally for T1D.

The transaction, expected to be completed by second-quarter 2023, is subject to customary closing conditions and clearance from the regulatory authorities. The transaction will be funded by Sanofi from its existing cash resources.

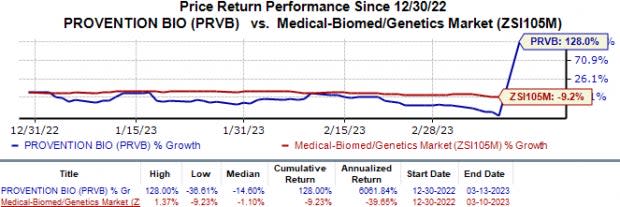

In the year so far, shares of Provention Bio have surged 128.0% against the industry’s 9.2% fall.

Image Source: Zacks Investment Research

With no other approved marketed drugs, Provention Bio is highly dependent on Tzield product sales for growth. An acquisition by a big pharma giant like Sanofi, which has high reserves of cash flow, would allow the company to advance the development of its pipeline, including label expansion studies for Tzield.

Once the acquisition is completed, Sanofi will add Tzield to its market portfolio. Sanofi believes the deal to be a strategic fit for its existing business, taking into consideration its expertise in the field of diabetes. Recently, Sanofi has been facing criticism from investors who have been very skeptical over its current pipeline of drugs. The deal will strengthen its existing diabetes business, which is facing intense competition. Sales of Sanofi’s global diabetes franchise have been declining since the past 4-5 years.

Teplizumab was originally developed by MacroGenics MGNX. The drug was acquired by Provention Bio from MacroGenics pursuant to an asset purchase agreement in 2018. Following the FDA approval for Tzield in Stage 3 T1D, Provention made an upfront payment of $60 million to MacroGenics.

MacroGenics is also eligible to receive milestone payments of up to $225 million on achievement of sales-related milestones and single-digit royalty payments on net sales of the product.

Provention Bio, Inc. Price

Provention Bio, Inc. price | Provention Bio, Inc. Quote

Zacks Rank & Stocks to Consider

Provention Bio currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Novo Nordisk NVO, which sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Novo Nordisk’s 2023 earnings per share have risen from $4.20 to $4.43. During the same period, the earnings for 2024 have risen from $4.90 to $5.19. Shares of Novo Nordisk have risen 3.8% in the year-to-date period.

Earnings of Novo Nordisk beat estimates in three of the last four quarters while missing the mark on one occasion, witnessing an earnings surprise of 3.00%, on average. In the last reported quarter, Novo Nordisk’s earnings beat estimates by 2.47%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Sanofi (SNY) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

MacroGenics, Inc. (MGNX) : Free Stock Analysis Report

Provention Bio, Inc. (PRVB) : Free Stock Analysis Report