PSEG (PEG) Set to Report Q2 Earnings: What's in the Offing?

Public Service Enterprise Group Incorporated PEG or PSEG is slated to report second-quarter 2022 results on Aug 2 before the opening bell.

Its bottom line outpaced the Zacks Consensus Estimate in the trailing four quarters, the average surprise being 6.95%.

Factors to Note

In May 2022, PSEG’s service territories witnessed warmer-than-normal temperatures. This, in turn, is likely to have boosted the electricity demand for cooling purposes among the company’s customers.

In June & July, PEG’s service territories experienced extreme weather conditions, accompanied by tornadoes and strong wind gusts. Moreover, its service territories witnessed floods due to heavy rainfall, which might have caused outages for some of its customers.

Such mixed weather patterns can be expected to have a moderate impact on the overall revenues of the company in the soon-to-be-reported quarter.

The Zacks Consensus Estimate for second-quarter revenues is pegged at $1.94 billion, suggesting growth of 3.5% from the year-ago quarter.

The rate-based growth from regulated investments and the lower cost resulting from the completed sale of PSEG fossil may have aided the margins of the company in the second quarter. This might have added impetus to its bottom line in the soon-to-be-reported quarter.

However, the aforementioned extreme weather and flood conditions might have caused infrastructural damage, thus increasing the repair and restoration expenses of the company. This might have dampened the bottom line of PSEG in the soon-to-be-reported quarter.

The Zacks Consensus Estimate for second-quarter earningsis pegged at 65 cents per share, indicating a decline of 7.1% from the prior-year reported figure.

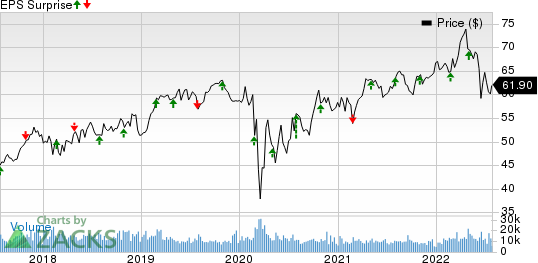

Public Service Enterprise Group Incorporated Price and EPS Surprise

Public Service Enterprise Group Incorporated price-eps-surprise | Public Service Enterprise Group Incorporated Quote

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for PSEG this time. The combination of a positive Earnings ESPand a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. However, that is not the case here.

Earnings ESP: PEG’s Earnings ESP is -1.32%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: PSEG carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are three Utilities you may want to consider as they have the right combination of elements to post an earnings beat this season:

WEC Energy Group WEC has an Earnings ESP of +0.08% and a Zacks Rank #2. The Zacks Consensus Estimate for WEC Energy’s second-quarter earnings is pegged at 86 cents per share, suggesting a decline of 1.2% from the year-ago quarter.

The Zacks Consensus Estimate for WEC’s second-quarter sales is pegged at $1.74 billion, indicating growth of 3.9% from the prior-year reported figure.

Consolidated Edison ED has an Earnings ESP of +1.15% and a Zacks Rank #3. The Zacks Consensus Estimate for its second-quarter earnings is pegged at 58 cents per share, indicating growth of 9.4% from the prior-year reported figure.

Consolidated Edison boasts a long-term earnings growth rate of 2%. The Zacks Consensus Estimate for ED’s second-quarter sales is pegged at $3.14 billion, suggesting growth of 5.5% from the prior-year reported figure.

Dominion Energy D has an Earnings ESP of +1.63% and a Zacks Rank #3. The Zacks Consensus Estimate for its second-quarter earnings, pegged at 77 cents per share, implies growth of 1.3% from the prior-year quarter’s tally.

D boasts a long-term earnings growth rate of 6.4%. Dominion Energy has a four-quarter negative earnings surprise of 0.65%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

Consolidated Edison Inc (ED) : Free Stock Analysis Report

WEC Energy Group, Inc. (WEC) : Free Stock Analysis Report

Dominion Energy Inc. (D) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research