Public Storage (PSA) Tops Q4 FFO, Issues Upbeat '22 View

Public Storage's PSA fourth-quarter 2021 core funds from operations (FFO) per share of $3.54 surpassed the Zacks Consensus Estimate of $3.44. The figure also increased 20.8% year over year.

Quarterly revenues of $924.3 million exceeded the Zacks Consensus Estimate of $912.3 million. Moreover, revenues increased 23.5% year over year.

Results reflect an improvement in the realized annual rent per available square foot and weighted average square foot occupancy in the reported quarter. The company also benefited from its expansion efforts through acquisitions, developments and extensions. Management also provided an upbeat guidance for 2022 core FFO per share.

For 2021, Public Storage reported core FFO per share of $12.93, up 21.9% from $10.61 in the prior year, and also beat the Zacks Consensus Estimate of $12.82. Revenues of $3.4 billion surged 17.2% year over year.

Behind the Headlines

Public Storage’s same-store revenues increased 13.7% year over year to $724.7 million during the fourth quarter, highlighting higher realized annual rent per available square foot and weighted average square foot occupancy. This REIT experienced a 13.8% increase in the realized annual rental income per available square foot to $18.91. Also, the weighted-average square foot occupancy of 95.9% expanded 0.7% year over year.

The same-store cost of operations increased 18.8% year over year, mainly reflecting a change in property tax timing, contributing to an increase in property tax expenses.

Consequently, PSA’s same-store net operating income (NOI) increased 12.2% to $550.8 million. Also, this REIT’s NOI growth from non-same-store facilities was $60.8 million due to the facilities acquired in 2020 and 2021 as well as the fill-up of the recently developed and expanded facilities.

Portfolio Activity

During the December-end quarter, Public Storage acquired 106 self-storage facilities, comprising 11.5 million net rentable square feet of area, for $2.3 billion. These included a portfolio of 56 properties, spanning 7.5 million net rentable square feet, operated under the brand name of All Storage for $1.5 billion. Following Dec 31, 2021, the company acquired or was under contract to acquire 15 self-storage facilities, spanning 1.2 million net rentable square feet of space across 10 states, for $212.4 million.

During the fourth quarter, this REIT opened two newly developed facilities and several expansion projects with 0.4 million net rentable square feet and costing $46.9 million. Finally, as of Dec 31, 2021, Public Storage had several facilities in development (1.8 million net rentable square feet), with an estimated cost of $331 million, as well as expansion projects (2.8 million net rentable square feet) worth $469 million. It expects to incur the remaining $527.5 million of development costs related to these projects, mainly over the next 18-24 months.

Balance-Sheet Position

Public Storage exited 2021 with $734.6 million of cash and equivalents, up from $257.6 million recorded at the end of 2020.

Guidance

For 2022, Public Storage projects core FFO per share in the range of $14.75-$15.65, ahead of the Zacks Consensus Estimate of $14.53.

The company’s full-year assumption is backed by 12-15% growth in same-store revenues, a 6-8% rise in same-store expenses and a 13.4-18.0% expansion in same-store NOI. Further, the company expects $1 billion of acquisitions and $250 million of development openings.

Dividend Update

On Feb 18, the company’s board announced a regular quarterly dividend of $2 per common share. The dividend will be paid out on Mar 31 to shareholders of record as of Mar 16, 2022.

Public Storage currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

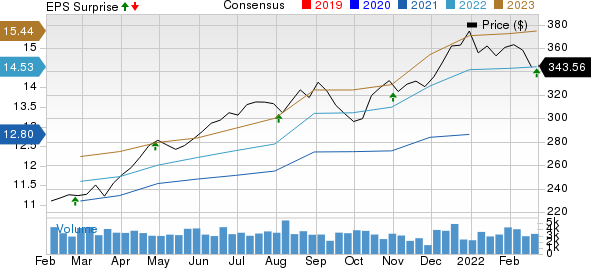

Public Storage Price, Consensus and EPS Surprise

Public Storage price-consensus-eps-surprise-chart | Public Storage Quote

Upcoming Releases

It’s time to look forward to the earnings releases of other REITs, including Iron Mountain Incorporated IRM and SBA Communications Corporation SBAC.

Iron Mountain is scheduled to report its numbers on Feb 24 and SBA Communications is slated to release fourth-quarter 2021 results on Feb 28.

The Zacks Consensus Estimate for Iron Mountain’s fourth-quarter 2021 FFO per share is pegged at 71 cents, suggesting a year-over-year increase of 7.6%. IRM currently carries a Zacks Rank of 3 (Hold).

The Zacks Consensus Estimate for SBA Communications’ fourth-quarter 2021 FFO per share is pegged at $2.80, implying a year-over-year increase of 12.45%. SBAC currently carries a Zacks Rank of 4 (Sell).

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Public Storage (PSA) : Free Stock Analysis Report

Iron Mountain Incorporated (IRM) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research