Use the Pullback to Invest in Stocks with Long-Term Potential

The simplest way to make money in the stock market is by buying cheap and selling when prices rise. But because it is so hard to guess a bottom, or a height for that matter, people make mistakes. And it’s true that we all make mistakes, from the most experienced of us to the novices.

One of the big mistakes we can make is to fret at the bloodbath in the market today. Everything that experts and market watchers are saying point to the increased likelihood of a successful soft landing. We have commodity prices receding, we have inventory building up in certain areas that are bringing down prices, we have the housing market softening with enough demand in the backdrop to ensure that there won’t be a crash, and most importantly, we have a relatively strong consumer.

The tightening in the jobs market is easing somewhat and we are continually adding more jobs. Even if the Fed continues to warn us, this is a positive scenario. It just doesn’t look like we are moving into a protracted period of weakness. Even if we do slip into a recession next year, it is likely to be short-lived.

So, getting back to the market, if prices are going down, that’s a good thing. It is becoming a buyers’ market. Although the market appears to be pricing in all the impending negativity (and then some), it could go down some more. That is always a possibility. But since it is practically impossible to guess a bottom, we can still buy some good stocks based on their outlook, the outlook for the industry to which they belong and analyst optimism on their long-term potential. That’s the theory behind these picks:

Taiwan Semiconductor Manufacturing Company Ltd. TSM

Taiwan Semiconductor manufactures, packages, tests and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan and the U.S. It provides complementary metal oxide silicon wafer fabrication processes to manufacture logic, mixed-signal, radio frequency and embedded memory semiconductors.

The Zacks Rank #1 stock is part of the Semiconductor - Circuit Foundry industry, which is in the top 1% of Zacks-classified industries. Our research shows that historically, the top 50% of Zacks-classified industries outperform the bottom 50% by a factor of 2 to 1. And that’s not all. When a stock with a #1 rank belongs to such an industry, it has a very good chance of appreciation in the near term. So these two factors alone make the shares attractive. But if you’re not convinced, we can also look at the numbers.

Analysts are currently quite upbeat about Taiwan Semiconductor. Their revenue and earnings estimates for the year represent growth of 36.9% and 52.9%, respectively. Moreover, growth is expected to continue the following year with revenue up another 14.4% while earnings increases another 3.5%. For the long term, they’re looking for 24.2% earnings growth.

The price decline of 6.1% doesn’t seem to make sense given the above. And valued on the baiss of price to earnings (P/E), the shares are trading at a 12.4X multiple, close to the lowest point of 12.38X over the past year. Therefore, it makes sense to accumulate the shares.

Haynes International, Inc. HAYN

Haynes International, Inc. develops, manufactures, markets and distributes nickel and cobalt-based alloys in sheet, coil and plate forms in the U.S., Europe and Asia.

The shares carry a Zacks Rank #1 and belong to the Steel – Speciality industry, which is in the top 1% of Zacks-classified industries.

Analysts currently expect its 2022 (ending September) revenue to grow 44.1% and its 2023 revenue to grow 13.8%. They expect its earnings to grow a respective 602.8% and 20.0%. They’ve taken their 2022 estimate up 32.2% and 2023 estimate up 12.6% in the last 60 days. The long-term growth is pegged at 20.0%.

Given all these positives, the 7.1% decline in prices over the last 4 weeks could be seen as a buying opportunity. Particularly because the valuation multiple of 9.2X earnings is really low, and close to its lowest point over the past year.

United Rentals, Inc. URI

United Rentals offers various kinds of industrial equipment on rent to construction and industrial companies involved in infrastructure and other projects, manufacturers, utilities, municipalities, homeowners and government entities. It two operating segments are General Rentals and Specialty.

United Rentals shares carry a Zacks Rank #1 and belong to the attractive Building Products – Miscellaneous industry (top 26%). This combination is indicative of share price appreciation.

The numbers also look good. With revenue growth expected to be 19.2% and 7.6% in 2022 and 2023, respectively and earnings growth expected to be 43.8% and 10.8%, United Rentals shares should have been on an upward trajectory. Especially since recent estimate revisions point to an improving trend: the Zacks Consensus Estimate for 2022 is up 6.9% while that for 2023 is up 4.7% in the last 60 days.

Yet despite the positive trend and a long-term growth estimate of 17.6%, the shares traded down 8.7% in the last 4 weeks. They currently trade at 8.7X earnings, which is close to their lowest point over the past year. This definitely looks like an opportunity to buy.

InterContinental Hotels Group plc IHG

InterContinental Hotels Group plc owns, manages, franchises and leases hotels in the Americas, Europe, Asia, the Middle East, Africa and Greater China. As of Dec 31, 2021, InterContinental operated 5,991 hotels and 880,327 rooms in approximately 100 countries under the Six Senses, Regent, InterContinental Hotels & Resorts, Vignette Collection, Kimpton Hotels & Restaurants, Hotel Indigo, EVEN Hotels, HUALUXE, Holiday Inn, Holiday Inn Express, Holiday Inn Club Vacations, avid, Staybridge Suites, Atwell Suites, Candlewood Suites, voco and Crowne Plaza brands.

The Zacks Rank #1 stock belongs in the Hotels and Motels industry (top 37%).

InterContinental is expected to grow its revenue 21.7% in 2022 followed by another 16.6% in 2023. Earnings are also expected to grow in both years, by a respective 88.4% and 23.8%. Its 2022 estimate has increased 9.1% in the last 30 days while the 2023 estimate increased 5.5%.

Despite these positives, and analyst expectations for 16.9% earnings growth over the long term, the company’s shares have dropped 10.0% in the last 4 weeks. The 17.0X earnings multiple is relatively close to the S&P 500’s 16.9X and also their lowest level of 16.6X over the past year. So, this too could be considered a buying opportunity.

Conclusion

The market appears to be pricing in the expected slowdown in the economy, so it’s relatively easy to find good undervalued stocks right now. Given the high level of volatility, we cannot rule out the possibility of further downside in the immediate future. But the possibility of greater upside thereafter looks stronger.

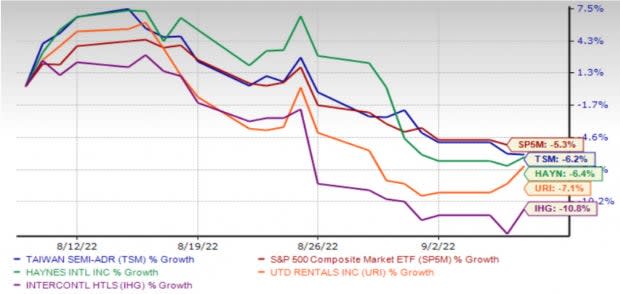

One-Month Price Performance

Image Source: Zacks Investment Research

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Hotels Group (IHG) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

United Rentals, Inc. (URI) : Free Stock Analysis Report

Haynes International, Inc. (HAYN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research