Pzena Investment Cuts Amgen, Halliburton

Richard Pzena (Trades, Portfolio) is the founder and Chief Investment Officer of Pzena Investment Management LLC. The hedge fund has an equity portfolio valued at $15.33 billion and composed of 169 stocks. It sold shares of the following stocks during the second quarter of 2020.

The Interpublic Group of Companies

The fund trimmed its position in The Interpublic Group of Companies Inc. (IPG) by 57.25%. The trade had an impact of -1.06% on the portfolio.

The holding company has a market cap of $7.16 billion and an enterprise value of $11.69 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 17.93% and return on assets of 2.78% are outperforming 62% of companies in the media, diversified industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.2 is below the industry median of 0.88.

The largest guru shareholder of the company is John Rogers (Trades, Portfolio) with 2.38% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 1.69% and Pzena with 1.66%.

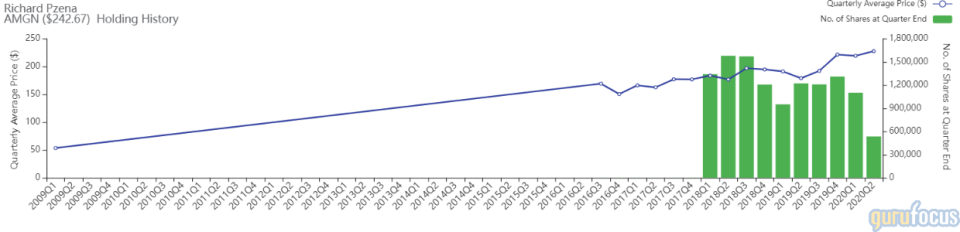

Amgen

The fund reduced its Amgen Inc. (AMGN) holding by 51.33%. The portfolio was impacted by -0.87%.

The company, which operates in the biotechnology-based human therapeutics field, has a market cap of $144.09 billion and an enterprise value of $166.90 billion.

GuruFocus gives the company a profitability and growth rating of 9 out of 10. The return on equity of 70.81% and return on assets of 11.95% are outperforming 88% of companies in the drug manufacturers industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.33 is below the industry median of 0.87.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 3.14% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.64% and Pioneer Investments (Trades, Portfolio) with 0.16%.

KKR

The fund curbed its position in KKR & Co Inc. (KKR) by 84.13%. The portfolio was impacted by -0.82%.

The investment firm has a market cap of $30.82 billion and an enterprise value of $71.79 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of -0.18% and return on assets of 0.03% are underperforming 63% of companies in the asset management industry. Its financial strength is rated 2 out of 10. The cash-debt ratio of 0.12 is below the industry median of 24.84.

Some notable guru shareholders are Jeff Ubben's ValueAct Holdings with 5.32% of outstanding shares, Chuck Akre (Trades, Portfolio) with 1.69% and Diamond Hill Capital (Trades, Portfolio) with 1.34%.

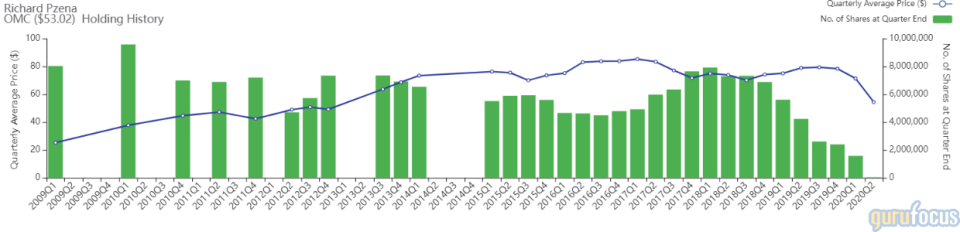

Omnicom

The fund reduced its position in Omnicom Group Inc. (OMC) by 96.88%, impacting the portfolio by -0.64%.

The holding company has a market cap of $11.49 billion and an enterprise value of $15.56 billion.

GuruFocus gives the company a profitability and growth rating of 8 out of 10. The return on equity of 37.3% and return on assets of 3.86% are outperforming 69% of companies in the media, diversified industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.48 is above the industry median of 0.88.

The largest guru shareholder of the company is First Eagle Investment (Trades, Portfolio) with 1.73% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 1.32% and HOTCHKIS & WILEY with 0.45%.

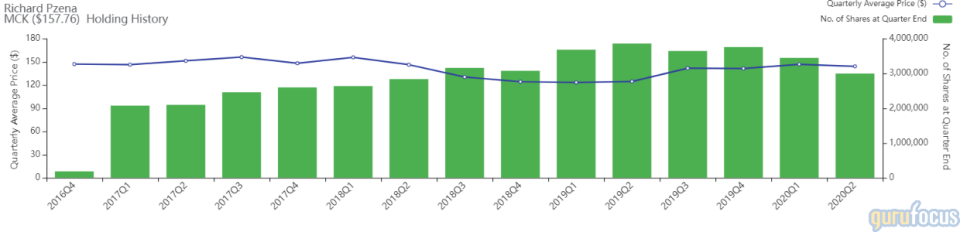

McKesson

The investment fund curbed its holding in McKesson Corp. (MCK) by 13.08%. The trade had an impact of -0.46% on the portfolio.

The company has a market cap of $25.73 billion and an enterprise value of $31.33 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. While the return on equity of 13.35% is outperforming the sector, the return on assets of 1.49% is underperforming 63% of companies in the medical distribution industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.43 is below the industry median of 0.63.

Other notable guru shareholders include Vanguard Health Care Fund (Trades, Portfolio) with 1.03% of outstanding shares, Seth Klarman (Trades, Portfolio)'s The Baupost Group with 1.03% and Larry Robbins (Trades, Portfolio) with 1.02%.

Halliburton

The investment fund cut its Halliburton Co. (HAL) position by 15.7%. The trade had an impact of -0.38% on the portfolio.

The oilfield-services company has a market cap of $12.74 billion and an enterprise value of $21.75 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -51.56% and return on assets of -16.36% are underperforming 83% of companies in the oil and gas industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.17 is below the industry median of 0.38.

The largest guru shareholder of the company is Dodge & Cox with 5.57% of outstanding shares, followed by HOTCHKIS & WILEY with 1.39% and T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.72%.

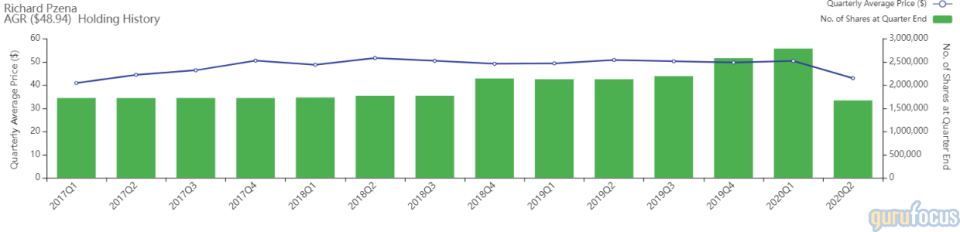

Avangrid

The investment fund cut its holding of Avangrid Inc. (AGR) by 40.05%. The trade had an impact of -0.37% on the portfolio.

The company has a market cap of $15.27 billion and an enterprise value of $24.22 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 4.6% and return on assets of 2.06% are underperforming 72% of companies in the utilities, regulated industry. Its financial strength is rated 3 out of 10 with cash-debt ratio of 0.01.

Another notable guru shareholder is Simons' firm with 0.38% of outstanding shares.

Disclosure: I do not own any stocks mentioned.

Read more here:

Hussman Strategic Advisors Sells Facebook, Exits Gilead

Elfun Trusts Trims PepsiCo, Gilead

The Vanguard Health Care Fund Cuts Eli Lilly, Merck & Co.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.