Pzena Investment Management Cuts Morgan Stanley,Viatris

- By Tiziano Frateschi

Richard Pzena (Trades, Portfolio)'s Pzena Investment Management LLC sold shares of the following stocks during the first quarter of 2021, which ended on March 31.

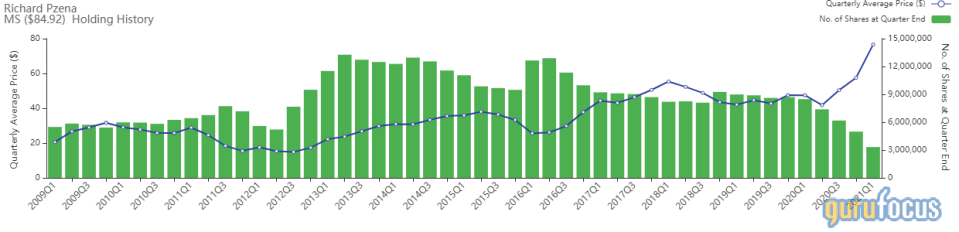

Morgan Stanley

The guru's Morgan Stanley (MS) position was reduced, impacting the portfolio by -0.54%.

The investment bank has a market cap of $158 billion and an enterprise value of $285 billion.

GuruFocus gives the global investment bank a profitability and growth rating of 5 out of 10. The return on equity of 13.75% is outperforming 84% of companies in the capital markets industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.5.

The largest guru shareholder of the company is PRIMECAP Management (Trades, Portfolio) with 0.67% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.51% and ValueAct Holdings LP (Trades, Portfolio) with 0.46%.

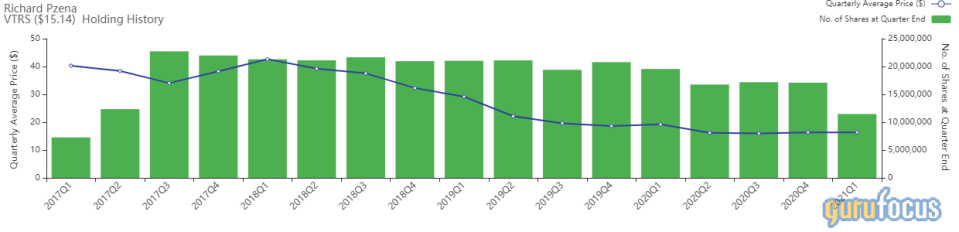

Viatris

The guru curbed the position in Viatris Inc. (VTRS) by 32.9%, impacting the portfolio by -0.50%.

The company has a market cap of $18.30 billion and an enterprise value of $43.36 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -4.76% and return on assets of -1.82% are underperforming 62% of companies in the drug manufacturers industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.04 is far below the industry median of 1.02.

The largest guru shareholders of the company include Vanguard Health Care Fund (Trades, Portfolio) with 4.57% of outstanding shares, Chris Davis (Trades, Portfolio) with 0.96% and John Paulson (Trades, Portfolio) with 0.94%.

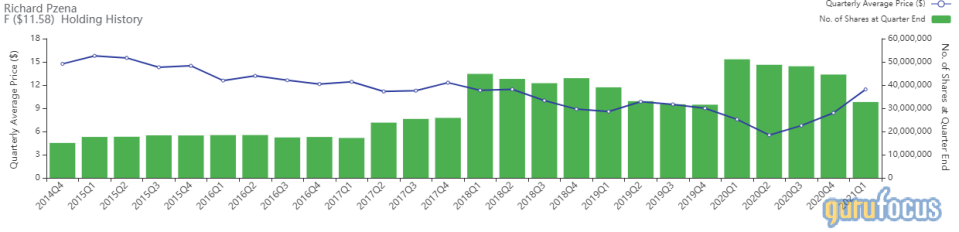

Ford Motor

The firm trimmed its position in Ford Motor Co. (F) by 26.6%. The trade had an impact of -0.49% on the portfolio.

The company, which manufactures automobiles, has a market cap of $48.22 billion and an enterprise value of $154.23 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 12.57% is outperforming 85% of companies in the vehicles and parts industry. Its financial strength is rated 3 out of 10 with a cash-debt ratio of 0.3.

The largest guru shareholder of the company is Pzena with 0.82% of outstanding shares, followed by Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.25% and Pioneer Investments (Trades, Portfolio) with 0.12%.

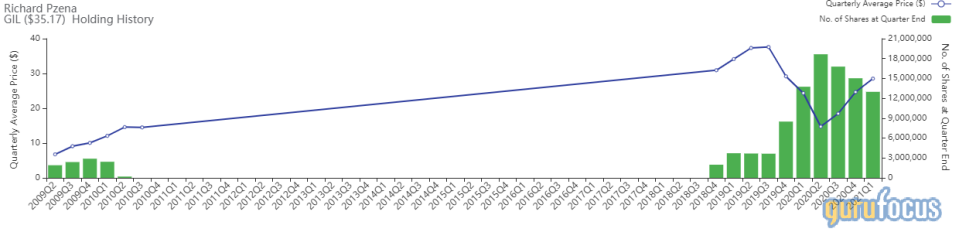

Gildan Activewear

The guru reduced the position in Gildan Activewear Inc. (GIL) by 13.62%, impacting the portfolio by -0.27%.

The company, which manufactures T-shirts, underwear, socks and hosiery, has a market cap of $6.97 billion and an enterprise value of $7.53 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of -2.62% and return on assets of -1.26% are underperforming 64% of companies in the manufacturing, apparel and accessories industry. Its financial strength is rated 6 out of 10 with a cash-debt ratio of 0.5.

The largest guru shareholders of the company include Pzena with 6.54% of outstanding shares, PRIMECAP Management (Trades, Portfolio) with 0.05%, Pioneer Investments (Trades, Portfolio) with 0.05% and Joel Greenblatt (Trades, Portfolio) with 0.01%.

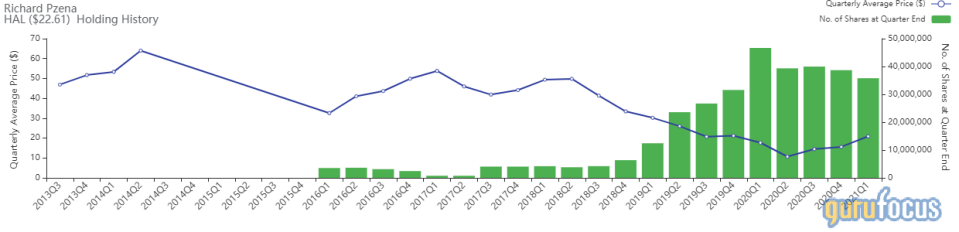

Halliburton

The firm reduced its position in Halliburton Co. (HAL) by 7.47%, impacting the portfolio by -0.26%.

The oilfield-services company has a market cap of $20.12 billion and an enterprise value of $28.29 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of -32.12% and return on assets of -8.23% are underperforming 75% of companies in the oil and gas industry. Its financial strength is rated 4 out of 10 with a cash-debt ratio of 0.23.

The largest guru shareholder of the company is Pzena with 4.02% of outstanding shares, followed by Dodge & Cox with 3.30% and HOTCHKIS & WILEY with 1.41%.

Avis Budget

The guru trimmed the position in Avis Budget Group Inc. (CAR) by 78.66%, impacting the portfolio by -0.25%.

The company, which provides automotive vehicle rental and car-sharing services, has a market cap of $5.72 billion and an enterprise value of $19.77 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on assets of -3.45 is underperforming 72% of companies in the business services industry. Its financial strength is rated 2 out of 10 with a cash-debt ratio of 0.04.

The largest guru shareholders of the company include Larry Robbins (Trades, Portfolio) with 2.47% of outstanding shares, Simons' firm with 0.55% and Paul Tudor Jones (Trades, Portfolio) with 0.05%.

Disclosure: I do not own any stocks mentioned.

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.