Pzena Investment Trims Stanley, Black & Decker Position

- By Tiziano Frateschi

Richard Pzena (Trades, Portfolio)'s Pzena Investment Management sold shares of the following stocks during the third quarter of fiscal 2020, which ended on Sept. 30.

Stanley Black & Decker

The fund reduced its stake in Stanley Black & Decker Inc. (NYSE:SWK) by 40.52%. The trade had an impact of -0.94% on the portfolio.

The company, which manufactures hand and power tools, has a market cap of $26.63 billion and an enterprise value of $32.12 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 10.19% and return on assets of 4.36% are outperforming 64% of companies in the industrial products industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.15 is below the industry median of 0.97.

The company's largest guru shareholder is Barrow, Hanley, Mewhinney & Strauss with 2.52% of outstanding shares, followed by Pioneer Investments (Trades, Portfolio) with 2.21% and John Rogers (Trades, Portfolio) with 0.35%.

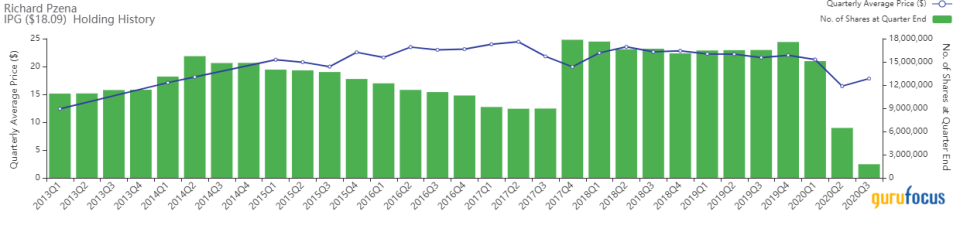

The Interpublic Group of Companies

The Interpublic Group of Companies Inc. (NYSE:IPG) position was trimmed by 72.7%, impacting the portfolio by -0.52%.

The holding company has a market cap of $7.06 billion and an enterprise value of $11.16 billion.

GuruFocus gives the company a profitability and growth rating of 7 out of 10. The return on equity of 21.92% and return on assets of 3.5% are outperforming 71% of companies in the diversified media industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.29 is below the industry median of 0.91.

The largest guru shareholder of the company is Rogers with 2.32% of outstanding shares, followed by Pioneer Investments with 1.25% and Hotchkis & Wiley with 0.84%.

Avangrid

The guru's fund exited its position in Avangrid Inc. (NYSE:AGR). The portfolio was impacted by -0.46%.

The company has a market cap of $15.25 billion and an enterprise value of $24.20 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 4.19% and return on assets of 1.87% are underperforming 71% of companies in the regulated utilities industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.01 is far below the industry median of 0.24.

The largest guru shareholder is Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.11% of outstanding shares, followed by Mario Gabelli (Trades, Portfolio)'s GAMCO Investors with 0.10% and John Hussman (Trades, Portfolio) with 0.01%.

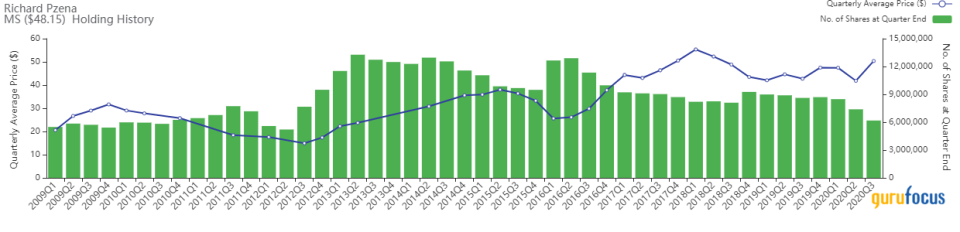

Morgan Stanley

The fund reduced its Morgan Stanley (NYSE:MS) holding by 16.34%, impacting the portfolio by -0.38%.

The investment bank has a market cap of $87.10 billion and an enterprise value of $196.17 billion.

GuruFocus gives the company a profitability and growth rating of 5 out of 10. The return on equity of 11.14% and return on assets of 1.07% are outperforming 50% of companies in the capital markets industry. Its financial strength is rated 3 out of 10. The cash-debt ratio of 0.52 is below the industry median of 2.53.

The largest guru shareholder of the company is ValueAct Holdings LP (Trades, Portfolio) with 0.90% of outstanding shares, followed by Ken Fisher (Trades, Portfolio) with 0.54% and the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.32%.

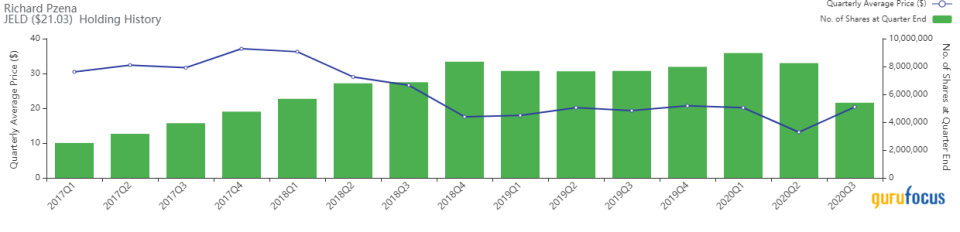

JELD-WEN Holding

The investment firm trimmed its JELD-WEN Holding Inc. (NYSE:JELD) position by 34.53%. The trade had an impact of -0.30% on the portfolio.

The company, which manufactures doors and windows, has a market cap of $2.11 billion and an enterprise value of $3.63 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 6.01% and return on assets of 1.37% are underperforming 58% of companies in the construction industry. Its financial strength is rated 4 out of 10. The cash-debt ratio of 0.23 is below the industry median of 0.64.

The largest guru shareholder of the company is Pzena with 5.37% of outstanding shares, followed by Simons' firm with 0.39% and Chuck Royce (Trades, Portfolio) with 0.30%.

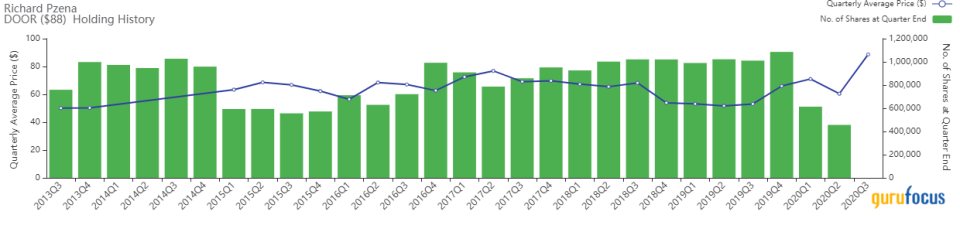

Masonite International

The investment fund divested of its Masonite International Corp. (NYSE:DOOR) position. The trade had an impact of -0.23% on the portfolio.

The company, which provides doors for the construction, renovation and remodeling industries, has a market cap of $2.16 billion and an enterprise value of $2.91 billion.

GuruFocus gives the company a profitability and growth rating of 6 out of 10. The return on equity of 13.2% and return on assets of 4.19% are outperforming 68% of companies in the construction industry. Its financial strength is rated 5 out of 10. The cash-debt ratio of 0.21 is below the industry median of 0.64.

The largest guru shareholder of the company is Simons' firm with 1.89% of outstanding shares, followed by PRIMECAP Management (Trades, Portfolio) with 0.76%, Hotchkis & Wiley with 0.27% and Lee Ainslie (Trades, Portfolio)'s Maverick Capital with 0.04%.

Disclosure: I do not own any stocks mentioned.

Read more here:

5 Guru Stocks Predicted to Expand Earnings?

5 Tech Companies Growing Fast

6 Real Estate Companies Trading with Low Price-Sales Ratios

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.