Q1 Ends in Red: 5 S&P 500 Banks to Watch for Q2 & Beyond

After an impressive 2021, investors were expecting a good start to 2022. However, the year began on a wrong footing as a number of concerns – rising inflation, supply chain imbalances and the Federal Reserve’s monetary policy tightening – weighed on market sentiments. The ongoing Russia-Ukraine conflict added fuel to the fire, which along with the flattening U.S. Treasury yield curve, has led to recessionary fears among investors.

All the three major indexes ended the first quarter in red, marking the worst quarterly performance in two years. Except for Energy and Utilities, all S&P 500 sectors closed in the red. The Financial sector was no exception, despite indications of rising interest rates. Thus, bank stocks (constituting a large part of the Finance sector) did not remain untouched by broader disappointing performance. The KBW Nasdaq Bank Index and the S&P Banks Select Industry Index declined 8.5% and 3.9%, respectively, in the quarter.

Despite such performance, bank stocks are likely to remain in the limelight as the interest rates rise. The central bank has been indicating the readiness for a bigger rate hike to fight raging inflation numbers. Let’s take a look at – First Republic Bank FRC, SVB Financial SIVB, Bank of New York Mellon BK, JPMorgan JPM and Citigroup C – which will not only gain from rising rates but also have solid prospects.

These banks have lost more than 10% in the quarter, thus giving the investors a good entry point. Also, these banks have strong fundamentals that will help withstand any near-term unfavorable developments.

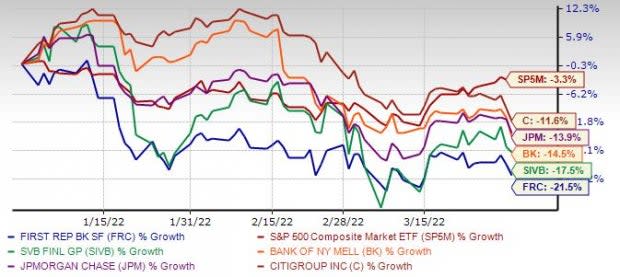

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Now, it’s the time to dig deeper and discuss these banks’ fundamentals in detail. All five banks currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

First Republic Bank has demonstrated considerable top-line strength. The bank’s net interest income (NII), which is also its primary source of income from operations, witnessed a four-year CAGR of 18% (ended 2021), mainly driven by growth in average interest-earning assets.

In the same time frame, non-interest income grew 19.2%, supported by a steady rise in investment management fees (accounting for almost 61% of fee income as of Dec 31, 2021). Such consistent growth in both NII and fee income suggests optimism about First Republic Bank’s top-line strength.

First Republic Bank’s balance-sheet growth story remains impressive. The company recorded notable growth in loan balances, driven by increased loan origination volumes with a three-year (2019-2021) CAGR of 22%. Also, its total deposits witnessed a CAGR of 31.7% in the same time frame.

For 2022, management expects loans to grow in the mid-teens on the back of solid momentum in household debt refinance products and professional lines of credit. FRC is also optimistic about its ability to continue generating deposits and onboard new clients, which are expected to support loan growth in the upcoming quarters.

At $162.10 per share, FRC is currently trading at a price/tangible book value of 2.45X, below the broader market average of 16.34X. Thus, the company’s beaten-down stock price and attractive valuation might be a good entry point for investors.

SVB Financial remains focused on an organic growth strategy, as is evident from a consistent rise in loans, deposits and net interest income over the past several years. The company’s net loans recorded a CAGR of 41.6% for the three-year ended 2021. NII and deposits witnessed a CAGR of 23.1% and 28.5%, respectively, over the same time frame. Improving non-interest income (a surge of 48.8% in 2021) will keep aiding top-line growth.

Management projects average loans to grow in the low-30s and average deposit balances to grow in the low-40s this year. NII is expected to rise in the high-30s, mainly on the back of solid balance sheet growth, reduction in average Fed cash balances, changing loan mix and spread compression.

SIVB is undertaking efforts to expand globally. While its U.K. and Asia operations seem to be growing, the businesses in Canada and Germany are expected to further boost revenues. The company’s international (reflects operations in the U.K., Europe, Israel, Asia and Canada) core fee income witnessed a five-year CAGR of 34% (ended 2021).

SVB Financial is expanding through strategic buyouts, which will continue supporting its position as one of the foremost providers of financing solutions to innovative companies. In its efforts to expand into technology investment banking, it acquired technology equity research firm, MoffettNathanson, in December 2021. In July, it acquired Boston Private, which is expected to further strengthen its private bank and wealth management offerings.

At $559.45 per share, SIVB is currently trading at a price/tangible book value of 2.68X, way below the broader market average of 16.34X. Thus, the company’s beaten-down stock price and attractive valuation might be a good entry point for investors.

Bank of New York Mellon or BNY Mellon is undertaking cost-saving initiatives to improve operating efficiencies. Overall costs are expected to remain manageable in the upcoming quarters as the company continues to eliminate unnecessary management layers and automates processes.

Though the near-zero interest rate environment hurts BK’s net interest margin (NIM) and net interest revenues (NIR), rising interest rates are expected to offer some support. The company expects NIR to increase 10%, primarily driven by higher rates and balance sheet mix, partially offset by an expectation of lower deposit balances.

BK has been trying to gain a foothold in foreign markets and is also undertaking several growth initiatives (including launching new services, digitizing operations and making strategic buyouts) of late. In December 2021, the company, through its subsidiary, acquired Optimal Asset Management. Given the huge growth potential of overseas securities markets and a rise in complex new securities, long-term growth prospects of the industry are encouraging. In 2021, non-U.S. revenues constituted 38% of total revenues.

At $49.63 per share, BNY Mellon is currently trading at a price/tangible book value of 2.27X, way below the broader market average of 16.34X. So, the company’s beaten-down stock price and attractive valuation might be a good entry point for investors.

JPMorgan, the largest U.S. bank in terms of assets, has been growing through on-bolt acquisitions, both domestic and international, of late. In March, it inked a deal to buy Global Shares, while this January, it agreed to acquire 49% stake in Viva Wallet. Last year, the company announced several acquisitions, which have enabled it to diversify revenues, and expand its fee income product suite and consumer bank digitally.

JPM is expanding its footprint in new regions by opening branches. The company has already added more than 220 new branches (of the targeted 400) and has a presence in 48 of 50 U.S. states. In addition to enhancing market share, the strategy will help the bank grab cross-selling opportunities by increasing its presence in the card and auto loan sectors. Apart from this, it has launched its digital retail bank Chase in the U.K. and continues to expand investment banking and asset management operations in China.

JPMorgan remains focused on acquiring the industry's best deposit franchise and strengthening its loan portfolio. As of Dec 31, 2021, loans to deposits ratio totaled 44%. Though loan demand was subdued since the onset of the coronavirus pandemic in 2020, there has been a decent rise in the same of late. Management projects loans to grow in high single-digit for 2022.

At $136.32 per share, JPM is currently trading at a price/tangible book value of 2.01X, way below the broader market average of 16.34X. So, the company’s beaten-down stock price and attractive valuation might be a good entry point for investors.

Citigroup has been emphasizing growth in core businesses through streamlining operations internationally. The company continues to optimize its branch network, and is making efforts to simplify operations and lower costs. In sync with this, it had a major strategic action last April, whereby the company will exit the consumer banking business in 13 markets across Asia and EMEA, including Australia, Bahrain, China, India, Indonesia and Korea.

The company has already signed deals to sell consumer businesses in India, Australia, Indonesia, Malaysia, Philippines, Thailand, Vietnam and Taiwan. C also plans to gradually wind down its consumer banking business in South Korea. In addition to this, this January, the company revealed plans to exit the consumer, small business and middle-market banking operations in Mexico. The exits will free up capital and help the company pursue investments in wealth management operations in Singapore, Hong Kong, the UAE and London. Citigroup anticipates the release of roughly $12 billion of allocated tangible common equity over time from such market exits.

The bank has been investing in opportunities across wealth and commercial banking, treasury and trade solutions, and securities service businesses to grow fee revenues across the Institutional Clients Group segment. Such efforts will bolster its position in the booming digital industry and diversify its revenue stream.

For 2022, the company is projecting low-single-digit growth in total revenues, excluding divestitures. This will likely be driven by higher interest rates, modest loan and deposit growth, higher fees and flat Market revenues.

At $53.40 per share, C is currently trading at a price/tangible book value of 0.68X, way below the broader market average of 16.34X. So, the company’s beaten-down stock price and attractive valuation might be a good entry point for investors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

The Bank of New York Mellon Corporation (BK) : Free Stock Analysis Report

First Republic Bank (FRC) : Free Stock Analysis Report

SVB Financial Group (SIVB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research