QIAGEN (QGEN) Beats Earnings and Revenue Estimates in Q3

QIAGEN N.V.'s QGEN third-quarter 2018 adjusted earnings per share (EPS) came in at 35 cents, up 9.4% year over year. The figure beat the Zacks Consensus Estimate of 33 cents by 6.1%. At constant exchange rate or CER, the company reported adjusted earnings of 36 cents.

Revenues in Detail

Net sales at actual rates in the third quarter grew 3.8% on a year-over-year basis to $377.9 million (6.5% at CER). Also, the top line surpassed the Zacks Consensus Estimate by 1.1%.

Sales from the Americas (49% of revenues) grew 9% at CER and revenues from Europe-Middle East-Africa (30%) increased 1%. Further, revenues from Asia-Pacific/Japan (21%) rose 11% year over year.

Segments in Detail

QIAGEN primarily generates revenues through Molecular Diagnostics, Applied Testing, Pharma and Academia, which represented 50%, 9%, 19% and 22% of net sales, respectively, in the reported quarter.

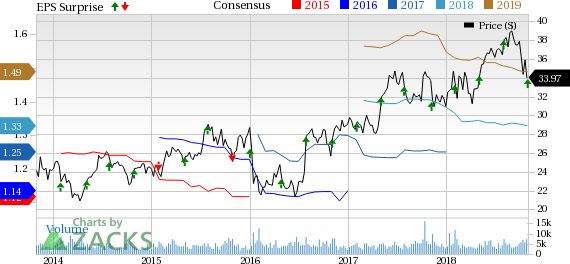

QIAGEN N.V. Price, Consensus and EPS Surprise

QIAGEN N.V. Price, Consensus and EPS Surprise | QIAGEN N.V. Quote

Molecular diagnostics sales were up 9% at CER. Sales derived from Applied Testing rose 1% at CER. Pharma sales rose 5% at CER in the third quarter and Academia sales improved 5% on growing demand.

Operational Update

Adjusted operating income (excluding items like restructuring charges, business integration, acquisition-related costs, litigation costs and the amortization of intangible assets acquired in business combinations) increased 7.9% year over year to $105.6 million in the third quarter. Moreover, adjusted operating margin expanded 100 basis points to 27.9%.

Financial Update

QIAGEN exited the third quarter with cash and cash equivalents of $599.8 million, down from $674.4 million at the end of the second quarter of 2018. Net cash provided by operating activities was $249 million for the nine months ending Sep 30, 2018, compared with $210.7 million a year ago. Moreover, the company reported free cash flow of $176.7 million for the first nine months compared with $146.1 million in the year-ago period.

QIAGEN announced a new commitment in January to return $200 million to shareholders via open-market repurchases, after returning $300 million to shareholders by the end of 2017. Notably, shares are being repurchased on the Frankfurt Stock Exchange. Through October 2018, the company has bought back a total of 2.7 million shares on the Frankfurt Stock Exchange for EUR 85.0 million (approximately $97 million at current exchange rates).

2018 Guidance

QIAGEN has maintained its 2018 guidance for total net sales growth at about 6-7% at CER. This guidance considers a drop in U.S. HPV test sales to have an adverse impact of around 1% on total net sales growth in 2018. Further, sales of about $7 million during the second half of 2018 from the acquisition of STAT-Dx was taken into account. The Zacks Consensus Estimate for 2018 revenues is pegged at $1.52 billion.

However, the company has raised its adjusted EPS guidance to $1.33-$1.34 at CER compared with $1.31-$1.33 at CER provided previously. Our consensus estimate for 2018 earnings of $1.33 is at the low end of the guided range.

Further, currency movements are expected to have a negative impact on 2018 net sales growth of up to 1% and an adverse impact of about 2 cents per share on adjusted EPS.

The company also provided the financial guidance for the fourth quarter of 2018. Net sales are expected to grow around 6-7% at CER. Adjusted EPS is expected at 39-40 cents at CER on an underlying basis. The Zacks Consensus Estimate for earnings stands at 43 cents per share, above the company’s guided range. Our consensus estimate for revenues is pegged at $424.5 million.

Further, currency movements are expected to have a negative impact on fourth-quarter 2018 net sales growth of up to 3-4% and up to a penny on adjusted EPS.

Our Take

QIAGEN ended the third quarter on a solid note. We are impressed with the year-over-year growth across all segments. The company also delivered a strong performance with respect to operating margin. Meanwhile, its commitment to return more to shareholders through increased repurchases reflects its solid cash position.

We are also upbeat about QIAGEN’s recent launch of three innovative Sample to Insight workflows for next-generation sequencing (NGS) research in oncology using its GeneReader NGS System and other NGS platforms. At the same time, the company unveiled major improvements to its Clinical Insight (QCI) bioinformatics solutions to deliver expanded Sample to Insight workflows for clinical NGS. QIAGEN will be introducing the NGS workflows at the Association for Molecular Pathology (AMP) Annual Meeting & Expo.

On the flip side, a competitive landscape and strong reliance on collaborations remain major overhangs.

Zacks Rank & Key Picks

QIAGEN currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader medical space, which reported solid earnings this season, are Intuitive Surgical ISRG, Stryker Corporation SYK and Merit Medical Systems, Inc. MMSI. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Intuitive Surgical reported third-quarter 2018 adjusted EPS of $2.83, which beat the Zacks Consensus Estimate of $2.65. Revenues totaled $920.9 million, also surpassing the consensus estimate of $918.6 million.

Stryker posted third-quarter 2018 adjusted EPS of $1.69, steering past the Zacks Consensus Estimate of $1.68. Operating margin was 17.8%, up 30 bps.

Merit Medical reported third-quarter 2018 adjusted EPS of 47 cents, which trumped the Zacks Consensus Estimate of 42 cents. Revenues of $221.6 million edged past the consensus estimate of $218 million.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

QIAGEN N.V. (QGEN) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research