Quaker Chemical (KWR) Tops Earnings & Sales Estimates in Q4

Quaker Chemical Corporation KWR recorded profits of $48.5 million or $2.72 per share in the fourth quarter, up from a profit of $15.2 million or 86 cents a year ago.

Barring one-time items, earnings came in at $1.63 per share for the reported quarter. It surpassed the Zacks Consensus Estimate of $1.50.

Net sales fell 1% year over year to $385.9 million in the quarter. It, however, topped the Zacks Consensus Estimate of $362.2 million. Sales fell due to a 2% decrease from price and product mix, partly offset by a 1% favorable impact from foreign currency swings.

Sales for the quarter rose 5% on a sequential comparison basis on improved volumes. The company saw a recovery of sales volumes from the impacts of the coronavirus pandemic in the quarter.

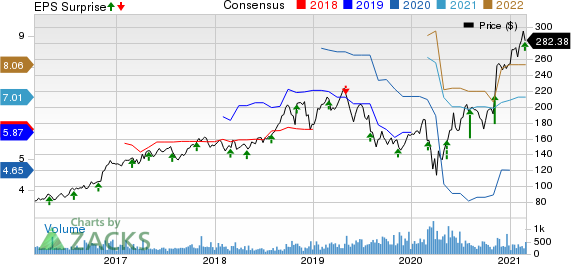

Quaker Chemical Corporation Price, Consensus and EPS Surprise

Quaker Chemical Corporation price-consensus-eps-surprise-chart | Quaker Chemical Corporation Quote

Margins

The company’s gross profit in the reported quarter rose around 4% year over year on the back of higher gross margins. Gross margin for the quarter was 36.8%, up from 34.8% a year ago.

Adjusted EBITDA was $65.5 million for the reported quarter, up 8% from the prior-year quarter.

FY20 Results

Earnings (as reported) for full-year 2020 was $2.22 per share, compared with earnings of $2.08 per share a year ago. Revenues climbed 25% year over year to $1,417.7 million for the full year. Full-year sales were driven by additional sales associated with the combination with Houghton International, Inc. and the acquisition of the operating divisions of Norman Hay plc.

Financials

The company ended 2020 with cash and cash equivalents of $181.8 million, up roughly 47% year over year. Long-term debt was $849 million, down around 4% year over year.

Net operating cash flow more than doubled year over year to $178.4 million for full-year 2020.

Outlook

Moving ahead, the company expects adjusted EBITDA for 2021 to be more than 20% higher than 2020 as it gains from a gradual rebound in demand, continues to take additional share in the marketplace, completes its integration cost synergies and benefits from its recent acquisitions. However, Quaker Chemical sees some short-term headwinds associated with lower-than-expected volumes to the automotive market due to the semiconductor shortage as well as higher raw material costs.

Price Performance

Quaker Chemical’s shares have rallied 80.8% in the past year compared with industry’s 26.6% growth.

Zacks Rank & Key Picks

Quaker Chemical currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Impala Platinum Holdings Limited IMPUY, Fortescue Metals Group Limited FSUGY and BHP Group BHP.

Impala Platinum has an expected earnings growth rate of 195.9% for the current fiscal. The company’s shares have rallied around 95% in the past year. It currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Fortescue has a projected earnings growth rate of 95.4% for the current fiscal. The company’s shares have surged around 184% in a year. It currently sports a Zacks Rank #1.

BHP Group has a projected earnings growth rate of 69.3% for the current fiscal year. The company’s shares have shot up around 72% in a year. It currently carries a Zacks Rank #1.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BHP Group Limited Sponsored ADR (BHP) : Free Stock Analysis Report

Impala Platinum Holdings Ltd. (IMPUY) : Free Stock Analysis Report

Quaker Chemical Corporation (KWR) : Free Stock Analysis Report

Fortescue Metals Group Ltd. (FSUGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research