Quanta Services (PWR) Lags on Q3 Earnings, Raises Guidance

Quanta Services Inc. PWR reported third-quarter 2018 adjusted earnings of 88 cents per share, missing the Zacks Consensus Estimate of 99 cents by 11.1%. However, the reported figure notably increased 39.7% from 63 cents recorded a year ago. The bottom-line growth is attributable to robust top line and the sound execution of its projects.

Total revenues came in at a record level of $2.99 billion, surpassing the consensus mark of $2.95 billion by 1.3%. Also, the top line increased 14.6% year over year, aided by robust revenue growth across the board.

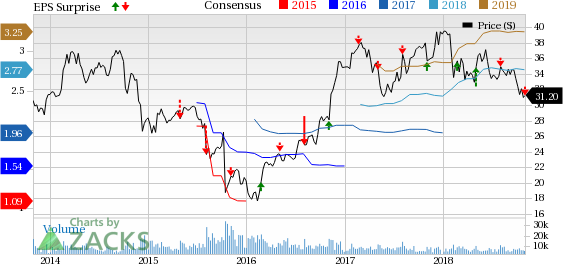

Quanta Services, Inc. Price, Consensus and EPS Surprise

Quanta Services, Inc. Price, Consensus and EPS Surprise | Quanta Services, Inc. Quote

Segment Details

Of the total quarterly revenues, the Electric Power Infrastructure segment accounted for 54.2%, and Oil and Gas Infrastructure contributed 45.8%.

Revenues from Electric Power Infrastructure came in at $1,617.7 million, up 7.5% year over year. Operating income of $179.2 million was up 19.4% from the year-ago level. Also, operating margins surged 110 basis points (bps) to 11.1%.

Oil and Gas Infrastructure segment revenues grew 23.8% from the prior-year quarter to $1,367.5 million. In fact, operating income of $96.1 million was up 64.2% from the year-ago period. Operating margins of 7% were up 230 bps.

Operating Highlights

In the reported quarter, overall operating income came in at $192.6 million compared with the prior-year figure of $140.4 million. Operating margin surged 110 bps from a year ago.

At the end of Sep 30, 2018, Quanta Services’ 12-month record backlog was $7,484.2 million, up from $6,446.2 million on Dec 31, 2017.

Liquidity

As of Sep 30, 2018, Quanta Services’ cash and cash equivalents were $113.5 million, down from $138.3 million on Dec 31, 2017. The company’s long-term debt and notes payable (net of current maturities) was $952.9 million, up from $670.7 million as of Dec 31, 2017.

In the quarter under review, net cash provided by operating activities totaled $39.1 million, which is much lower than $173.6 million recorded in the year-ago quarter.

The company bought back more than $300 million of its common stock this year.

Notable Developments

In October 2018, Quanta Services secured a contract by PacifiCorp to serve Aeolus via providing engineering, procurement and construction solutions to its Jim Bridger Transmission Line Project.

Also, in September 2018, the company signed a five-year sole-source transmission alliance agreement for $400 million with a municipal utility. Per the deal, Quanta Services will provide transmission, construction and maintenance services in Texas.

2018 Guidance Raised

Buoyed by strong performance through 2018 so far, the company remains optimistic about the third half of 2018, given strengthening of its base business activity that seasonally increases and ramped-up construction activity in its larger pipeline projects.

The company increased its adjusted earnings expectation for 2018 to the range of $2.70-$2.80 per share compared with prior anticipation of $2.55-$2.95. Considering the impressive operating performance so far in 2018, it increased its revenue projection to the range of $10.95-$11.05 billion from earlier expectation of $10.35-$10.75 billion.

EBITDA is now expected in the range of $813.3-$838.2 million (versus $763.3-$864.8 million projected earlier). Adjusted EBITDA is anticipated within $878.6-$903.6 versus $824.7-$926.2 million expected earlier.

Zacks Rank & Stocks to Consider

Quanta Services currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Construction sector include Jacobs Engineering Group Inc. JEC, Comfort Systems USA, Inc. FIX and North American Construction Group Ltd. NOA, each carrying a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Jacobs surpassed the consensus estimate in all the trailing four quarters, with average surprise rate of 15.4%.

Comfort Systems surpassed the consensus mark in three of the trailing four quarters, with average earnings surprise of 16.5%.

North American Construction is expected to record an earnings growth rate of 235.7% in 2018.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comfort Systems USA, Inc. (FIX) : Free Stock Analysis Report

Quanta Services, Inc. (PWR) : Free Stock Analysis Report

Jacobs Engineering Group Inc. (JEC) : Free Stock Analysis Report

North American Construction Group Ltd. (NOA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research