QuidelOrtho (QDEL) Reports Solid Preliminary Q4 Revenues

QuidelOrtho Corporation QDEL recently announced preliminary revenues for the fourth quarter and full-year 2022. The robust preliminary results drove up the shares of the company by 0.7% in the after-hours trading session.

The company is scheduled to release fourth-quarter results on Feb 15 after the closing bell.

Per the preliminary report, fourth-quarter 2022 revenues are estimated to be $853 million-$868 million on a reported basis. The Zacks Consensus Estimate of $753 million lies below the preliminary figure.

The company’s COVID-19 product revenues for the quarter are expected to be around $124 million-$134 million. The non-COVID-19 product revenue is expected to be in the range of $729 million-$734 million, representing 485% growth on a GAAP basis and 18% growth on a proforma constant-currency basis at the midpoint.

Per management, the to-be-reported quarter’s solid results have been driven by growth across its Molecular Diagnostics, Transfusion Medicine (TM) and Point-of-Care (POC) business units. QuidelOrtho’s solid foothold in the POC market with the Sofia platform and QuickVue Flu Test enabled it to serve patients in a strong respiratory season, driving substantial revenue growth.

Management is also upbeat about achieving its critical integration milestones while maintaining commercial and operational excellence across the organization during the fourth quarter, thus raising our optimism about the stock.

Full-Year Prelim Results

Per QuidelOrtho, its full-year total revenues are likely to be in the range of $4,038 million-$4,053 million. The Zacks Consensus Estimate of $3.94 billion lies below the preliminary figure.

The COVID-19 product revenue is expected to be in the range of $1,441 million-$1,451 million. The non-COVID-19 product revenue is expected to be in the range of $2,597 million-$2,602 million, representing 502% growth on a GAAP basis and 11% growth on a proforma constant-currency basis at the midpoint.

A Brief Q4 Analysis

QuidelOrtho has been observing a robust adoption of its products over the past few months. The company has been witnessing a solid uptick in its non-COVID product revenues over the past few months, which has considerably driven QuidelOrtho’s fourth-quarter revenues. This is an encouraging trend amid the falling COVID-19 infection rate, resulting in lower COVID-related product revenues.

Over the past few months, QuidelOrtho has also been witnessing strength in its POC and TM business units, which also looks promising for the stock. QuidelOrtho is also expected to witness strength in its overall business with its ongoing integration, thereby creating new cross-selling opportunities.

The company’s preliminary projection of robust improvement in revenues on the back of strength in its businesses lifts our confidence in the stock.

Price Performance

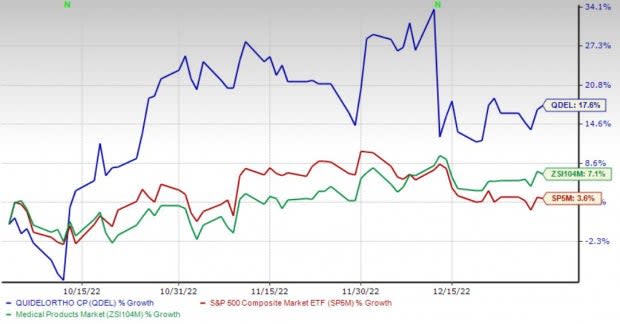

Shares of the company have gained 17.6% between Oct 3, 2022 and Jan 1, 2023 compared with the industry’s 7.1% rise and the S&P 500’s 3.6% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, QuidelOrtho carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are AMN Healthcare Services, Inc. AMN, Cardinal Health, Inc. CAH and Merit Medical Systems, Inc. MMSI.

AMN Healthcare, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 3.3%. AMN’s earnings surpassed the Zacks Consensus Estimate in all the trailing four quarters, the average beat being 10.9%.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AMN Healthcare has lost 7.5% against the industry’s 1.9% rise between Oct 3, 2022 and Jan 1, 2023.

Cardinal Health, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.7%. CAH’s earnings surpassed estimates in two of the trailing four quarters and missed the same in the other two, the average beat being 3%.

Cardinal Health has gained 13.1% compared with the industry’s 9.1% rise between Oct 3, 2022 and Jan 1, 2023.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average beat being 25.4%.

Merit Medical has gained 21.9% compared with the industry’s 9.1% rise between Oct 3, 2022 and Jan 1, 2023.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

QuidelOrtho Corporation (QDEL) : Free Stock Analysis Report