Quidel's (QDEL) Antigen Tests Successful in Omicron Detection

Quidel Corporation QDEL recently confirmed the efficacy of its antigen tests concerning continued detection of COVID-19 variants, including Omicron. The company has been at the forefront of the battle against the pandemic, and has been making efforts to evaluate COVID-19 mutations.

Currently, Quidel’s portfolio of antigen tests includes QuickVue At-Home OTC COVID-19 Test and Sofia SARS Antigen FIA.

This latest announcement is expected to significantly expand Quidel’s market share for sequencing, thus strengthening its global foothold.

Significance of the Announcement

Per management, the announcement regarding the success of the company’s antigen tests follows a recent testing using live South African samples. Quidel’s antigen tests — QuickVue At-Home OTC COVID-19 Test and Sofia SARS Antigen FIA — successfully detected the SARS-CoV-2 Omicron variant.

Recently, the FDA also indicated that data from preliminary RADx laboratory studies (with heat-inactivated Omicron samples) indicated the efficacy of the QuickVue antigen tests to detect the Omicron variant with similar performance as with other variants. The same laboratory has also completed additional testing using live virus. These data also suggest that the QuickVue antigen tests can detect the live Omicron variant with equal effectiveness as with other variants.

Quidel, which has been ramping up its weekly production of COVID-19 antigen tests to offer better access to affordable COVID-19 testing, has been vigilant in evaluating its assays. The evaluations will be done with both genetic sequencing and real-world virus sample studies in order to guarantee its products’ efficacy as the coronavirus evolves.

Industry Prospects

Per a report by Facts & Factors published on GlobeNewswire, the global genome sequencing market is expected to reach $12.9 billion by 2026 from $95 billion in 2020 at a CAGR of 20%. Factors like the rising prevalence of genetic disorders, continued mutations of the SARS-CoV-2 virus and the need for disease management are expected to drive the market.

Given the market potential, the latest announcement is expected to significantly boost Quidel’s global business.

Recent Developments

This month, Quidel entered into a definitive agreement to acquire Ortho Clinical Diagnostics Holdings plc. The buyout is expected to significantly expand Quidel’s point-of-care diagnostics portfolio with access to Ortho Clinical Diagnostics’ broad global reach across many countries. This, in turn, will likely accelerate growth for Quidel’s existing product portfolio and provide exposure to new and emerging markets.

In November, the company reported third-quarter 2021 results where it recorded robust top-line performance. Total sales of COVID-19 and influenza products were also strong during the quarter. Apart from this, Quidel received the CE Mark for Savanna multiplex molecular analyzer and Savanna RVP4 assay in the third quarter.

Among the notable developments, Quidel, in September, had announced that it would make its non-prescription QuickVue At-Home OTC COVID-19 Test available to consumers at more than 7,000 CVS Health’s pharmacy locations across the United States as well as online at cvs.com.

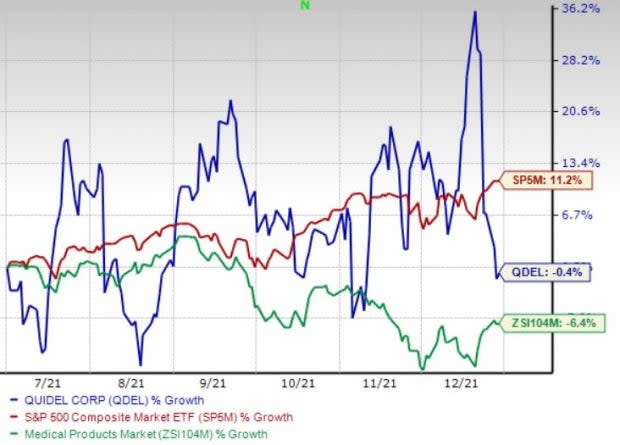

Price Performance

Shares of Quidel have lost 0.5% in the past six months compared with the industry’s 6.4% fall. The S&P 500 rose 11.2% in the same time frame.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, Quidel sports a Zacks Rank #1 (Strong Buy).

A few other top-ranked stocks investors can consider in the broader medical space are Laboratory Corporation of America Holdings LH or LabCorp, Thermo Fisher Scientific Inc. TMO and AMN Healthcare Services AMN.

LabCorp, carrying a Zacks Rank #2 (Buy), has an estimated long-term growth rate of 10.6%. LH’s earnings surpassed estimates in the trailing four quarters, the average surprise being 25.73%. You can see the complete list of today’s Zacks #1 Rank stocks here.

LabCorp has gained 51.6% compared with the industry’s 16.9% rise over the past year.

Thermo Fisher has an estimated long-term growth rate of 14%.TMO’s earnings surpassed estimates in the trailing four quarters, the average surprise being 9.02%. It currently carries a Zacks Rank #2.

Thermo Fisher has gained 42.3% compared with the industry’s 11.9% rise over the past year.

AMN Healthcare has an estimated long-term growth rate of 16.2%. AMN’s earnings surpassed estimates in the trailing four quarters, the average surprise being 19.51%. It currently flaunts a Zacks Rank #1.

AMN Healthcare has gained 78.8% against the industry’s 49.9% fall over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Laboratory Corporation of America Holdings (LH) : Free Stock Analysis Report

Thermo Fisher Scientific Inc. (TMO) : Free Stock Analysis Report

AMN Healthcare Services Inc (AMN) : Free Stock Analysis Report

Quidel Corporation (QDEL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research