Is Rackla Metals (CVE:RAK) In A Good Position To Deliver On Growth Plans?

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So should Rackla Metals (CVE:RAK) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Rackla Metals

Does Rackla Metals Have A Long Cash Runway?

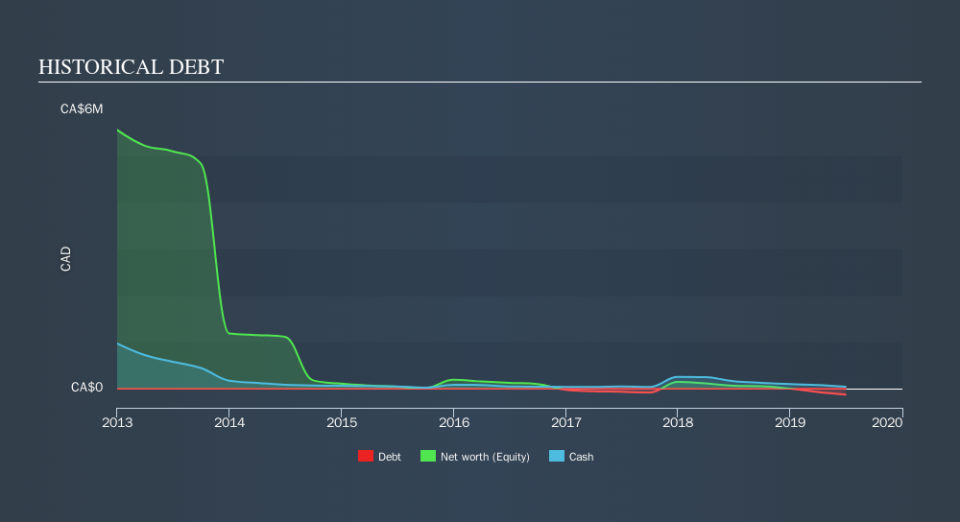

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2019, Rackla Metals had cash of CA$36k and no debt. In the last year, its cash burn was CA$121k. Therefore, from June 2019 it had roughly 4 months of cash runway. With a cash runway that short, we strongly believe that the company must raise cash or else douse its cash burn promptly. The image below shows how its cash balance has been changing over the last few years.

How Is Rackla Metals's Cash Burn Changing Over Time?

Because Rackla Metals isn't currently generating revenue, we consider it an early-stage business. So while we can't look to sales to understand growth, we can look at how the cash burn is changing to understand how expenditure is trending over time. Given the length of the cash runway, we'd interpret the 29% reduction in cash burn, in twelve months, as prudent if not necessary for capital preservation. Rackla Metals makes us a little nervous due to its lack of substantial operating revenue. We prefer most of the stocks on this list of stocks that analysts expect to grow.

How Hard Would It Be For Rackla Metals To Raise More Cash For Growth?

While Rackla Metals is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Rackla Metals's cash burn of CA$121k is about 5.0% of its CA$2.4m market capitalisation. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

How Risky Is Rackla Metals's Cash Burn Situation?

On this analysis of Rackla Metals's cash burn, we think its cash burn relative to its market cap was reassuring, while its cash runway has us a bit worried. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. For us, it's always important to consider risks around cash burn rates. But investors should look at a whole range of factors when researching a new stock. For example, it could be interesting to see how much the Rackla Metals CEO receives in total remuneration.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.