Railroads Ride on Multiple Tailwinds: 3 Stocks in Focus

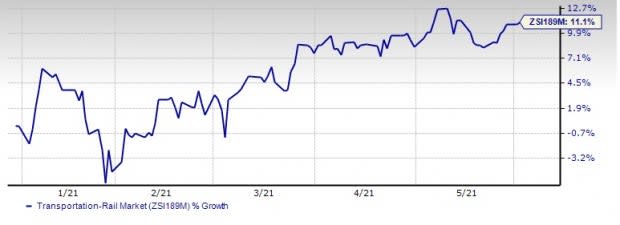

On an encouraging note, the transportation sector is on the mend this year after being severely hit by the coronavirus-led evils in 2020. With the broader sector currently on its way to recovery, one of its key components, railroads, are no exception. Evidently, the Zacks Transportation- Rail industry has gained in double-digits (up 11.1%) so far this year.

Image Source: Zacks Investment Research

Through this write up, we examine the factors responsible for the healthy price performance of railroads this year.

The improving freight conditions in the United States represent a huge positive for the railroads. The betterment in the freight scenario can be gauged by the latest Cass Freight Shipments Index report, according to which shipment volumes increased 27.6% on a year-over-year basis in April. Notably, this record uptick in May was much higher than the 10% year-over-year rise recorded in March.

Apart from the brightening freight scene, the constant efforts of railroads to cut costs and improve efficiencies are supporting the bottom line, thereby aiding growth. The adoption of the precision-scheduled railroading (PSR) model by railroads like Union Pacific Corporation UNP, Norfolk Southern Corporation NSC and Kansas City Southern KSU is ramping up efficiencies for these companies.

Mainly due to the cost-reduction measures, a keenly-watched metric in the railroad industry — operating ratio (operating expenses as a % of revenues) — is improving for most railroads. Evidently, at Norfolk Southern, adjusted operating ratio improved 220 basis points to 61.5% in first-quarter 2021. The metric is expected to improve by more than 300 basis points in 2021 from the 2020 levels. Notably, the company aims at an operating ratio of around 60% for 2021.

Moreover, owing to an uptick in economic activities, carload volumes recovered from the pandemic lows experienced in mid-2020. Notably, railroads are recognizing robust intermodal volumes, courtesy of the COVID-driven e-commerce demand. At CSX Corporation CSX, intermodal volumes expanded 10% in first-quarter 2021. Backed by strong volumes, intermodal revenues climbed 11% year over year in the same period.

3 Railroad Stocks to Focus on

In view of the above tailwinds, we present three companies, each presently carrying a Zacks Rank #3 (Hold) and witnessing favorable earnings estimate revisions that investors should watch out for.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Norfolk Southern, headquartered in Norfolk, VA, is benefiting from reduced costs, aided by the PSR model. Despite the current uncertain scenario, the company’s consistent efforts to reward its shareholders are highly encouraging and affirm its financial prowess. Notably, in January 2021, the company’s board approved a 5% hike in its quarterly dividend on the company's common stock from 94 cents to 99 cents per share. Moreover, it raised its long-term dividend payout ratio target from 33% of net income to the 35-40% range. In March-quarter 2021, the company paid out $840 million to its shareholders through dividends ($249 million) and buybacks ($591 million). Strong free cash flow generation, which was up 27% year over year in the first quarter, supports its shareholder friendly activities.

The stock has witnessed the Zacks Consensus Estimate for current-year earnings being revised 1.2% upward over the past 60 days.

Canadian Pacific Railway Limited CP is domiciled in Calgary, Canada. Notably, the gradual improvement in freight-market conditions is aiding the company. The company’s robust performance with respect to grain movement is highly appreciative as well. Efforts to reward its shareholders bode well too.

The stock has witnessed the Zacks Consensus Estimate for current-year earnings move 2.8% north over the past 60 days.

Union Pacific is based in Omaha, NE. Consistent efforts to check costs are driving the company’s bottom line. Moreover, its efforts to reward its shareholders even in the current uncertain scenario bears testimony to its financial strength. Last month, the company announced hiked its quarterly dividend to $1.07 per share (annually: $4.28 per share) by 10%. Additionally, Union Pacific recently entered into accelerated buyback programs for shares worth $2-billion of common stock. Notably, 7.2 million shares of common stock repurchased under the expedited authorizations were received by the railroad operator on May 26, 2021.

The stock has witnessed the Zacks Consensus Estimate for current-year earnings being revised 0.9% upward over the past 60 days.

Notably, shares of Norfolk Southern, Canadian Pacific and Union Pacific have gained 17.4%, 17.3% and 7.8% year to date, respectively.

Take a look —

Image Source: Zacks Investment Research

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Union Pacific Corporation (UNP) : Free Stock Analysis Report

Kansas City Southern (KSU) : Free Stock Analysis Report

CSX Corporation (CSX) : Free Stock Analysis Report

Norfolk Southern Corporation (NSC) : Free Stock Analysis Report

Canadian Pacific Railway Limited (CP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research