I Ran A Stock Scan For Earnings Growth And Capital Drilling (LON:CAPD) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Capital Drilling (LON:CAPD). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

View our latest analysis for Capital Drilling

Capital Drilling's Improving Profits

In the last three years Capital Drilling's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Capital Drilling's EPS shot from US$0.04 to US$0.074, over the last year. You don't see 85% year-on-year growth like that, very often.

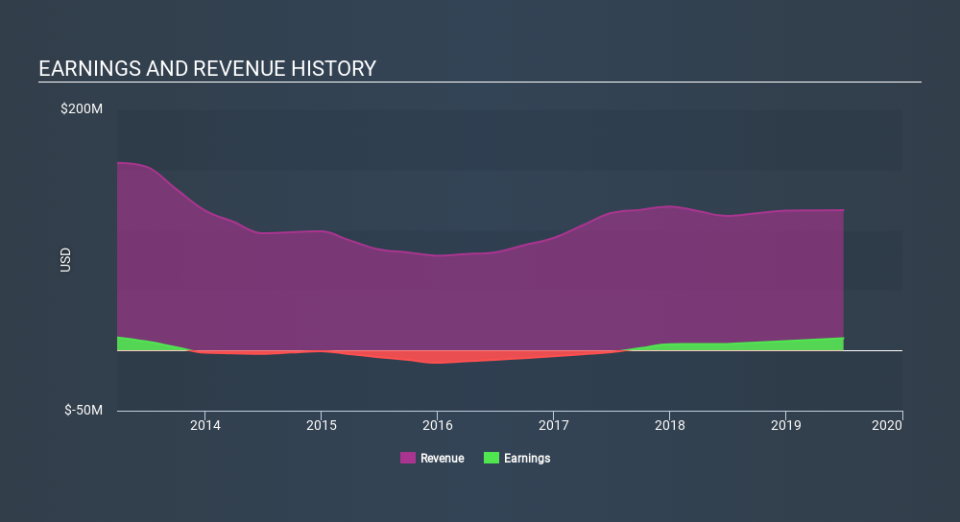

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Capital Drilling shareholders can take confidence from the fact that EBIT margins are up from 11% to 15%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Capital Drilling's forecast profits?

Are Capital Drilling Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Like a sturdy phalanx Capital Drilling insiders have stood united by refusing to sell shares over the last year. But my excitement comes from the US$50k that Senior Independent Non-Executive Director David Abery spent buying shares (at an average price of about US$0.60).

Along with the insider buying, another encouraging sign for Capital Drilling is that insiders, as a group, have a considerable shareholding. To be specific, they have US$22m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Those holdings account for over 31% of the company; visible skin in the game.

Does Capital Drilling Deserve A Spot On Your Watchlist?

Capital Drilling's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bunch of shares, and one has been buying more. Because of the potential that it has reached an inflection point, I'd suggest Capital Drilling belongs on the top of your watchlist. Of course, just because Capital Drilling is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

As a growth investor I do like to see insider buying. But Capital Drilling isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.