I Ran A Stock Scan For Earnings Growth And Owens Corning (NYSE:OC) Passed With Ease

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Owens Corning (NYSE:OC). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for Owens Corning

How Fast Is Owens Corning Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. We can see that in the last three years Owens Corning grew its EPS by 13% per year. That's a pretty good rate, if the company can sustain it.

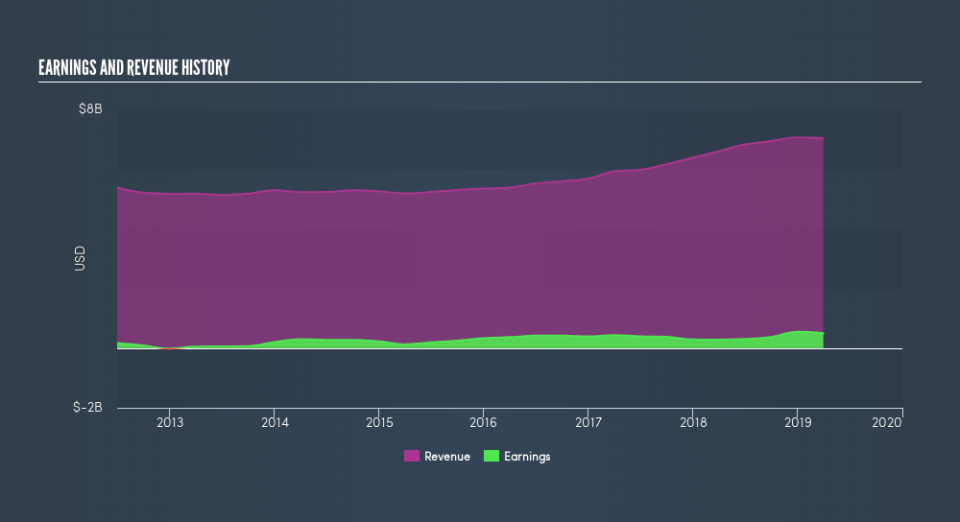

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Owens Corning's EBIT margins were flat over the last year, revenue grew by a solid 6.6% to US$7.0b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Owens Corning's future profits.

Are Owens Corning Insiders Aligned With All Shareholders?

Since Owens Corning has a market capitalization of US$5.5b, we wouldn't expect insiders to hold a large percentage of shares. But we do take comfort from the fact that they are investors in the company. Given insiders own a small fortune of shares, currently valued at US$87m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Does Owens Corning Deserve A Spot On Your Watchlist?

One positive for Owens Corning is that it is growing EPS. That's nice to see. Just as polish makes silverware pop, the high level of insider ownership enhances my enthusiasm for this growth. The combination sparks joy for me, so I'd consider keeping the company on a watchlist. If you think Owens Corning might suit your style as an investor, you could go straight to its annual report, or you could first check our discounted cash flow (DCF) valuation for the company.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.