Ray Dalio Commentary- The Changing World Order: The Big Cycles Over the Last 500 Years

Note: To make this an easier and shorter article to read, I tried to convey the most important points in simple language and bolded them, so you can get the gist of the whole thing in just a few minutes by focusing on what's in bold. Past chapters from the series can be found here: Introduction, Chapter 1 and Chapter 2. Additionally, if you want a simple and entertaining 30-minute explanation of how what a lot of what I'm talking about here works, see "How the Economic Machine Works," which is available on YouTube.

In Chapter 1 ("The Big Picture in a Tiny Nutshell"), I looked at the archetypical rises and declines of empires and their reserve currencies and the various types of powers that they gained and lost, and in Chapter 2 ("The Big Cycle of Money, Credit, Debt, and Economic Activity") and its appendix ("The Changing Value of Money") I reviewed the big money, credit, and debt cycles. In this chapter, I will review the rises and declines of the Dutch, British, and American empires and their reserve currencies and will touch on the rise of the Chinese empire.

While the evolution of empires and currencies is one continuous story that started before there was recorded history, in this chapter I am going to pick up the story around the year 1600. My objective is simply to put where we are in perspective of history and bring us up to date. I will begin by very briefly reviewing what the Big Cycle looks like and then scan through the last 500 years to show these Big Cycles playing out before examining more closely the declines of the Dutch and British empires and their reserve currencies. Then I will show how the decline of the British empire and the pound evolved into the rise of the US empire and US dollar and I will take a glimpse at the emergence of the Chinese empire and the Chinese renminbi.

That will bring us up to the present and prepare us to try to think about what will come next.

The Big Cycle of the Life of an Empire

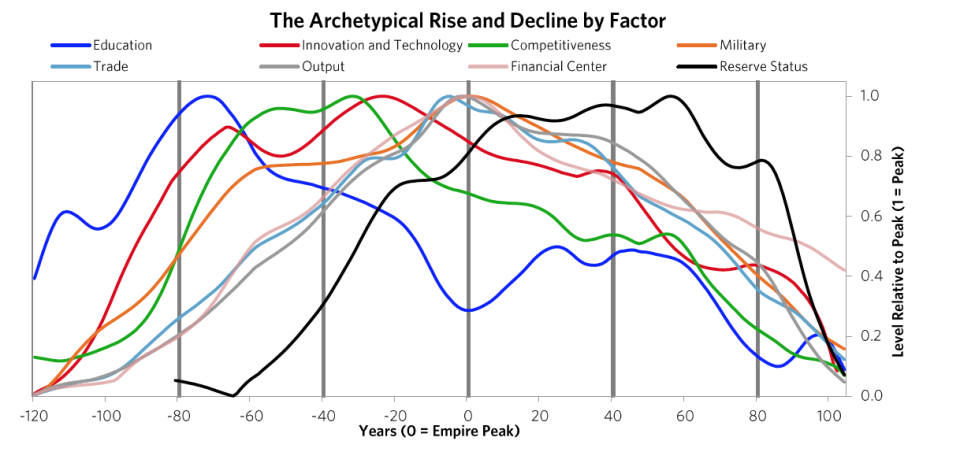

Just as there is a human life cycle that typically lasts about 80 years (give or take) and no two are exactly the same but most are similar, there is an analogous empire life cycle that has its own typical patterns. For example, for most of us, during the first phase of life we are under our parents' guidance and learn in school until we are about 18-24, at which point we enter the second phase. In this phase we work, become parents, and take care of others who are trying to be successful. We do this until we are about 55-65, at which time we enter the third phase when we become free of obligations and eventually die. It is pretty easy to tell what phases people are in because of obvious markers, and it is sensible for them to know what stages they are in and to behave appropriately in dealing with themselves and with others based on that. The same thing is true for countries. The major phases are shown on this chart. It's the ultra-simplified archetypical Big Cycle that I shared in the last chapter.

In brief, after the creation of a new set of rules establishes the new world order, there is typically a peaceful and prosperous period. As people get used to this they increasingly bet on the prosperity continuing, and they increasingly borrow money to do that, which eventually leads to a bubble. As the prosperity increases the wealth gap grows. Eventually the debt bubble bursts, which leads to the printing of money and credit and increased internal conflict, which leads to some sort of wealth redistribution revolution that can be peaceful or violent. Typically at that time late in the cycle the leading empire that won the last economic and geopolitical war is less powerful relative to rival powers that prospered during the prosperous period, and with the bad economic conditions and the disagreements between powers there is typically some kind of war. Out of these debt, economic, domestic, and world-order breakdowns that take the forms of revolutions and wars come new winners and losers. Then the winners get together to create the new domestic and world orders.

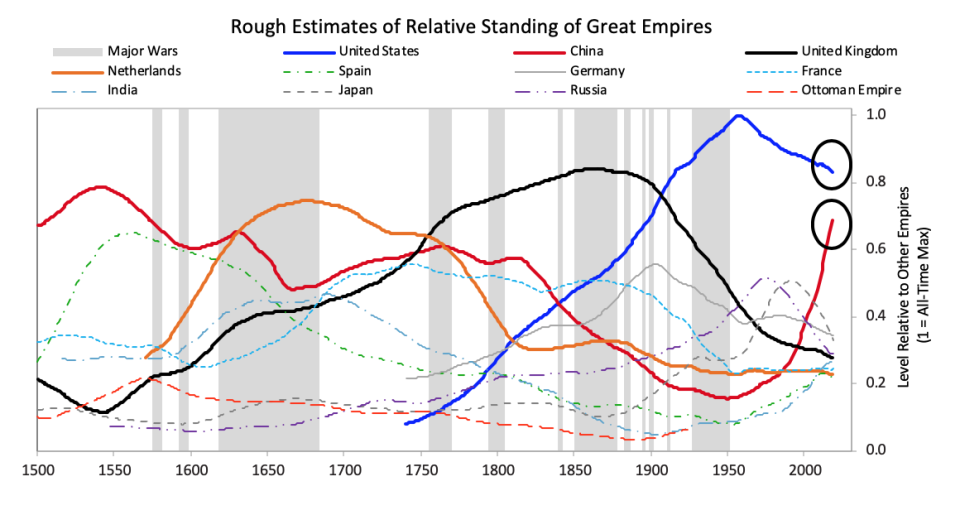

That is what has repeatedly happened through time. The lines in the chart signify the relative powers of the 11 most powerful empires over the last 500 years. In the chart below you can see where the US and China are currently in their cycles. As you can see the United States is now the most powerful empire by not much, it is in relative decline, Chinese power is rapidly rising, and no other powers come close.

Because that chart is a bit confusing, for simplicity the next chart shows the same lines as in that chart except for just the most powerful reserve currency empires (which are based on an average of eight different measures of power that we explained in Chapter 1 and will explore more carefully in this chapter).

The next chart offers an even more simplified view. As shown, the United States and China are the only two major powers, you can see where each of their Big Cycles is, and you can see that they are approaching comparability, which is when the risks of wars of one type or another are greater than when the leading powers are earlier in the cycle. To be clear, I didn't start out trying to make an argument and then go looking for stats to support it; doing that doesn't work in my profession as only accuracy pays. I simply gathered stats that reflected these different measures of strength and put them in these indices, which led to these results. I suspect that if you did that exercise yourself picking whatever stats you'd like you'd see a similar picture, and I suspect that what I'm showing you here rings true to you if you're paying attention to such things.

For those reasons I suspect that all I am doing is helping you put where we are in perspective. To reiterate, I am not saying anything about the future. I will do that in the concluding chapter of this book. All I want to do is bring you up to date and, in the process, make clear how these cycles have worked in the past, which will also alert you to the markers to watch out for and help you see where in the cycles the major countries are and what is likely to come next.

The chart below from Chapter 1 shows this play out via the eight measures of strength--education, innovation and technology, competitiveness, military, trade, output, financial center, and reserve status--that we capture in the aggregate charts. It shows the average of each of these measures of strength, with most of the weight on the most recent three reserve countries (the US, the UK, and the Dutch).[1]

As explained in Chapter 1, in brief these strengths and weaknesses are mutually reinforcing--i.e., strengths and weaknesses in education, competitiveness, economic output, share of world trade, etc., contribute to the others being strong or weak, for logical reasons--and their order is broadly indicative of the processes that lead to the rising and declining of empires. For example, quality of education has been the long-leading strength of rises and declines in these measures of power, and the long-lagging strength has been the reserve currency. That is because strong education leads to strengths in most areas, including the creation of the world's most common currency. That common currency, just like the world's common language, tends to stay around because the habit of usage lasts longer than the strengths that made it so commonly used.

We will now look at the specifics more closely, starting with how these Big Cycles have played out over the last 500 years and then looking at the declines of the Dutch and British empires so you can see how these things go.

1) The Last 500 Years in About 4,000 Words

The Rise & Decline of the Dutch Empire and the Dutch Guilder

In the 1500-1600 period the Spanish empire was the pre-eminent economic empire in the "Western" world while the Chinese empire under the Ming Dynasty was the most powerful empire in the "Eastern" world, even more powerful than the Spanish empire (see the green dashed line and the red solid line in chart 2). The Spanish got rich by taking their ships and military power around the world, seizing control of vast areas (13% of the landmass of the earth!) and extracting valuable things from them, most importantly gold and silver which were the money of the time. As shown by the orange line in the chart of the relative standing of the great empires, the Dutch gained power as Spanish power was waning. At the time Spain controlled the small area we now call Holland. When the Dutch became powerful enough in 1581, they overthrew the Spanish and went on to eclipse both the Spanish and the Chinese as the world's richest empire from around 1625 to their collapse in 1780. The Dutch empire reached its peak around 1650 in what was called the Dutch Golden Age. This period was one of great globalization as ships that could travel around the world to gain the riches that were out there flourished, and the Dutch, with their great shipbuilding and their economic system, were ahead of others in using ships, economic rewards, and military power to build their empire. Holland (as we now call it) remained the richest power for about 100 years. How did that happen?

The Dutch were superbly educated people who were very inventive--in fact they came up with 25% of all major inventions in the world at their peak in the 17th century. The two most important inventions they came up with were 1) ships that were uniquely good that could take them all around the world, which, with the military skills that they acquired from all the fighting they did in Europe, allowed them to collect great riches around the world, and 2) the capitalism that fueled these endeavors.

Not only did the Dutch follow a capitalist approach to resource allocation, they invented capitalism. By capitalism I mean public debt and equity markets. Of course production existed before, but that is not capitalism, and of course trade existed before, but that is not capitalism, and of course private ownership existed before, but that is not capitalism. By capitalism I mean the ability of large numbers of people to collectively lend money and buy ownership in money-making endeavors. The Dutch created that when they invented the first listed public company (the Dutch East India Company) and the first stock exchange in 1602 and when they built the first well-developed lending system in which debt could more easily be created.

They also created the world's first reserve currency. The Dutch guilder was the first "world reserve currency" other than gold and silver because it was the first empire to extend around much of the world and to have its currency so broadly accepted. Fueled by these qualities and strengths, the Dutch empire continued to rise on a relative basis until around 1700 when the British started to grow strongly.

The numerous investment market innovations of the Dutch and their successes in producing profits attracted investors, which led to Amsterdam becoming the world's leading financial center; the Dutch government channeled money into debt and some equity investments in various businesses, the most important of which was the Dutch East India Company.

At this time of prosperity, other countries grew in power too. As other countries became more competitive, the Dutch empire became more costly and less competitive, and it found maintaining its empire less profitable and more challenging. Most importantly the British got stronger economically and militarily in the classic ways laid out in Chapter 1. Before they had become clear competitors they had military partnerships during most of the 80+ years leading up to the Fourth Anglo-Dutch War. That changed over time as they bumped into each other in the same markets. The Dutch and British had lots of conflicts over economic issues. For example, the English made a law that only English ships could be used to import goods into England, which hurt Dutch shipping companies that had a big business of shipping others' goods to England, which led to the English seizing Dutch ships and expanding the British East India Company. Typically before all-out war is declared there is about a decade of these sorts of economic, technological, geopolitical, and capital wars when the conflicting powers approach comparability and test and try to intimidate each other's powers. At the time the British came up with military inventions and built more naval strength, and they continued to gain relative economic strength.

As shown in the chart of relative standing of empires shown above, around 1750 the British became a stronger power than the Dutch, particularly economically and militarily, both because the British (and French) became stronger and because the Dutch became weaker. As is classic the Dutch a) became more indebted, b) had a lot of internal fighting over wealth (between its states/provinces, between the rich and the poor, and between political factions)[2], and c) had a weakened military--so the Dutch were weak and divided, which made them vulnerable to attack.

As is typical, the rising great power challenged the existing leading power in a war to test them both economically and militarily. The English hurt the Dutch economically by hurting their shipping business with other countries. The British attacked the Dutch. Other competing countries, most importantly France, took this as an opportunity to grab shipping business from the Dutch. That war, known as the Fourth Anglo-Dutch War, lasted from 1780 to 1784. The British won it handily both financially and militarily. That bankrupted the Dutch and caused Dutch debt and equities, the Dutch guilder, and the Dutch empire to collapse. In the next section we will look at that collapse up close.

At that time, in the late 18th century, there was a lot of fighting between countries with various shifting alliances within Europe. While similar fights existed around the world as they nearly always do, the only reason I'm focusing on these fights is because I'm focusing just on the leading powers and these were the leading two. After the British defeated the Dutch, Great Britain and its allies (Austria, Prussia, and Russia) continued to fight the French led by Napoleon in the Napoleonic Wars. Finally, after around a quarter-century of frequent fighting since the start of the French Revolution, the British and its allies won in 1815.

The Rise & Decline of the British Empire and the British Pound

As is typical after wars, the winning powers (most notably the UK, Russia, Austria, and Prussia) met to agree on the new world order. That meeting was called the Congress of Vienna. In it the winning powers re-engineered the debt, monetary, and geopolitical systems and created a new beginning as laid out in the Treaty of Paris. That set the stage for Great Britain's 100-year-long "imperial century" during which Great Britain became the unrivaled world power, the British pound became the world's dominant currency, and the world flourished.

As is typical, following the period of war there was an extended period--in this case 100 years--of peace and prosperity because no country wanted to challenge the dominant world power and overturn the world order that was working so well. Of course during these 100 years of great prosperity there were bad economic periods along the lines of what we call recessions and which used to be called panics (e.g., the Panic of 1825 in the UK, or the Panics of 1837 and 1873 in the US) and there were military conflicts (e.g., the Crimean War between Russia on one side and the Ottoman empire with a coalition of Western European powers as allies on the other), but they were not significant enough to change the big picture of this being a very prosperous and peaceful period with the British on top.

Like the Dutch before them, the British followed a capitalist system to incentivize and finance people to work collectively, and they combined these commercial operations with military strength to exploit global opportunities in order to become extremely wealthy and powerful. For example the British East India Company replaced the Dutch East India Company as the world's most economically dominant company and the company's military force became about twice the size of the British government's standing military force. That approach made the British East India Company extremely powerful and the British people very rich and powerful. Additionally, at the same time, around 1760, the British created a whole new way of making things and becoming rich while raising people's living standards. It was called the Industrial Revolution. It was through machine production, particularly propelled by the steam engine. So, this relatively small country of well-educated people became the world's most powerful country by combining inventiveness, capitalism, great ships and other technologies that allowed them to go global, and a great military to create the British empire that was dominant for the next 100 years.

Naturally London replaced Amsterdam as the world's capital markets center and continued to innovate financial products.

Later in that 100-year peaceful and prosperous period, from 1870 to the early 1900s the inventive and prosperous boom continued as the Second Industrial Revolution. During it human ingenuity created enormous technological advances that raised living standards and made those who developed them and owned them rich.

This period was for Great Britain what "the Dutch Golden Age" was for the Dutch about 200 years earlier because it raised the power in all the eight key ways--via excellent education, new inventions and technologies, stronger competitiveness, higher output and trade, a stronger military and financial center, and a more widely used reserve currency.

At this time several other countries used this period of relative peace and prosperity to get richer and stronger by colonizing enormous swaths of the world. As is typical during this phase, other countries copied Britain's technologies and techniques and flourished themselves, producing prosperity and, with it, great wealth gaps. For example, during this period there was the invention of steel production, the development of the automobile, and the development of electricity and its applications such as for communications including Alexander Graham Bell's telephone and Thomas Edison's incandescent light bulb and phonograph. This is when the United States grew strongly to become a leading world power. These countries became very rich and their wealth gaps increased. That period was called "the Gilded Age" in the US, "la Belle Epoque" in France, and "the Victorian Era" in England. As is typical at such times the leading power, Great Britain, became more indulgent while its relative power declined, and it started to borrow excessively.

As other countries became more competitive, the British empire became more costly and less profitable to maintain. Most importantly other European countries and the US got stronger economically and militarily in the classic ways laid out in Chapter 1. As shown in the chart of the standing of empires above, the US became a comparable power economically and militarily around 1900 though the UK retained stronger military power, trade, and reserve currency status, and the US continued to gain relative strength from there.

From 1900 until 1914, as a consequence of the large wealth gaps, there became 1) greater arguments about how wealth should be divided within countries and 2) greater conflicts and comparabilities in economic and military powers that existed between European countries. As is typical at such times the international conflicts led to alliances being formed and eventually led to war. Before the war the conflicts and the alliances were built around money and power considerations. For example, typical of conflicting powers that seek to cut off their enemies' access to money and credit, Germany under Bismarck refused to let Russia sell its bonds in Berlin, which led them to be sold in Paris, which reinforced the French-Russian alliance. The wealth gap in Russia led it to tumble into revolution in 1917 and out of the war, which is a whole other dramatic story about fighting over wealth and power that is examined in Part 2 of this book. Similar to the economically motivated shipping conflict between the British and the Dutch, Germany sank five merchant ships that were going to England in the first years of the war. That brought the United States into the war. Frankly, the complexities of the situations leading up to World War I are mind-boggling, widely debated among historians, and way beyond me.

That war, which was really the first world war because it involved countries all around the world because the world had become global, lasted from 1914 until 1918 and cost the lives of an estimated 8.5 million soldiers and 13 million civilians. As it ended, the Spanish flu arrived, killing an estimated 20-50 million people over two years. So 1914-20 was a terrible time.

The Rise of the American Empire and the US Dollar After World War I[3]

As is typical after wars, the winning powers--in this case the US, Britain, France, Japan, and Italy--met to set out the new world order. That meeting, called the Paris Peace Conference, took place in early 1919, lasted for six months, and concluded with the Treaty of Versailles. In that treaty the territories of the losing powers (Germany, Austria-Hungary, the Ottoman empire, and Bulgaria) were carved up and put under the controls of the winning empires and the losing powers were put deeply into debt to the winning powers to pay back the winning countries' war costs with these debts payable in gold. The United States was then clearly recognized as a leading power so it played a role in shaping the new world order. In fact the term "new world order" came about in reference to US President Woodrow Wilson's vision for how countries would operate in pursuit of their collective interest through a global governance system (the League of Nations) which was a vision that quickly failed. After World War I the US chose to remain more isolationist while Britain continued to expand and oversee its global colonial empire. The monetary system in the immediate post-war period was in flux. While most countries endeavored to restore gold convertibility, currency stability against gold only came after a period of sharp devaluations and inflation.

The large foreign debt burdens placed on Germany set the stage for 1) Germany's post-war inflationary depression from 1920 to 1923 that wiped out the debts and was followed by Germany's strong economic and military recovery, and 2) a decade of peace and prosperity elsewhere, which became the "Roaring '20s."

During that time the United States also followed a classic capitalist approach to resource allocation and New York became a rival financial center to London, channeling debt and investments into various businesses.

Other countries became more competitive and prosperous and increasingly challenged the leading powers. Most importantly Germany, Japan, and the US got stronger economically and militarily in the classic ways laid out in Chapter 1. However, the US was isolationist and didn't have a big colonial empire past its borders so it was essentially out of the emerging conflict. As shown in the chart of the standing of empires above, Germany and Japan both gained in power relative to the UK during this interwar period, though the UK remained stronger.

As is typical, the debts and the wealth gaps that were built up in the 1920s led to the debt bubbles that burst in 1929 which led to depressions, which led to the printing of money, which led to devaluations of currencies and greater internal and external conflicts over wealth and power in the 1930s. For example, in the United States and the UK, while there were redistributions of wealth and political power, capitalism and democracy were maintained, while in Germany, Japan, Italy, and Spain they were not maintained. Russia played a significant peripheral role in ways I won't delve into. China at the time was weak, fragmented, and increasingly controlled by a rising and increasingly militaristic and nationalistic Japan. To make a long story short, the Japanese and Germans started to make territorial expansions in the early to mid-1930s, which led to wars in Europe and Asia in the late 1930s that ended in 1945.

As is typical, before all-out wars were declared there was about a decade of economic, technological, geopolitical, and capital wars when the conflicting powers approached comparability and tested and tried to intimidate the other powers. While 1939 and 1941 are known as the official start of the wars in Europe and the Pacific, the wars really started about 10 years before that, as economic conflicts that were at first limited progressively grew into World War II. As Germany and Japan became more expansionist economic and military powers, they increasingly competed with the UK, US, and France for both resources and influence over territories.

That brought about the second world war which, as usual, was won by the winning countries coming up with new technologies (the nuclear bomb, while the most important, was just one of the newly invented weapons). Over 20 million died directly in the military conflicts, and the total death count was still higher. So 1930-45, which was a period of depression and war, was a terrible time.

The Rise of the American Empire and the US Dollar After World War II

As is typical after wars, the winning powers--most importantly the US, Britain, and Russia--met to set out the new world order. While the Bretton Woods Conference, Yalta Conference, and Potsdam Conference were the most noteworthy, several other meetings occurred that shaped the new world order, which included carving up the world and redefining countries and areas of influence and establishing a new money and credit system. In this case, the world was divided into the US-controlled capitalist/democratic countries and Russia-controlled communist and autocratically controlled countries, each with their own monetary systems. Germany was split into pieces, with the United States, Great Britain, and France having control of the West and Russia having control of the East. Japan was under US control and China returned to a state of civil war, mostly about how to divide the wealth, which was between communists and capitalists (i.e., the Nationalists). Unlike after World War I when the United States chose to be relatively isolationist, after World War II the United States took the primary leadership role as it had most of the economic, geopolitical, and military responsibility.

The US followed a capitalist system. The new monetary system of the US-led countries had the dollar linked to gold and had most other countries' currencies tied to the dollar. This system was followed by over 40 countries. Because the US had around two-thirds of the world's gold then and because the US was much more powerful economically and militarily than any other country, this monetary system has worked best and carried on until now. As for the other countries that were not part of this system--most importantly Russia and those countries that were brought into the Soviet Union and the satellite countries that the Soviets controlled--they were built on a much weaker foundation that eventually broke down. Unlike after World War I, when the losing countries were burdened with large debts, countries that were under US control, including the defeated countries, received massive financial aid from the US via the Marshall Plan. At the same time the currencies and debts of the losing countries were wiped out, with those holding them losing all of their wealth in them. Great Britain was left heavily indebted from its war borrowings and faced the gradual end of the colonial era which would lead to the unraveling of its empire which was becoming uneconomic to have.

During this post-World War II period the United States, its allies, and the countries that were under its influence followed a classic capitalist-democratic approach to resource allocation. New York flourished as the world's pre-eminent financial center, and a new big debt and capital markets cycle began. That produced what has thus far been a relatively peaceful and prosperous 75-year period that has brought us to today.

As is typical of this peaceful and prosperous part of the cycle, in the 1950-70 period there was productive debt growth and equity market development that were essential for financing innovation and development early on. That eventually led to too much debt being required to finance both war and domestic needs--what was called "guns and butter." The Vietnam War and the "War on Poverty" occurred in the US. Other countries also became overly indebted and the British indebtedness became over-leveraged which led to a number of currency devaluations, most importantly the breakdown of the Bretton Woods monetary system (though countries like the UK and Italy had already devalued prior to that time). Then in 1971, when it was apparent that the US didn't have enough gold in the bank to meet the claims on gold that it had put out, the US defaulted on its promise to deliver gold for paper dollars which ended the Type 2 gold-backed monetary system, and the world moved to a fiat monetary system. As is typical, this fiat monetary system initially led to a wave of great dollar money and debt creation that led to a big wave of inflation that carried until 1980-82 and led to the worst economic downturn since the Great Depression. It was followed by three other waves of debt-financed speculations, bubbles, and busts--1) the 1982 and 2000 money and credit expansion that produced a dot-com bubble that led to the 2000-01 recession, 2) the 2002-07 money and credit expansion that produced a real estate bubble that led to the 2008 Great Recession, and 3) the 2009-19 money and credit expansion that produced the investment bubble that preceded the COVID-19 downturn. Each of these cycles raised debt and non-debt obligations (e.g., for pensions and healthcare) to progressively higher levels and led the reserve currency central banks of the post-war allies to push interest rates to unprecedented low levels and to print unprecedented amounts of money. Also classically, the wealth, values, and political gaps widened within countries, which increases internal conflicts during economic downturns. That is where we now are.

During this prosperous post-war period many countries became more competitive with the leading powers economically and militarily. The Soviet Union/Russia initially followed a communist resource allocation approach as did China and a number of other smaller countries. None of these countries became competitive following this approach. However, the Soviet Union did develop nuclear weapons to become militarily threatening and gradually a number of other countries followed in developing nuclear weapons. These weapons were never used because using them would produce mutually assured destruction. Because of its economic failures the Soviet Union/Russia could not afford to support a) its empire, b) its economy, and c) its military at the same time in the face of US President Ronald Reagan's arms race spending. As a result the Soviet Union broke down in 1991 and abandoned communism. The breakdown of its money/credit/economic system was disastrous for it economically and geopolitically for most of the 1990s. In the 1980-95 period most communist countries abandoned classic communism and the world entered a very prosperous period of globalization and free-market capitalism.

In China, Mao Zedong's death in 1976 led Deng Xiaoping to a shift in economic policies to include capitalist elements including private ownership of large businesses, the development of debt and equities markets, great technological and commercial innovations, and even the flourishing of billionaire capitalists--all, however, under the strict control of the Communist Party. As a result of this shift and the simultaneous shift in the world to greater amounts of globalism China grew much stronger in most ways. For example, since I started visiting China in 1984, the education of its population has improved dramatically, the real per capita income has multiplied by 24, and it has become the largest country in the world in trade (exceeding the US share of world trade), a rival technology leader, the holder of the greatest foreign reserves assets in the world by a factor of over two, the largest lender/investor in the emerging world, the second most powerful military power, and a geopolitical rival of the United States. And it is growing in power at a significantly faster pace than the United States and other "developed countries."

At the same time, we are in a period of great inventiveness due to advanced information/data management and artificial intelligence supplementing human intelligence with the Americans and Chinese leading the way. As shown at the outset of Chapter 1, human adaptability and inventiveness has proven to be the greatest force in solving problems and creating advances. Also, because the world is richer and more skilled than ever before, there is a tremendous capacity to make the world better for more people than ever if people can work together to make the whole pie as big as possible and to divide it well. That brings us to where we now are.

As you can see, all three of these rises and declines followed the classic script laid out in Chapter 1 and summarized in the charts at the beginning of this chapter, though each had its own particular turns and twists.

Now let's look at these cases, especially the declines, more closely.

A Closer Look at the Rises and Declines of the Leading Empires Over the Last 500 Years

The Dutch Empire and the Dutch Guilder

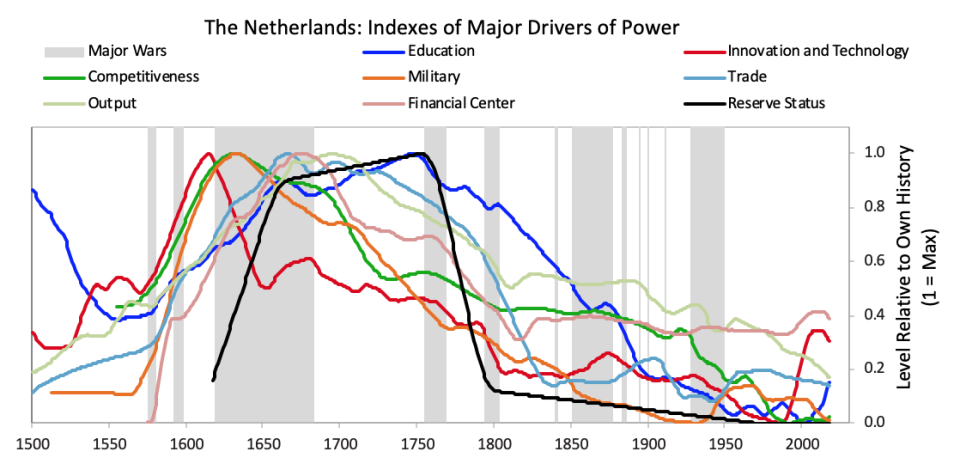

Before we get to the collapse of the Dutch empire and the Dutch guilder let's take a quick look at the whole arc of its rise and decline. While I previously showed you the aggregated power index for the Dutch empire, the chart below shows the eight powers that make it up from the ascent around 1575 to the decline around 1780. In it, you can see the story behind the rise and decline.

After declaring independence in 1581, the Dutch fought off the Spanish and built a global trading empire that became responsible for over a third of global trade largely via the first mega-corporation, the Dutch East India Company. As shown in the chart above, with a strong educational background the Dutch innovated in a number of areas. They produced roughly 25% of global inventions in the early 17th century,[4] most importantly in shipbuilding, which led to a great improvement in Dutch competitiveness and its share of world trade. Propelled by these ships and the capitalism that provided the money to fuel these expeditions, the Dutch became the largest traders in the world, accounting for about one-third of world trade.[5] As the ships traveled around the world, the Dutch built a strong military to defend them and their trade routes.

As a result of this success they got rich. Income per capita rose to over twice that of most other major European powers.[6] They invested more in education. Literacy rates became double the world average. They created an empire spanning from the New World to Asia, and they formed the first major stock exchange with Amsterdam becoming the world's most important financial center. The Dutch guilder became the first global reserve currency, accounting for over a third of all international transactions.[7] For these reasons over the course of the late 1500s and 1600s, the Dutch became a global economic and cultural power. They did all of this with a population of only 1-2 million people. Below is a brief summary of the wars they had to fight to build and hold onto their empire. As shown, they were all about money and power.

Eighty Years' War (1566-1648): This was a revolt by the Netherlands against Spain (one of the strongest empires of that era), which eventually led to Dutch independence. The Protestant Dutch wanted to free themselves from the Catholic rule of Spain and eventually managed to become de facto independent. Between 1609 and 1621, the two nations had a ceasefire. Eventually, the Dutch were recognized by Spain as independent in the Peace of Munster, which was signed together with the Treaty of Westphalia, ending both the Eighty Years' War as well as the Thirty Years' War.[8]

First Anglo-Dutch War (1652-1654): This was a trade war. More specifically, in order to protect its economic position in North America and damage the Dutch trade that the English were competing with, the English Parliament passed the first of the Navigation Acts in 1651 that mandated that all goods from its American colonies must be carried by English ships, which set off hostilities between the two countries.[9]

The Dutch-Swedish War (1657-1660): This war centered around the Dutch wanting to maintain low tolls on the highly profitable Baltic trade routes. This was threatened when Sweden declared war on Denmark, a Dutch ally. The Dutch defeated the Swedes and maintained the favorable trade arrangement.[10]

The Second Anglo-Dutch War (1665-1667): England and the Netherlands fought again over another trade dispute, which again ended with a Dutch victory.[11]

The Franco-Dutch War (1672-1678) and the Third Anglo-Dutch War (1672-1674): This was also a fight over trade. It was between France and England on one side and the Dutch (called the United Provinces), the Holy Roman Empire, and Spain on the other.[12] The Dutch largely stopped French plans to conquer the Netherlands and forced France to reduce some of its tariffs against Dutch trade,[13] but the war was more expensive than previous conflicts, which increased their debts and hurt the Dutch financially.

The Fourth Anglo-Dutch War (1780-1784): This was fought between the Dutch and the rapidly strengthening British, partially in retaliation for Dutch support of the US in the American Revolution. The war ended in significant defeat for the Dutch, and the costs of the fighting and eventual peace helped usher in the end of the guilder as a reserve currency.[14]

Continue reading here.

This article first appeared on GuruFocus.