Ray Dalio: Lots of Character, Less Than Inspiring Results

- By Robert Abbott

Since Ray Dalio (Trades, Portfolio) burst onto the investing scene, he has been a unique and intriguing character. He started investing at age 12, he was fired from one investment firm for egregious behavior, he has been a highly controversial manager of his own company and he has had a reputation as one of the biggest and best hedge fund managers in the world.

Warning! GuruFocus has detected 2 Warning Sign with NCS. Click here to check it out.

The intrinsic value of VWO

Yet, between the clusters of good years, there have been many flat or losing years, leaving his long-term results less than inspiring.

Who is Dalio?

Born in 1949, Dalio began investing at the precocious age of 12, a result of caddying for business people at a golf club. He bought $300 worth of shares in Northeast Airlines; when the airline merged with another company, Dalio tripled his money.

He received a bachelor"s degree in finance from Long Island University and an MBA from Harvard Business School. His first job after graduating was working on the floor of the New York Stock Exchange, where he traded commodity futures. He later became the director of commodities at Dominick & Dominick.

Next Dalio moved to Shearson Hayden Stone in 1974, where he was a futures trader and broker. According to Fortune magazine, Dalio was fired from Shearson Hayden for providing inappropriate entertainment for a group of visiting clients, and for punching a manager in the face on New Year"s Eve.

Shortly afterward, in 1975, he started his own firm, Bridgewater Associates. Earlier this year (2017), during a company-wide shakeup, Dalio announced he would resign as co-CEO but stay on in an advisory role.

Over his 42 years at Bridgewater, Dalio has received numerous honors. In the description of his book, "Principles: Life and Work" at Amazon.com, Dalio says Bridgewater has made more money for its clients than any other hedge fund, Fortune magazine named it the fifth most important private company in the country and that he appeared on a Time magazine list of the 100 most influential people in the world.

He has won acclaim for predicting the 2008 financial crisis, and explained his thinking in an essay titled, "How the Economic Machine Works; A Template for Understanding What is Happening Now."

While he is backing away from Bridgewater, the firm will continue to operate.

Dalio is not only a well-educated investment manager, but also an articulate advocate for smarter investments. At the same time, he apparently has some questionable character traits.

What is Bridgewater?

According to its Form ADV Part 2A, Bridgewater Associates provides investment management services, primarily to pooled investment vehicles, single investor funds and managed account clients. While the firm began by offering money management and consulting services in global credit and currency markets, it now specializes in institutional portfolio management. Its objective is to generate consistent and uncorrelated returns.

On its website, Bridgewater emphasizes its principles and culture with this statement, "Our unique success is the direct result of our unique way of being. We want an idea meritocracy in which meaningful work and meaningful relationships are pursued through radical truth and radical transparency."

Radical truth and radical transparency are the most controversial aspects of the Bridgewater operation. Managers and staff are constantly evaluating each other on as many as 100 different metrics. Believers say it helps everyone understand their strengths and weaknesses; detractors say it can be abusive and led to cult-like conditions within the company.

Financial journalist Michelle Celarier called it a "bizarre culture." She points out Dalio"s retirement as co-CEO came in the wake of articles in several esteemed business publications, articles that critically addressed Bridgewater"s culture.

In its What We Do section, the firm says it is "focused on understanding how the world works. By having the deepest possible understanding of the global economy and financial markets, and translating that understanding into great portfolios and strategic partnerships with institutional clients."

The company is owned by current and former Bridgewater employees (as well as trusts they may have established). In a Form ADV filed Aug. 24, it reports having $239.3 billion of discretionary assets under management.

Bridgewater initially looks like many other investment management firms, but diverges from them because of Dalio"s unique views that have been woven into the firm"s culture. Whether those practices helped or hurt Dalio"s clients will no doubt be an ongoing argument.

Dalio"s strategies

Dalio is essentially a strategic asset allocator, according to a StreetAuthority Network article. It points to a Bloomberg Markets 50 Summit, where Dalio shared his core strategy.

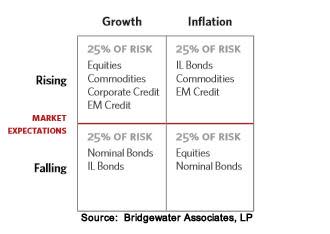

Dalio believes in diversification, based on a balanced, structured portfolio. The overall structure is made up of four elements (or 2 + 2). The first pair refer to market perceptions among investors: rising expectations versus falling expectations. The second pair is based on growth versus inflation. Putting these four elements together produces this four-cell matrix, shown at the Summit:

Allocating assets within these four cells provides a framework, Dalio says, for all-season investing.

Dalio told the Summit that 15 is the ideal number of uncorrelated return streams. If both of those conditions can be satisfied--15 and uncorrelated streams--risk is reduced by 80%.

As he points out in a document about his All Weather Fund, bonds do best in a deflationary recession, equities are best when growth is occurring and cash is tops when capital is in short supply. With the right number of return streams and uncorrelated return streams, an investor need not predict the future. In other words, create a portfolio that will do well in different environments.

Alex Barrow at Macro Ops argues that investors must understand cross-asset correlation to make this work. It is not correlation in the usual sense, but rather knowing the fundamental drivers of each asset class; each asset class will do well in some stages, but not in others. As a global macro trader, he says he likes having a market neutral book that brings in beta in a risk-adjusted way. He sums up by saying, "Use diversification to collect your beta and overlay that with a concentrated book for your alpha."

In August of this year, Dalio wrote and published an article that dealt slightly differently with this subject. Breaking apart the first paragraph, we get these strategic and process insights:

"There are returns, and there are risks. We think of them individually, and then we combine them into a portfolio."

"We think of returns and opportunities as coming from those things we"d bet on, and we think of risks as the adverse market consequences of us being wrong due to our being out of balance."

"We start with our balanced beta portfolio--i.e., that portfolio that would most certainly fund our intended uses of the money."

"Everyone should have their own based on their own projected uses of money, though more generally, it"s our All Weather portfolio."

"We then create a balanced portfolio of opportunity/alpha bets based on what we think is likely to happen."

"We then combine them."

These are the successive sentences of the first paragraph of Dalio"s article, separated to get the most out of each individual thought.

This is not your grandfather"s asset allocation or diversification. Dalio has created a framework which he says will radically reduce risk while providing opportunities for ongoing alpha.

Holdings

A unique sectoral profile, one with very few stocks owned outright, shows up in this GuruFocus chart:

Even though stocks play a relatively minor role, Dalio still deals with a lot of equity value. Not surprising, considering the vast size of his portfolio.

These are the top 10 equity holdings:

Vanguard FTSE Emerging Markets (VWO): 25.82%

iShares MSCI Emerging Markets Asia Index Fund (EEM): 19.67%

SPDR S&P 500 (SPY): 15.98%

iShares Core MSCI Emerging Markets (IEMG): 8.98%

SPDR Gold Trust (GLD): 3.18%

iShares iBoxx $ Investment Grade Corporate Bond (LQD): 1.97%

iShares MSCI Brazil Capped Index Fund (EWZ): 1.90%

iShares 20+ Year Treasury Bond ETF (TLT): 1.75%

iShares TIPS Bond (TIP): 1.47%

iShares iBoxx $ High Yield Corporate Bond (HYG): 1.40%

Dalio"s top 10 holdings are all exchange-traded funds (ETFs), but focused on different areas, including stocks and bonds, geography, government bonds and corporate bonds. Each of these ETFs will have a place in one of the four cells seen above.

Performance

As a September Fortune article observes of Bridgewater"s growth, "That growth has been driven by performance: Over the past four decades, the firm has made more money for its investors than any other hedge fund in history--nearly $50 billion through last year, according to Bloomberg. Dalio himself has become one of the 100 richest people in the world."

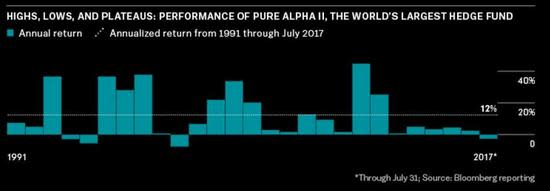

Yet, it would appear clients would need good timing to see outstanding returns. This Bloomberg chart of the firm"s annual returns between 1991 and 2017 illustrates the story:

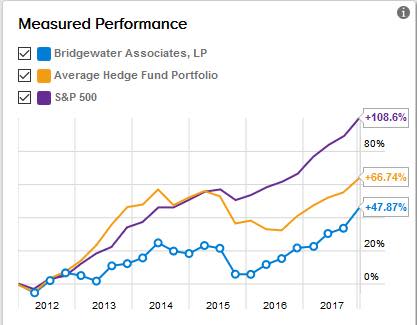

Finally, this TipRanks chart shows him falling far behind the S&P 500 over the past five years:

The charts above do not indicate whether these results are gross or net to Dalio"s clients, nor do they distinguish between strategies. However, investors will be disappointed to see just a 12% average annual return over the past 26 years, when the legend seemed to suggest so much more.

Conclusion

In Dalio, we meet another hedge fund manager who manages many billions of dollars and has made billions for himself. Yet after all that, the average annual returns are just average. Certainly, the last six years have had a big affect on his average, but that will be little consolation to the big pension and mutual funds that have entrusted their capital to him.

In theory, the strategies make sense and he has had only four losing years in the past 26, but that still amounts to 15% of years being losers. Next, 12 of those 26 years produced returns that hardly crept above the zero line.

For value investors, Dalio will be another larger-than-life character who has been interesting to watch, but whose philosophy and strategy will have little practical value.

Disclosure: I do not own shares in any of the companies or ETFs listed in this article, nor do I expect to acquire any in the next 72 hours.

This article first appeared on GuruFocus.

Warning! GuruFocus has detected 2 Warning Sign with NCS. Click here to check it out.

The intrinsic value of VWO