Raymond James' (RJF) Q3 Earnings Miss on Dismal Trading

Raymond James Financial Inc. RJF announced third-quarter fiscal 2018 (ended Jun 30) earnings per share of $1.55, which lagged the Zacks Consensus Estimate of $1.64. On a year-over-year basis, the bottom line jumped 23%.

Results benefited from improvement in net revenues, reflecting solid investment banking performance and higher interest rates. Also, growth in assets acted as a tailwind. However, higher expenses and dismal trading performance were on the downside.

Net income for the quarter totaled $232.3 million, up 25% from the year-ago quarter.

Revenues Improve, Costs Rise

Net revenues for the quarter amounted to $1.84 billion, rising 13% year over year. The rise was attributable to an increase in almost all the revenue components except net trading profits. Further, the reported figure topped the Zacks Consensus Estimate of $1.82 billion.

Segment wise, in the reported quarter, RJ Bank registered an increase of 25% in net revenues. Further, Asset Management and Private Client Group depicted top-line improvement of 34% and 13%, respectively. However, Capital Markets witnessed a decline of 7% in net revenues, while Others reported negative revenues against positive revenues in the prior-year quarter.

Non-interest expenses increased 13% year over year to $1.52 billion. The rise was largely due to increase in all cost components, except for the absence of acquisition-related costs and lower bank loan loss provision.

As of Jun 30, 2018, client assets under administration increased 14% on a year-over-year basis to $754.3 billion, while financial assets under management surged 49% to $135.5 billion.

Balance Sheet Strong, Capital Ratios Improve

As of Jun 30, 2018, Raymond James reported total assets of $36.4 billion, relatively stable sequentially. Total equity rose 5% from the prior quarter to $6.2 billion.

Book value per share was $42.24, up from $37.46 as of Jun 30, 2017.

As of Jun 30, 2018, total capital ratio came in at 24.9%, increasing from 23.3% as of Jun 30, 2017. Also, Tier 1 capital ratio was 24.0% compared with 22.3% in the year-ago period.

Also, return on equity came in at 15.4% at the end of the reported quarter, up from 13.8% a year ago.

Our Take

Raymond James remains well positioned to grow via acquisitions, given its strong liquidity position. Also, given a solid capital position, it is expected to continue enhancing shareholder value through efficient capital deployment activities.

However, mounting expenses mainly due to higher compensation costs and bank loan loss provisions are likely to continue hurting bottom-line growth. Lack of geographic diversification also remains a major concern as it might hamper the company’s financials and limit flexibility.

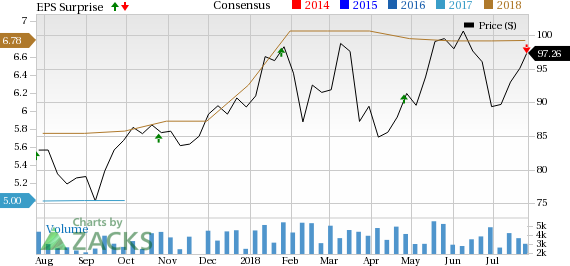

Raymond James Financial, Inc. Price, Consensus and EPS Surprise

Raymond James Financial, Inc. Price, Consensus and EPS Surprise | Raymond James Financial, Inc. Quote

Currently, Raymond James carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Investment Brokerage Firms

Charles Schwab’s SCHW second-quarter 2018 earnings of 60 cents per share surpassed the Zacks Consensus Estimate of 58 cents. Revenue growth (driven by a rise in interest income and trading revenues) and absence of fee waivers supported the results. Further, the quarter witnessed an impressive rise in total client assets and new brokerage accounts. However, higher expenses remained the undermining factor.

Interactive Brokers Group, Inc.’ IBKR second-quarter 2018 earnings per share of 58 cents surpassed the Zacks Consensus Estimate of 51 cents. Results benefited from an improvement in revenues and rise in Daily Average Revenue Trades (DARTs) along with lower expenses. Further, the Electronic Brokerage segment continued to perform decently.

E*TRADE Financial ETFC recorded a positive earnings surprise of 6.7% in second-quarter 2018. Earnings of 95 cents per share easily surpassed the Zacks Consensus Estimate of 89 cents. Results reflected improved net revenues and a benefit to provision for loan losses. DARTs increased year over year. Further, the quarter witnessed rise in customer accounts and reduced delinquencies. However, elevated operating expenses were on the downside.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

E*TRADE Financial Corporation (ETFC) : Free Stock Analysis Report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research